State Of Michigan Tax Lien

State Of Michigan Tax Lien - 205.29 taxes, interest, and penalties as lien. The michigan department of treasury may. What does a state tax lien do? (1) taxes administered under this act, together.

The michigan department of treasury may. 205.29 taxes, interest, and penalties as lien. What does a state tax lien do? (1) taxes administered under this act, together.

What does a state tax lien do? 205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together. The michigan department of treasury may.

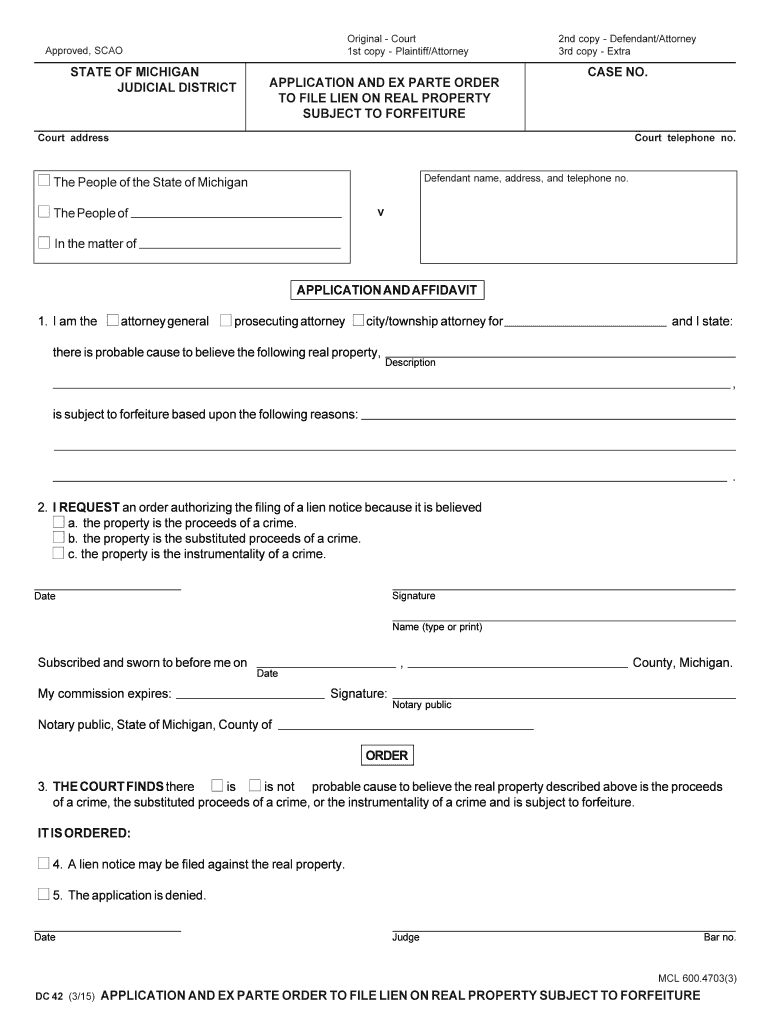

Mc 94 Complete with ease airSlate SignNow

205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together. The michigan department of treasury may. What does a state tax lien do?

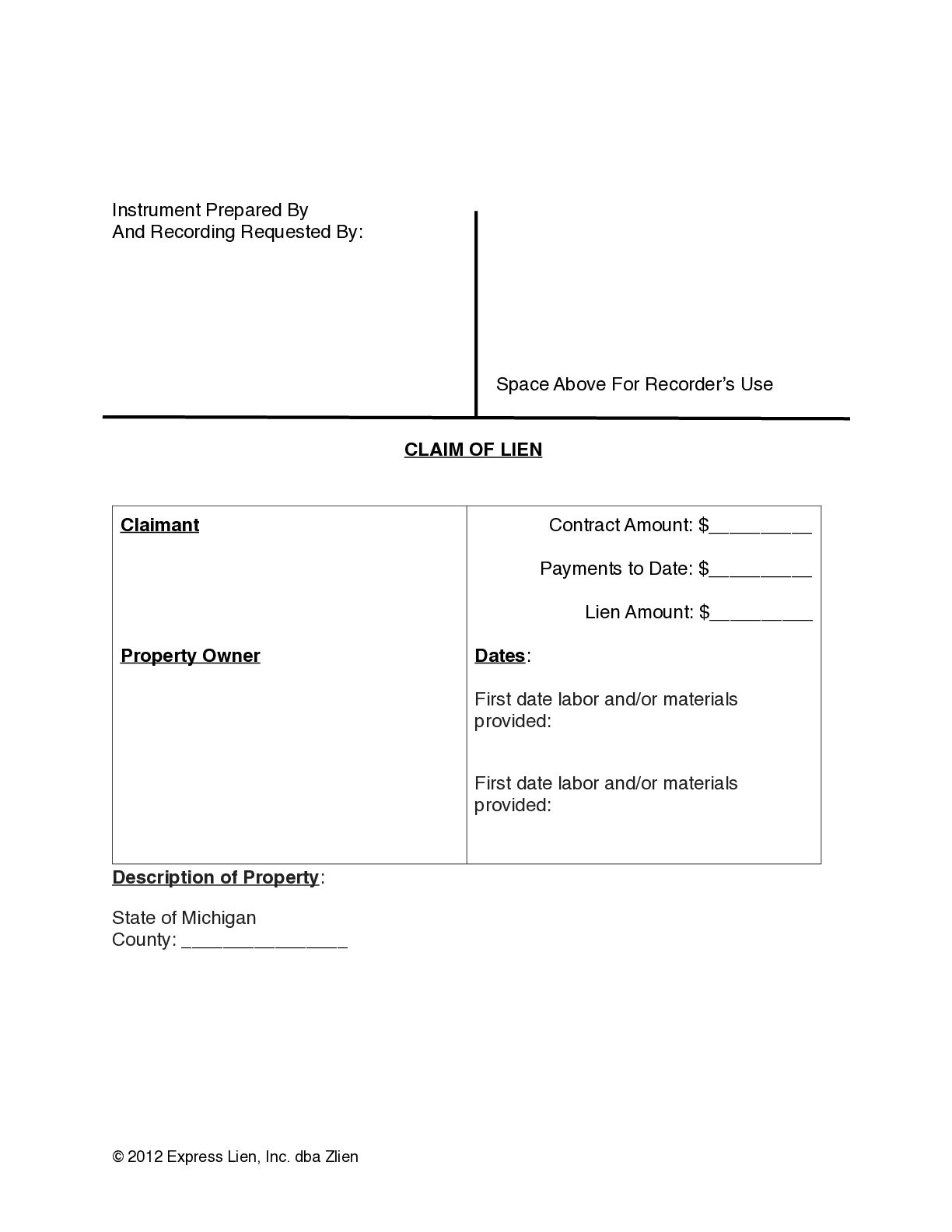

How To File a Lien in Michigan zlien

The michigan department of treasury may. What does a state tax lien do? 205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together.

michigan lien Doc Template pdfFiller

(1) taxes administered under this act, together. 205.29 taxes, interest, and penalties as lien. What does a state tax lien do? The michigan department of treasury may.

Michigan Mechanics Lien Form Free Downloadable Template

What does a state tax lien do? 205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together. The michigan department of treasury may.

Michigan lien Fill out & sign online DocHub

205.29 taxes, interest, and penalties as lien. What does a state tax lien do? The michigan department of treasury may. (1) taxes administered under this act, together.

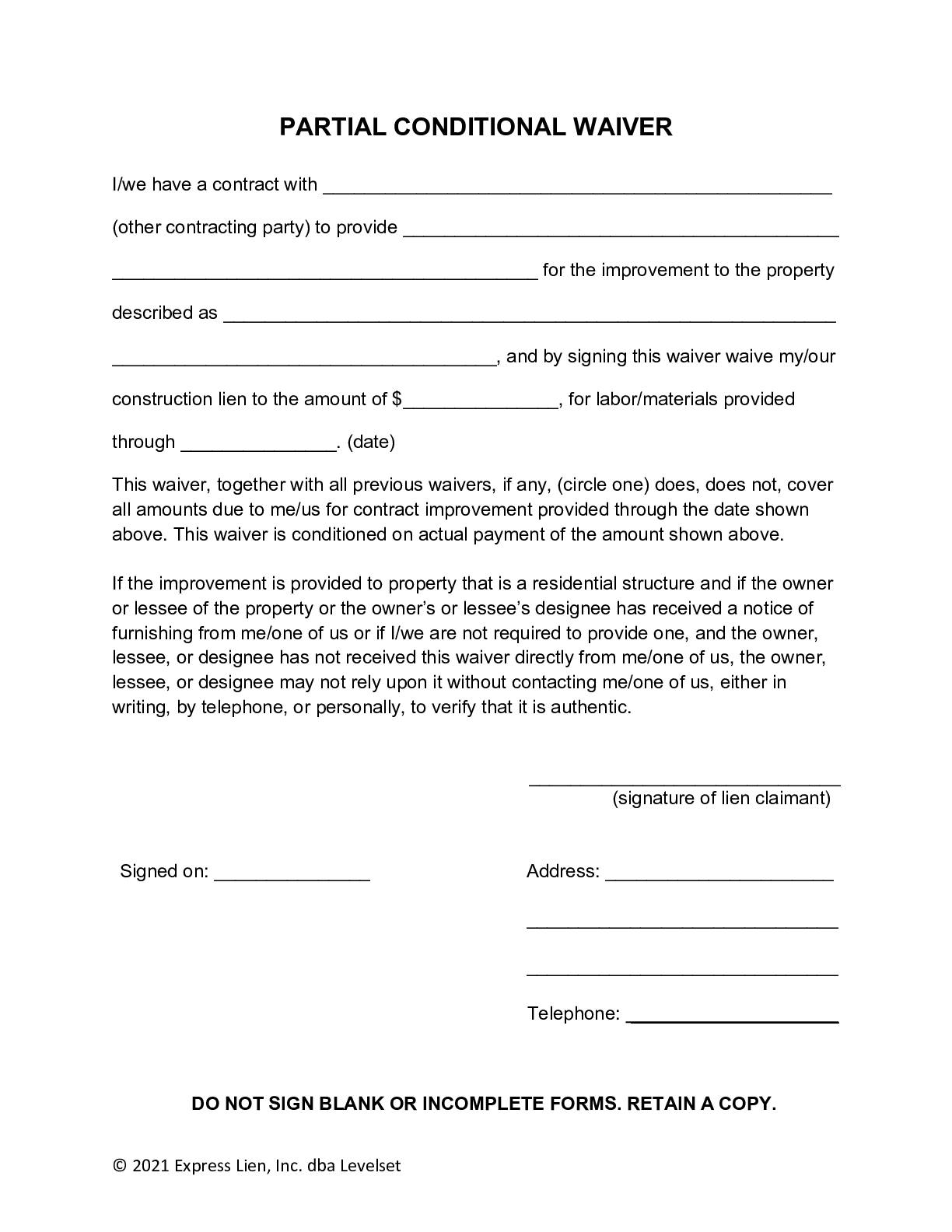

Michigan Partial Conditional Lien Waiver Form Free

The michigan department of treasury may. 205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together. What does a state tax lien do?

Tax Lien Sale Download Free PDF Tax Lien Taxes

The michigan department of treasury may. 205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together. What does a state tax lien do?

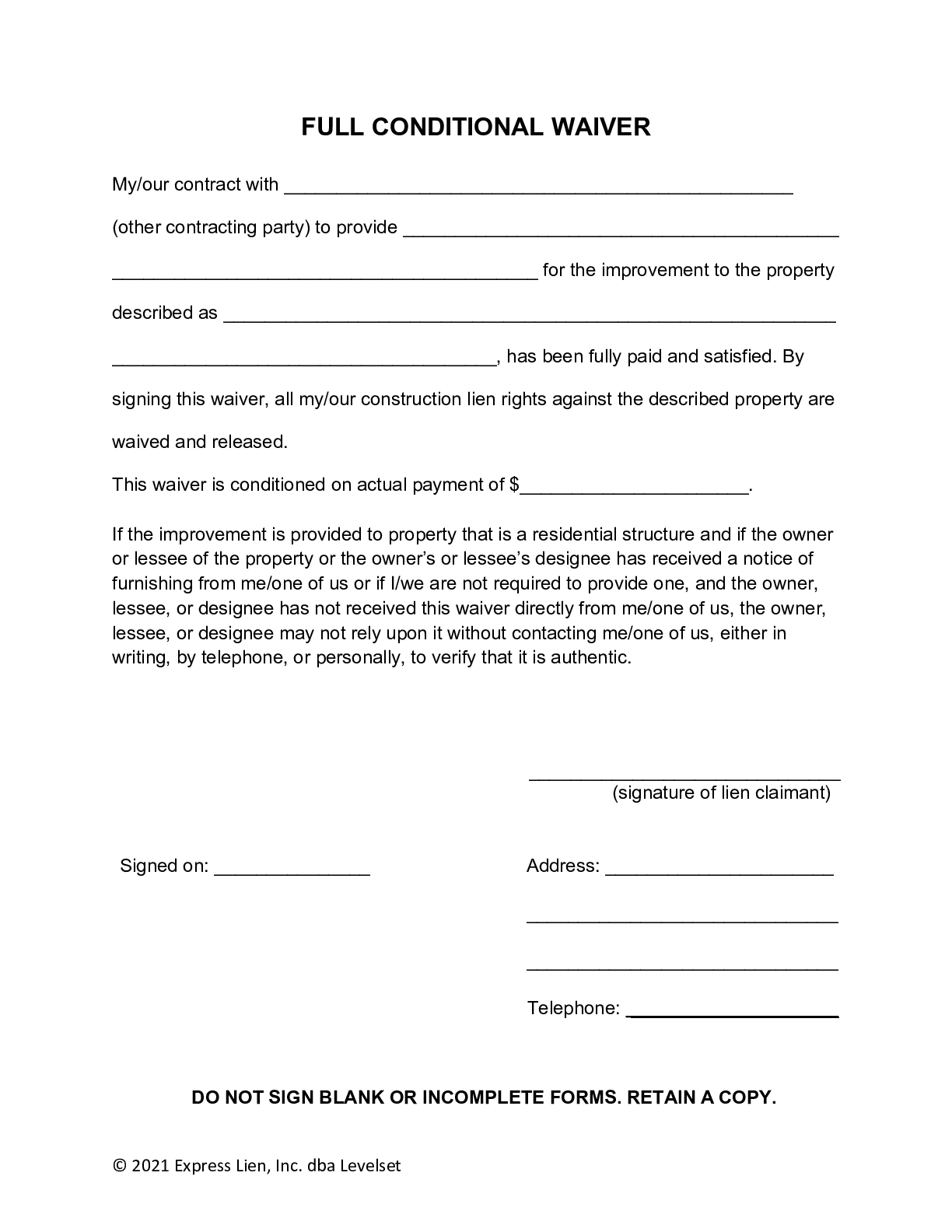

Michigan Lien Waiver FAQs, Guide, Forms, & Resources

205.29 taxes, interest, and penalties as lien. What does a state tax lien do? (1) taxes administered under this act, together. The michigan department of treasury may.

The Complete Guide to Michigan Lien & Notice Deadlines National Lien

What does a state tax lien do? 205.29 taxes, interest, and penalties as lien. The michigan department of treasury may. (1) taxes administered under this act, together.

What Does A State Tax Lien Do?

205.29 taxes, interest, and penalties as lien. The michigan department of treasury may. (1) taxes administered under this act, together.