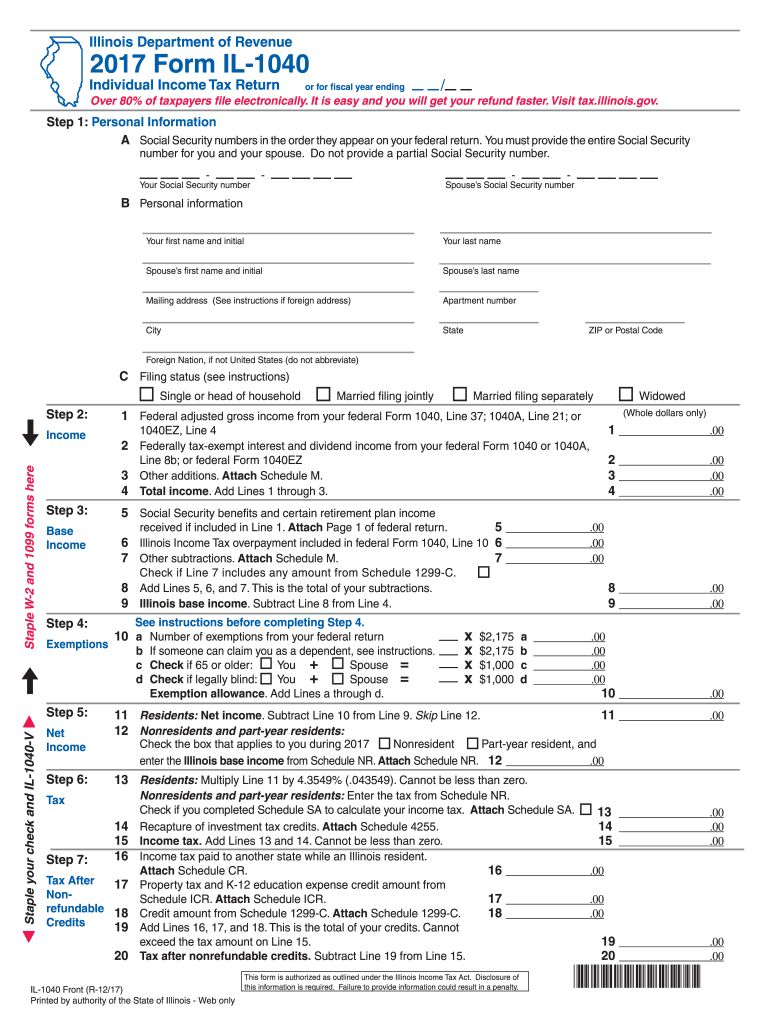

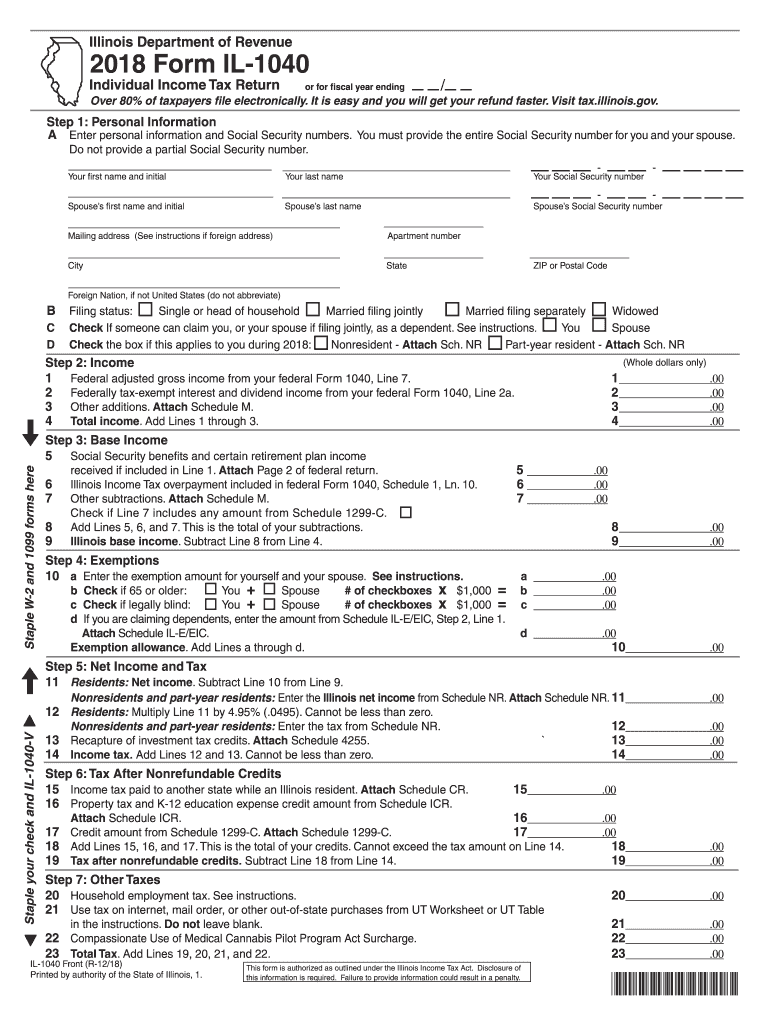

State Tax Withholding Form Illinois

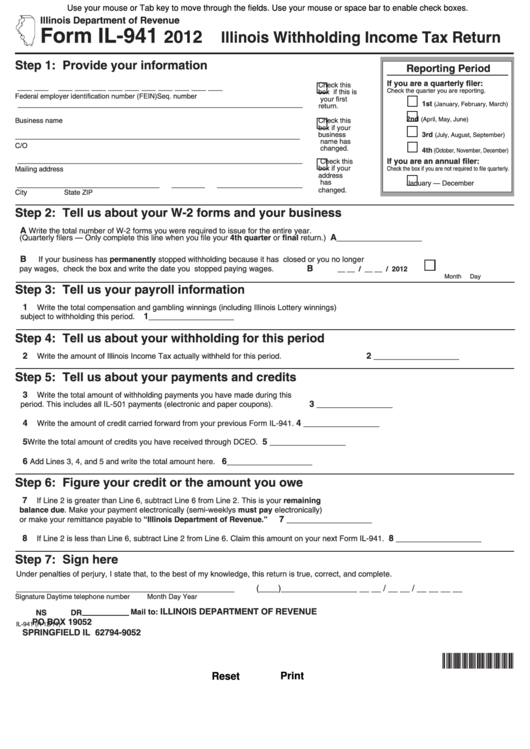

State Tax Withholding Form Illinois - If you are an employee, you must complete this form so your employer can withhold the correct amount of. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Withholding income tax credits information and worksheets. From your pay depends, in part, on the number of allowances you claim on this form.

From your pay depends, in part, on the number of allowances you claim on this form. Withholding income tax credits information and worksheets. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. If you are an employee, you must complete this form so your employer can withhold the correct amount of. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay.

2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. If you are an employee, you must complete this form so your employer can withhold the correct amount of. From your pay depends, in part, on the number of allowances you claim on this form. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Withholding income tax credits information and worksheets.

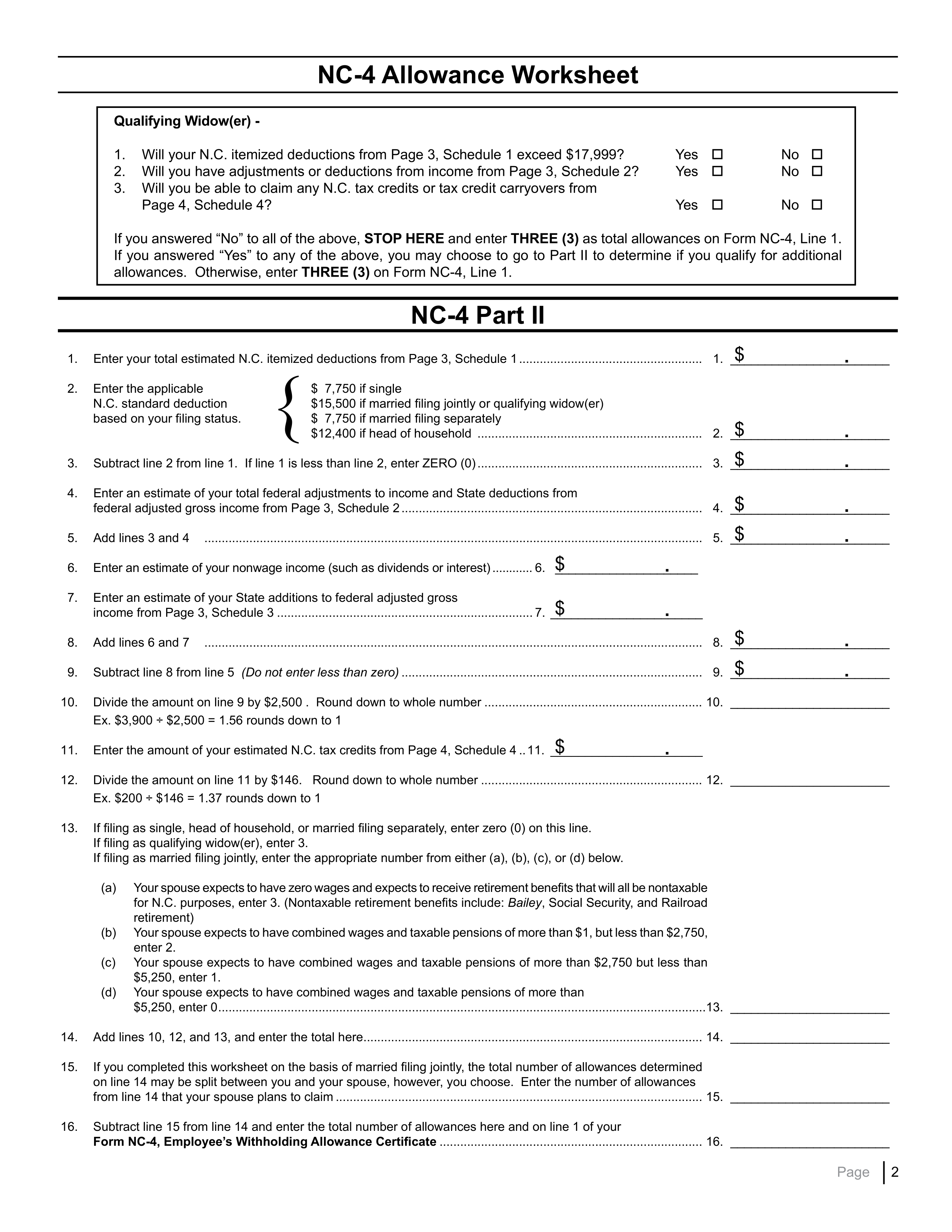

Nc Withholding Tables 2024 Midge Susette

If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. If you are an employee, you must complete this form so your employer can withhold the correct amount of. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding.

New York State Employee Tax Withholding Form

If you are an employee, you must complete this form so your employer can withhold the correct amount of. From your pay depends, in part, on the number of allowances you claim on this form. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay..

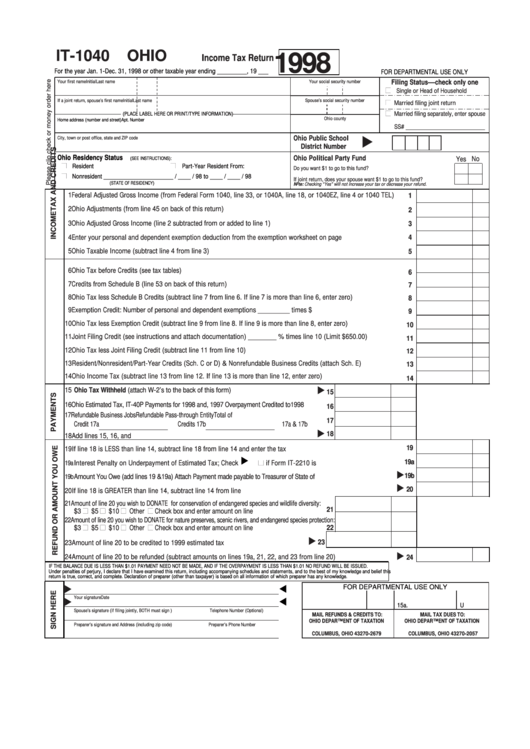

Online Ohio State Tax Withholding Form

From your pay depends, in part, on the number of allowances you claim on this form. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. Withholding income tax credits information and worksheets. If you are an employee, you must complete this form so your employer can withhold the correct amount.

Illinois state tax form Fill out & sign online DocHub

2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. If you are an employee, you must complete this form so your employer can withhold the.

State Tax Withholding Form Ohio

If you are an employee, you must complete this form so your employer can withhold the correct amount of. Withholding income tax credits information and worksheets. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012).

North Carolina State Withholding Form Nc4 Ez

If you are an employee, you must complete this form so your employer can withhold the correct amount of. From your pay depends, in part, on the number of allowances you claim on this form. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. Withholding income tax credits information and.

Indiana State Tax Withholding Form Wh4p

From your pay depends, in part, on the number of allowances you claim on this form. If you are an employee, you must complete this form so your employer can withhold the correct amount of. Withholding income tax credits information and worksheets. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior.

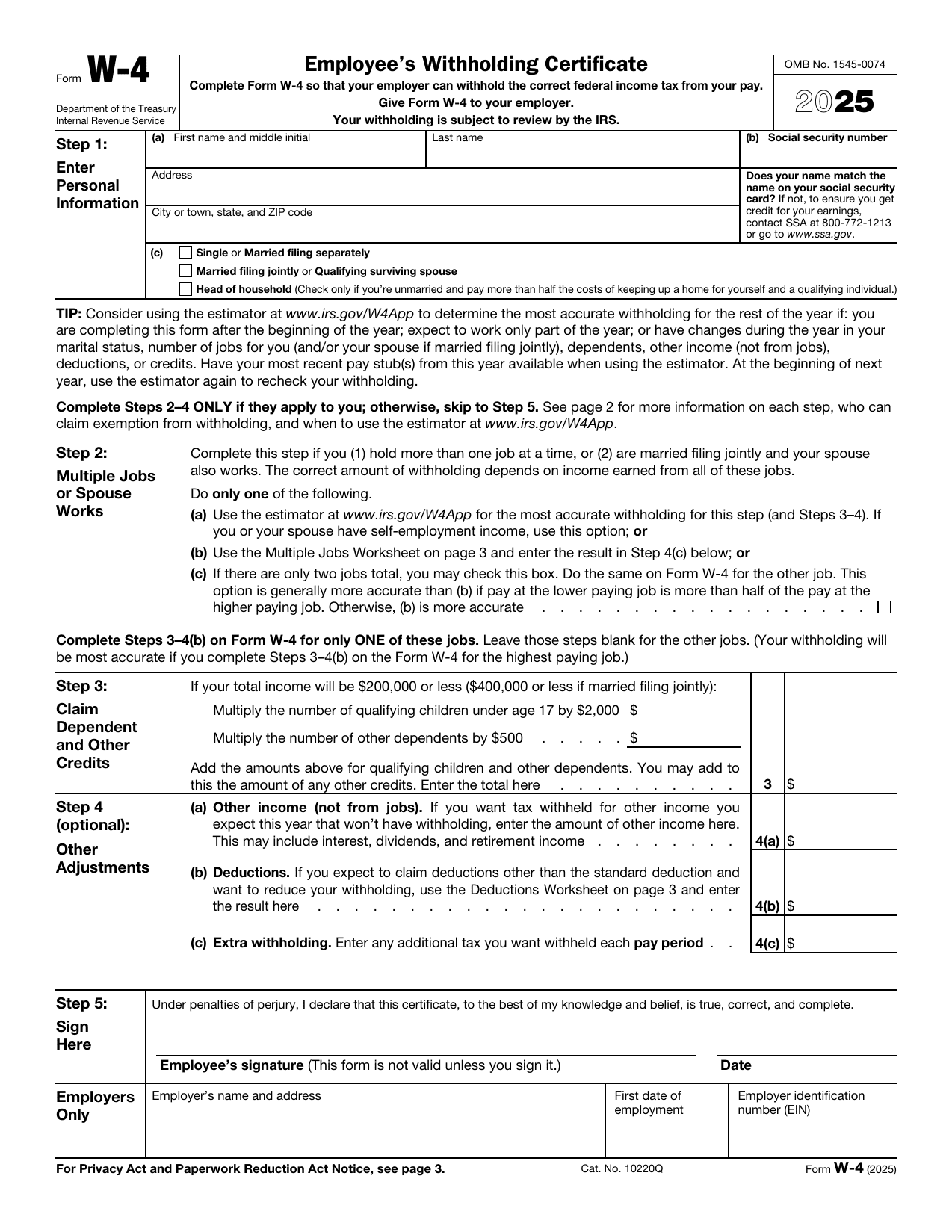

State Withholding Tax Form 2023 Printable Forms Free Online

If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. If you are an employee, you must complete this form so your employer can withhold the.

Illinois State Tax Complete with ease airSlate SignNow

From your pay depends, in part, on the number of allowances you claim on this form. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. Withholding income tax credits information and worksheets. If you are an employee, you must complete this form so your employer can withhold the correct amount.

Illinois Tax Withholding Form

If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. From your pay depends, in part, on the number of allowances you claim on this form. Withholding income tax credits information and worksheets. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years.

From Your Pay Depends, In Part, On The Number Of Allowances You Claim On This Form.

2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. Withholding income tax credits information and worksheets. If you are an employee, you must complete this form so your employer can withhold the correct amount of. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay.