State Or Local Income Tax Refunds Credits Or Offsets

State Or Local Income Tax Refunds Credits Or Offsets - How do i receive local credit for income tax paid to another state? You must first apply credit for income taxes paid to another state against your. Taxable refunds, credits or offsets of state or local income taxes if you receive a refund of (or credit for) state or local income taxes in a year. It is possible that your state refund is taxable income. Every person who, with respect to any individual, during any calendar year makes payments of refunds of state or local income taxes (or. If a taxpayer receives a refund, credit, or offset relating to either state or local income taxes, that benefit may be subjected to federal taxation the. Is my state refund taxable income if i itemized my federal tax return? If you received a refund, credit, or offset from either state or local income taxes, you must include that amount as income if you.

How do i receive local credit for income tax paid to another state? If a taxpayer receives a refund, credit, or offset relating to either state or local income taxes, that benefit may be subjected to federal taxation the. You must first apply credit for income taxes paid to another state against your. Every person who, with respect to any individual, during any calendar year makes payments of refunds of state or local income taxes (or. It is possible that your state refund is taxable income. Is my state refund taxable income if i itemized my federal tax return? If you received a refund, credit, or offset from either state or local income taxes, you must include that amount as income if you. Taxable refunds, credits or offsets of state or local income taxes if you receive a refund of (or credit for) state or local income taxes in a year.

It is possible that your state refund is taxable income. Is my state refund taxable income if i itemized my federal tax return? How do i receive local credit for income tax paid to another state? If a taxpayer receives a refund, credit, or offset relating to either state or local income taxes, that benefit may be subjected to federal taxation the. Every person who, with respect to any individual, during any calendar year makes payments of refunds of state or local income taxes (or. If you received a refund, credit, or offset from either state or local income taxes, you must include that amount as income if you. Taxable refunds, credits or offsets of state or local income taxes if you receive a refund of (or credit for) state or local income taxes in a year. You must first apply credit for income taxes paid to another state against your.

Local Taxes by State Local Tax Data Tax Foundation

How do i receive local credit for income tax paid to another state? Every person who, with respect to any individual, during any calendar year makes payments of refunds of state or local income taxes (or. If a taxpayer receives a refund, credit, or offset relating to either state or local income taxes, that benefit may be subjected to federal.

State And Local Tax Refund Worksheet 2019

How do i receive local credit for income tax paid to another state? It is possible that your state refund is taxable income. You must first apply credit for income taxes paid to another state against your. Is my state refund taxable income if i itemized my federal tax return? Taxable refunds, credits or offsets of state or local income.

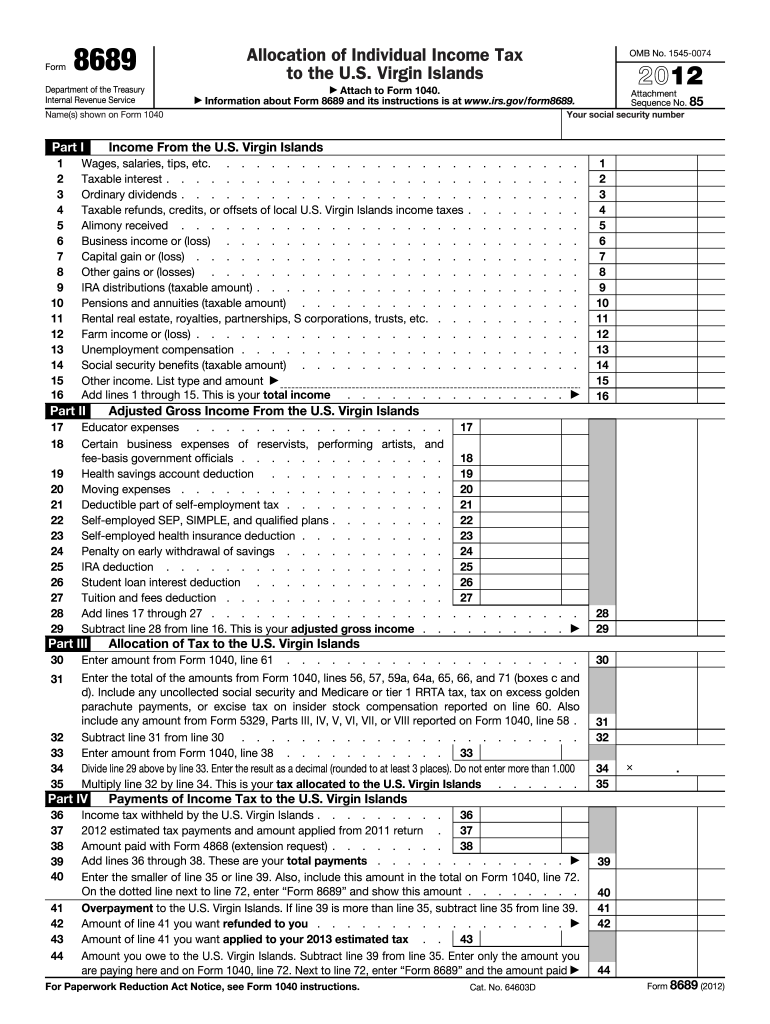

Taxable Refunds, Credits, or Offsets of Local U Fill Out and Sign

If a taxpayer receives a refund, credit, or offset relating to either state or local income taxes, that benefit may be subjected to federal taxation the. If you received a refund, credit, or offset from either state or local income taxes, you must include that amount as income if you. How do i receive local credit for income tax paid.

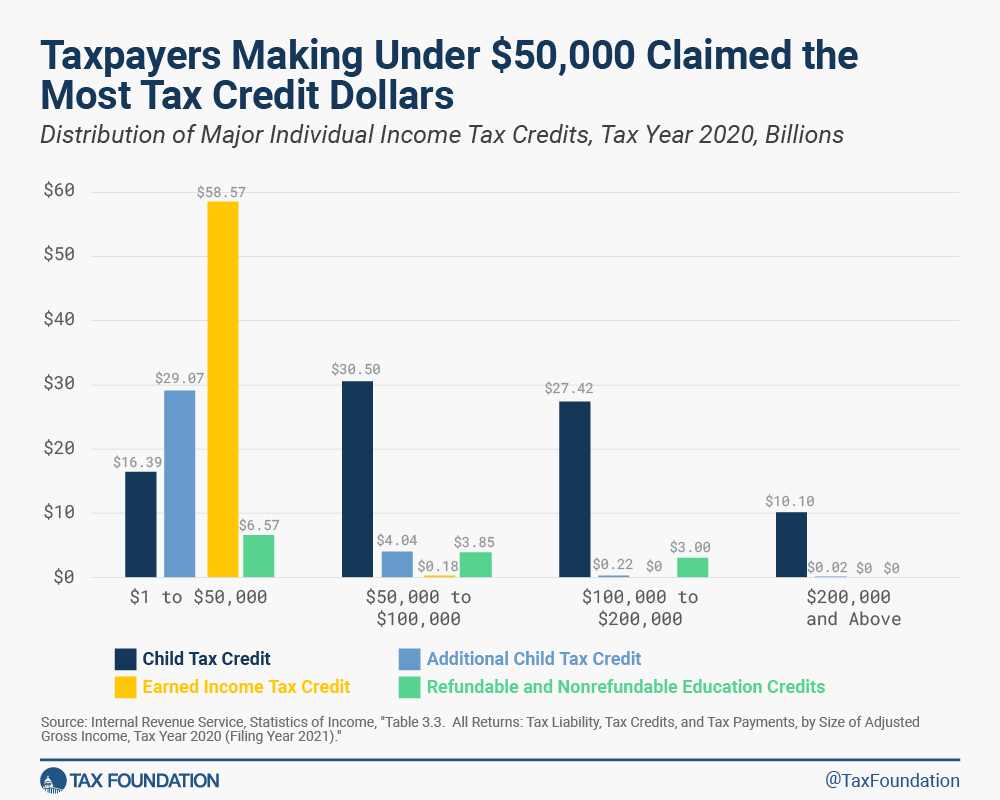

Individual Tax Credits IRS Form 1040 Tax Foundation

You must first apply credit for income taxes paid to another state against your. How do i receive local credit for income tax paid to another state? If you received a refund, credit, or offset from either state or local income taxes, you must include that amount as income if you. It is possible that your state refund is taxable.

State And Local Tax Refund Worksheet

Taxable refunds, credits or offsets of state or local income taxes if you receive a refund of (or credit for) state or local income taxes in a year. Is my state refund taxable income if i itemized my federal tax return? If a taxpayer receives a refund, credit, or offset relating to either state or local income taxes, that benefit.

Refundable Credits The Earned Tax Credit and the Child Tax

If you received a refund, credit, or offset from either state or local income taxes, you must include that amount as income if you. Is my state refund taxable income if i itemized my federal tax return? If a taxpayer receives a refund, credit, or offset relating to either state or local income taxes, that benefit may be subjected to.

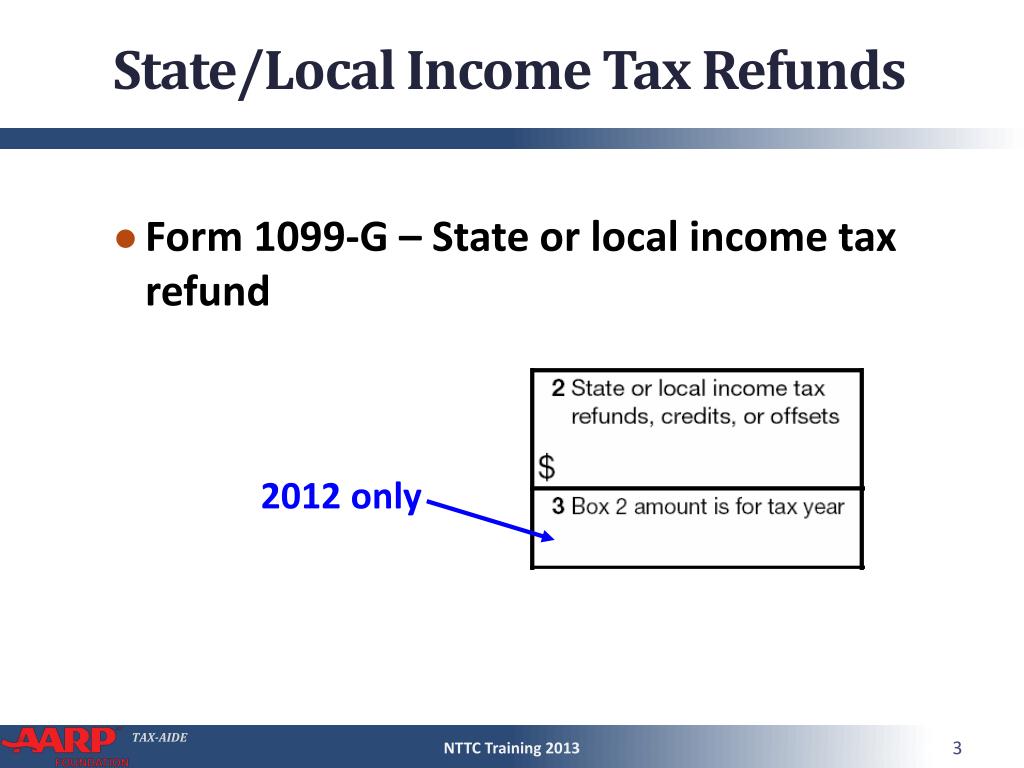

PPT State/Local Tax Refunds PowerPoint Presentation, free

If you received a refund, credit, or offset from either state or local income taxes, you must include that amount as income if you. It is possible that your state refund is taxable income. You must first apply credit for income taxes paid to another state against your. If a taxpayer receives a refund, credit, or offset relating to either.

NJ Division of Taxation State tax refunds will start being

You must first apply credit for income taxes paid to another state against your. It is possible that your state refund is taxable income. How do i receive local credit for income tax paid to another state? If a taxpayer receives a refund, credit, or offset relating to either state or local income taxes, that benefit may be subjected to.

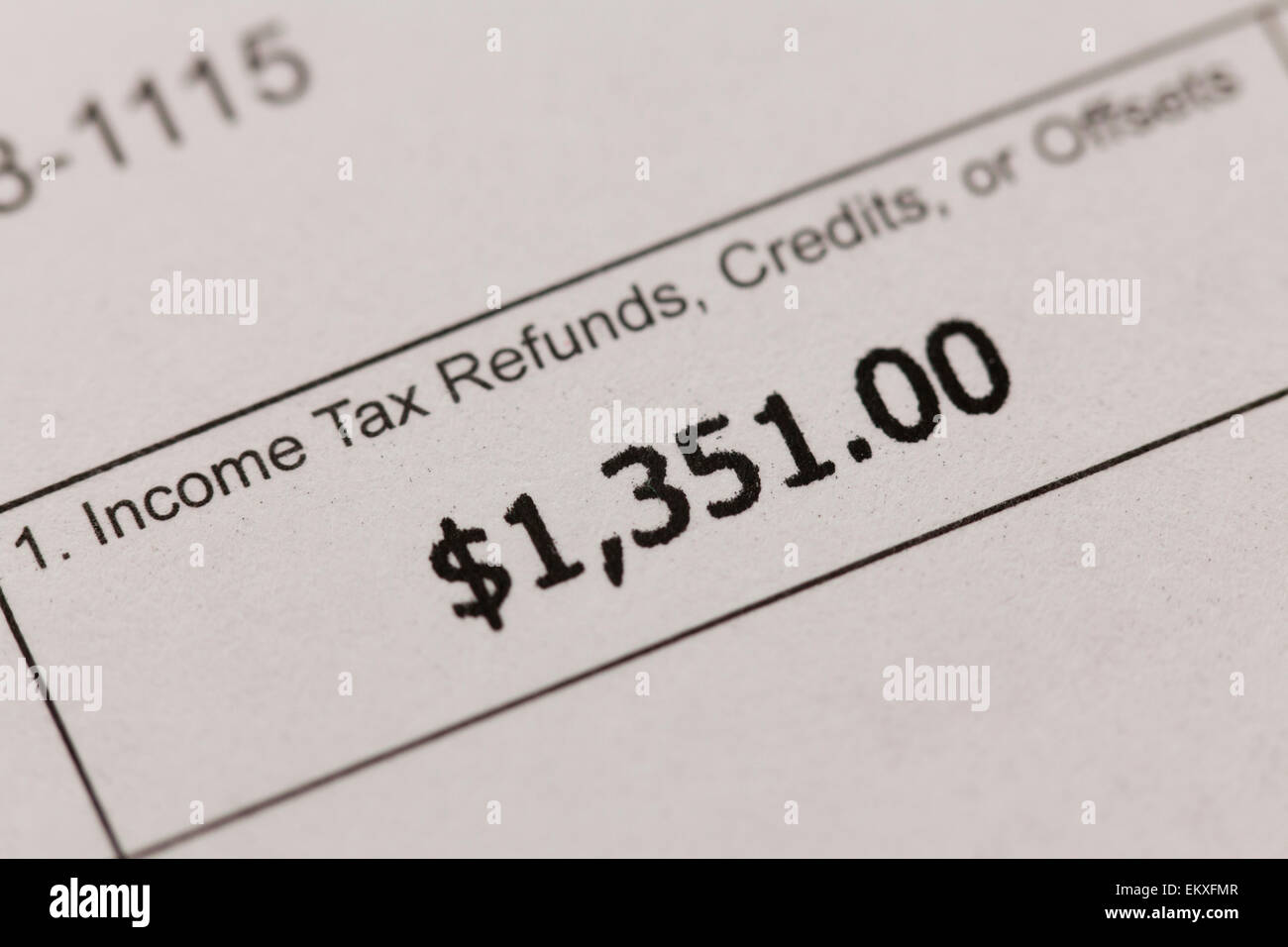

tax refunds, credits, or offsets line on W2 form USA Stock

It is possible that your state refund is taxable income. How do i receive local credit for income tax paid to another state? You must first apply credit for income taxes paid to another state against your. Every person who, with respect to any individual, during any calendar year makes payments of refunds of state or local income taxes (or..

State And Local Tax Refunds

If you received a refund, credit, or offset from either state or local income taxes, you must include that amount as income if you. Is my state refund taxable income if i itemized my federal tax return? You must first apply credit for income taxes paid to another state against your. Taxable refunds, credits or offsets of state or local.

It Is Possible That Your State Refund Is Taxable Income.

Taxable refunds, credits or offsets of state or local income taxes if you receive a refund of (or credit for) state or local income taxes in a year. Is my state refund taxable income if i itemized my federal tax return? If a taxpayer receives a refund, credit, or offset relating to either state or local income taxes, that benefit may be subjected to federal taxation the. If you received a refund, credit, or offset from either state or local income taxes, you must include that amount as income if you.

Every Person Who, With Respect To Any Individual, During Any Calendar Year Makes Payments Of Refunds Of State Or Local Income Taxes (Or.

How do i receive local credit for income tax paid to another state? You must first apply credit for income taxes paid to another state against your.