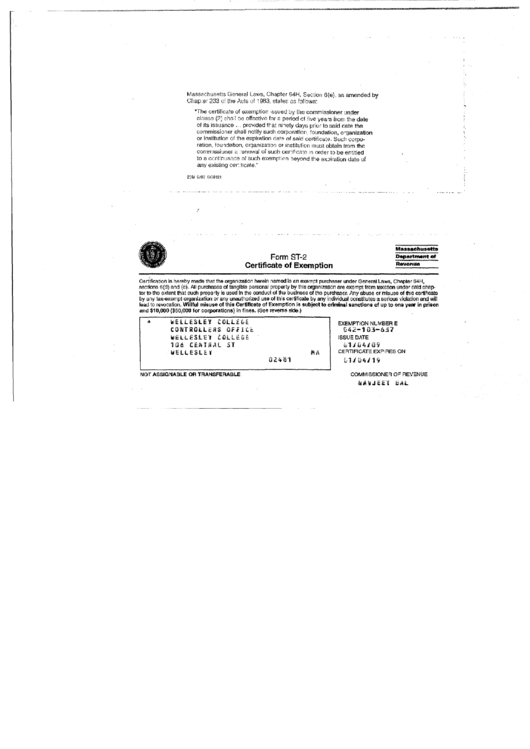

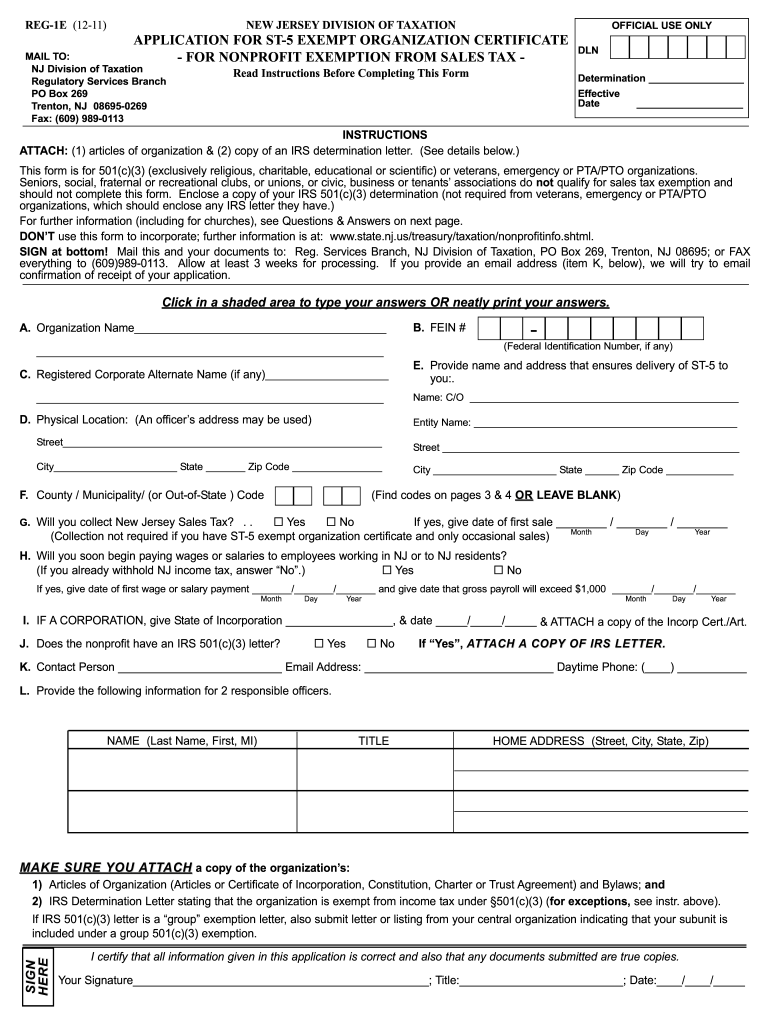

St 5 Tax Exempt Form

St 5 Tax Exempt Form - Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

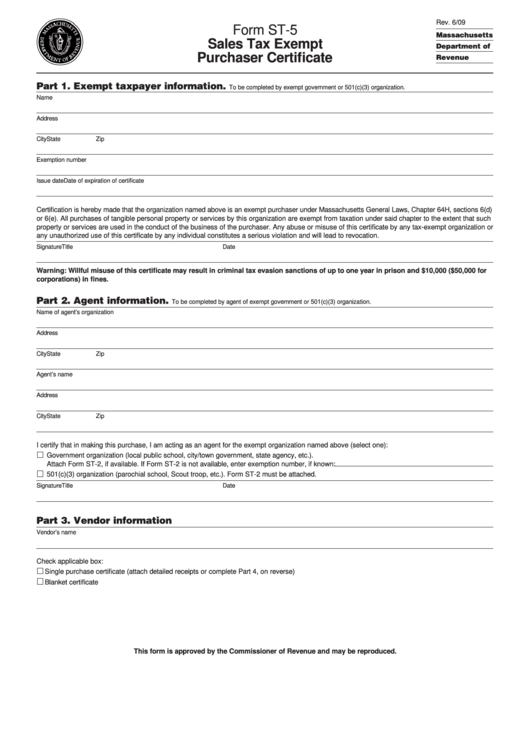

Form St5 Sales Tax Exempt Purchaser Certificate Filing Example

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use.

Tax Exempt Forms San Patricio Electric Cooperative

Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

South Carolina Vehicle Tax Exemption Form

Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

Fillable Form St5 Sales Tax Exempt Purchaser Certificate printable

Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

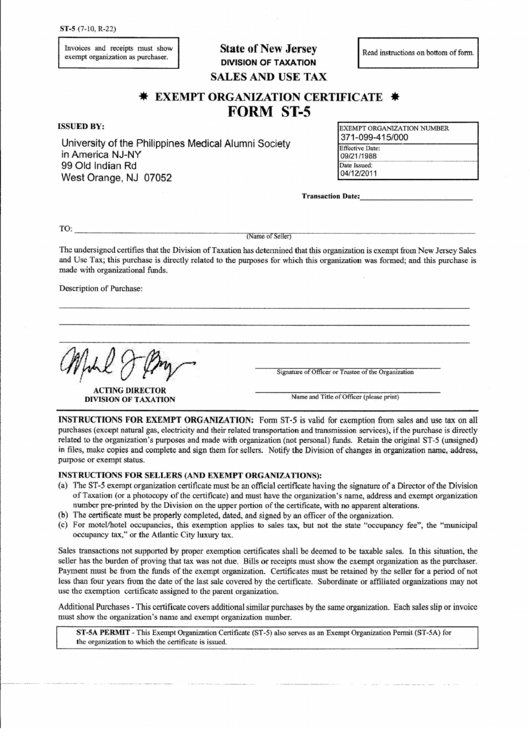

Nj Sales Tax Exempt Form

Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

Form St5 Exempt Organization Certificate printable pdf download

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use.

Nj st 5 tax exempt form Fill out & sign online DocHub

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use.

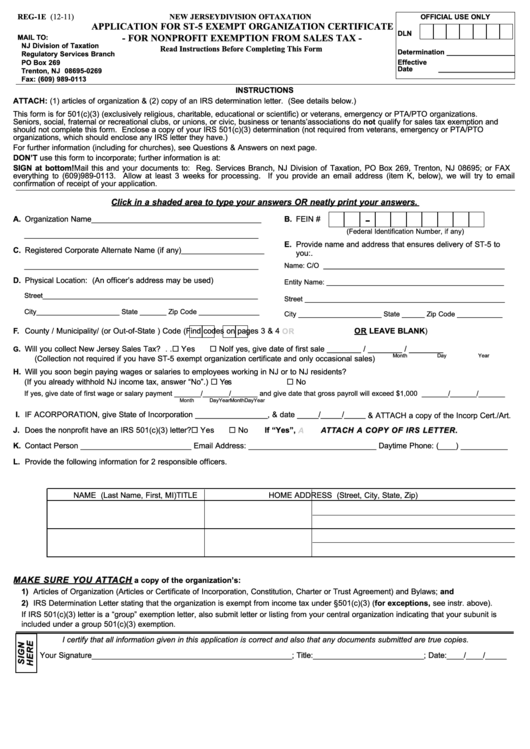

Form Reg1e Application For St5 Exempt Organization Certificate For

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use.

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use.

2011 Form NJ REG1E Fill Online, Printable, Fillable, Blank pdfFiller

Form st‑5, is used by a qualified, registered nonprofit organization to purchase, with its own funds, goods, and services for its exclusive use. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

Form St‑5, Is Used By A Qualified, Registered Nonprofit Organization To Purchase, With Its Own Funds, Goods, And Services For Its Exclusive Use.

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.