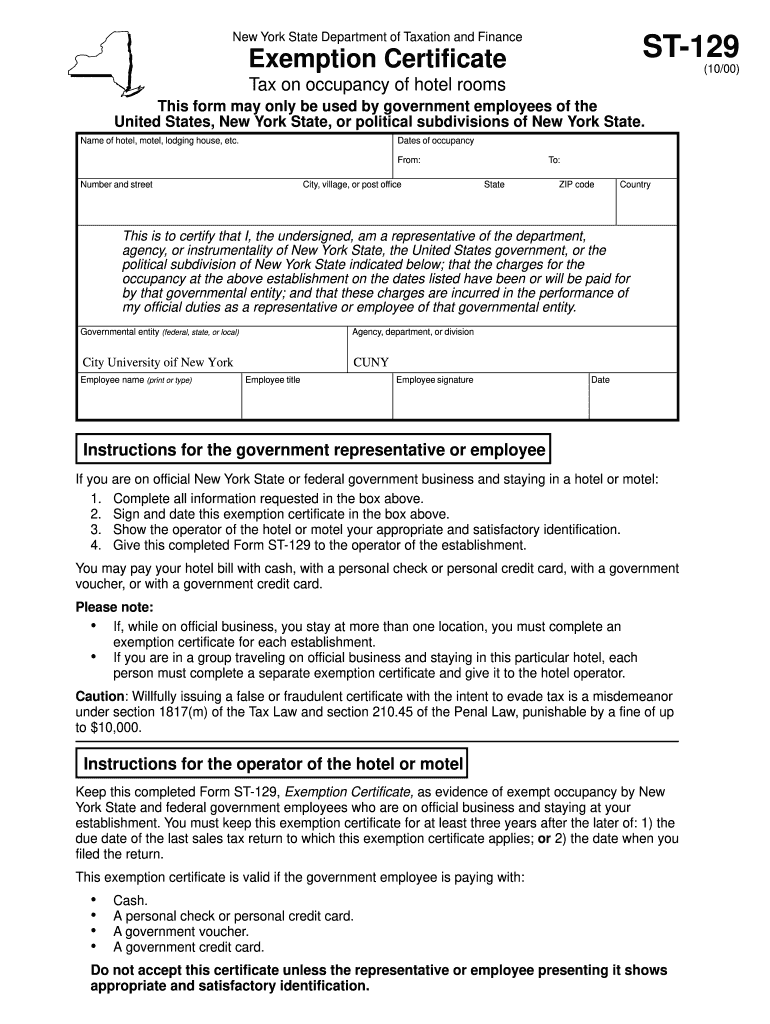

Tax Exempt Form Ohio

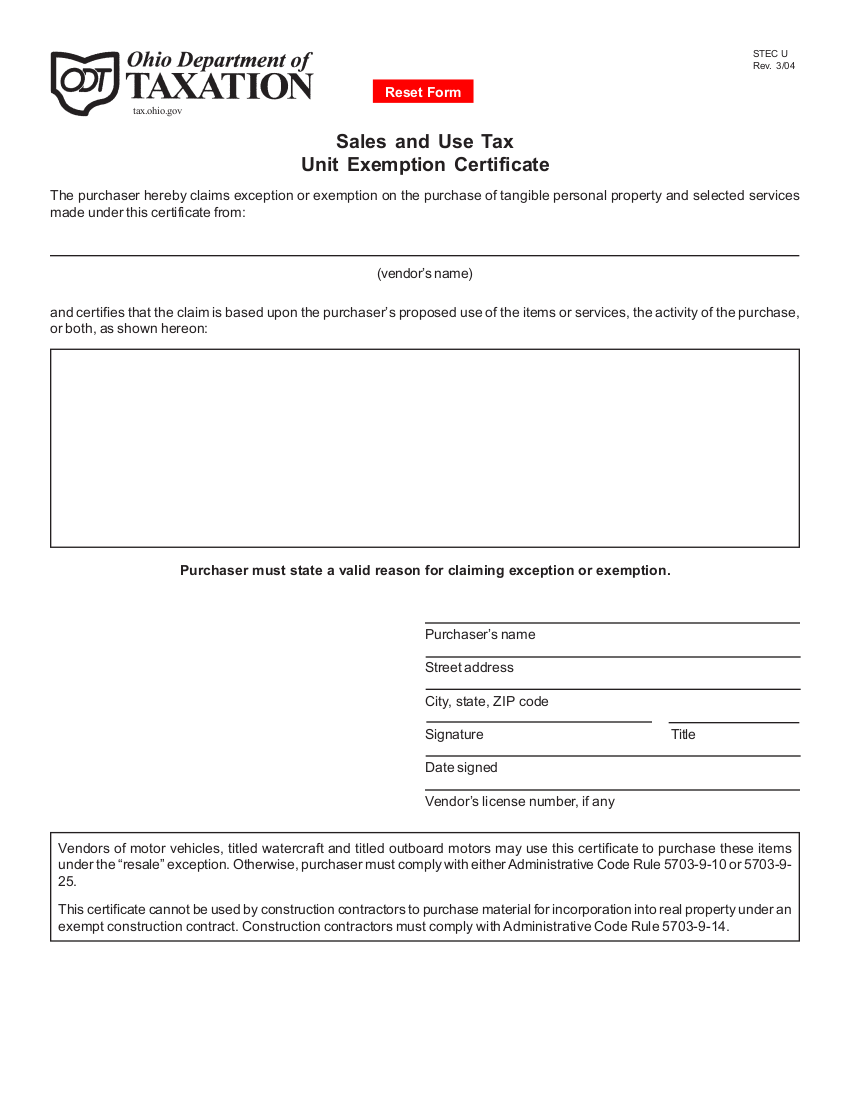

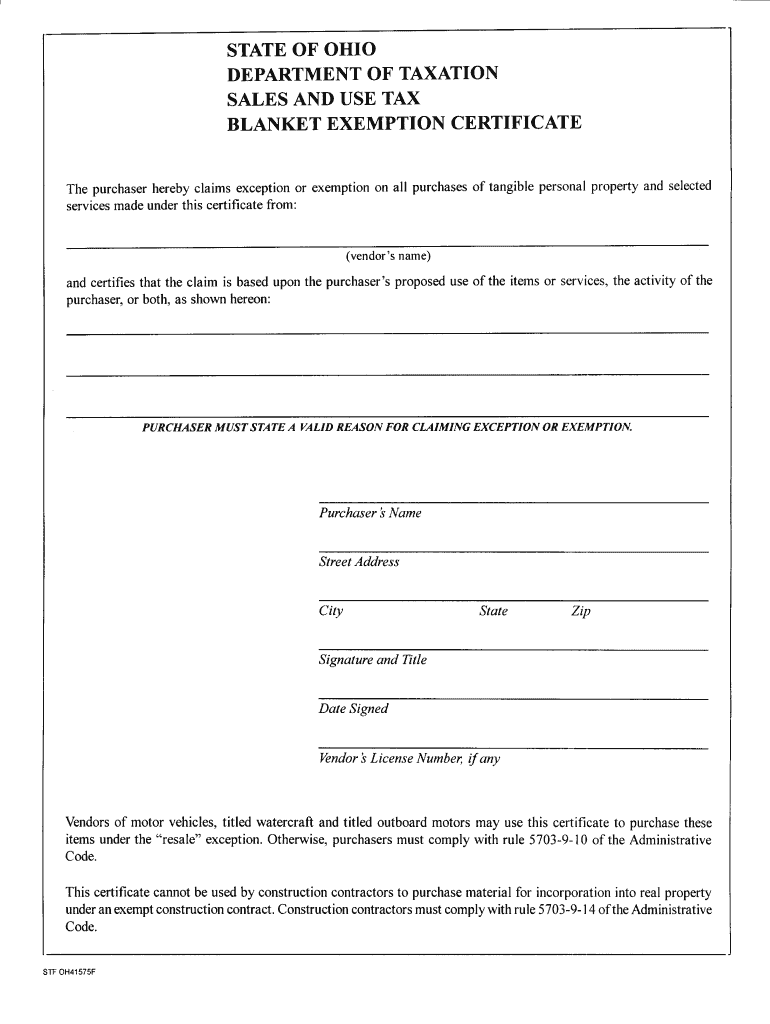

Tax Exempt Form Ohio - This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Purchasers must state a valid. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download or print the forms.

This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Purchasers must state a valid. Download or print the forms.

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. Download or print the forms. Purchasers must state a valid. What purchases are exempt from the ohio sales tax?

Printable State Tax Forms

What purchases are exempt from the ohio sales tax? This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. There is a special contractor's exemption certificate and a construction contract.

Ohio tax exempt form Fill out & sign online DocHub

Download or print the forms. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Purchasers must state a valid. This form allows purchasers to claim exception or exemption on certain.

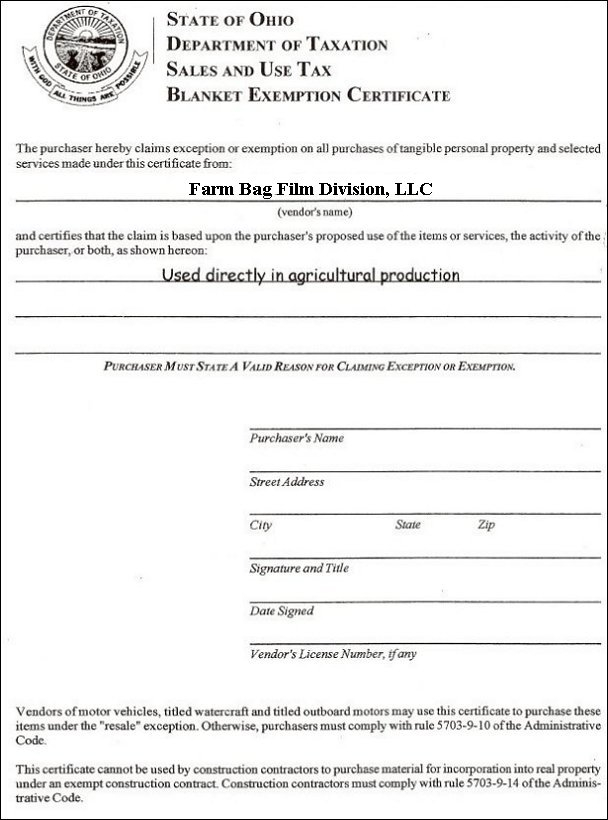

Fillable Ohio Vendor Tax Exempt Form Printable Forms Free Online

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Purchasers must state a valid. What purchases are exempt from the ohio sales tax? This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. There is a special contractor's exemption.

Blank Fillable Ohio Tax Exempt Form Printable Forms Free Online

This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. There is a special contractor's.

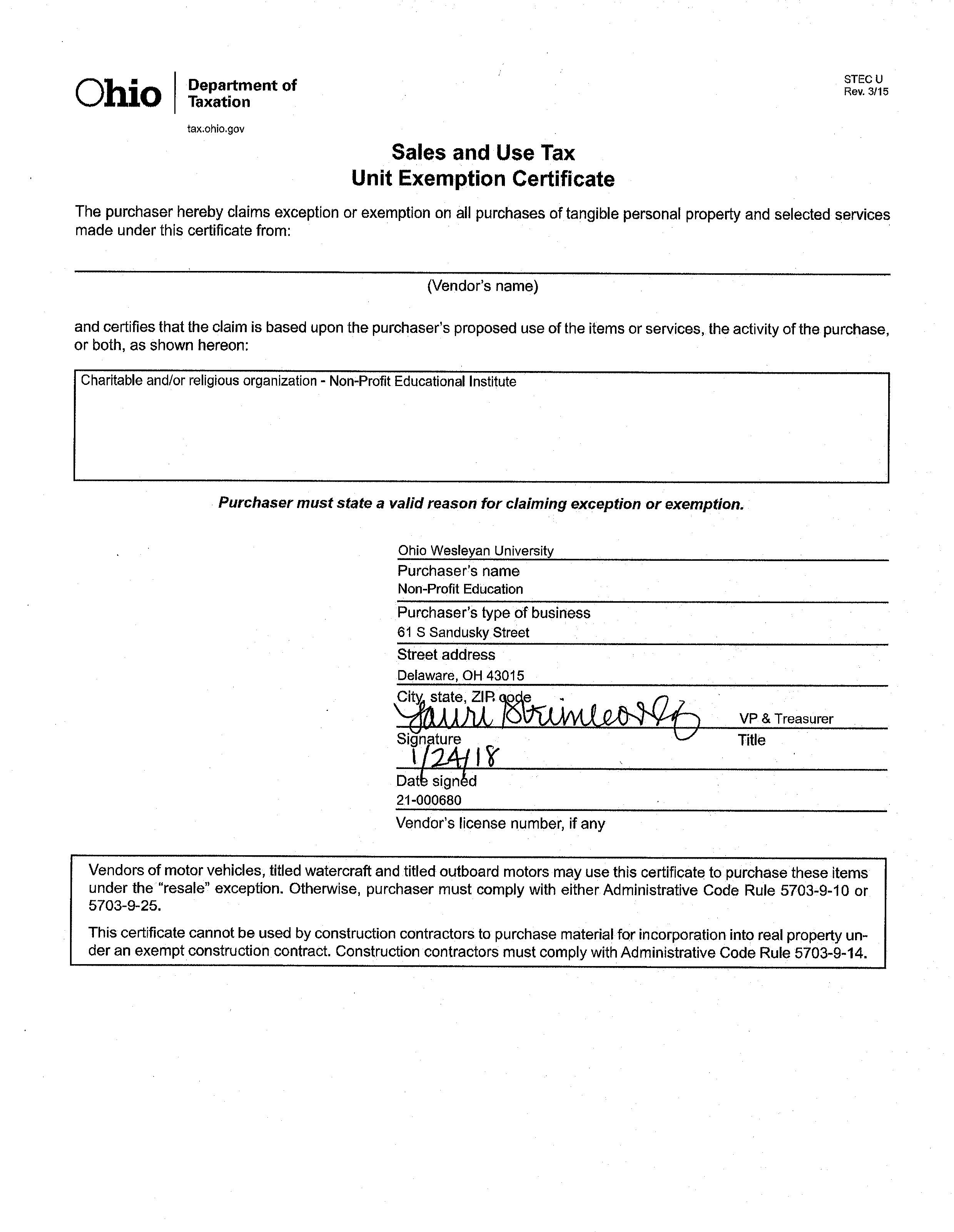

State Of Ohio Unit Tax Exempt Form

This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Download or print the forms. What purchases are exempt from the ohio sales tax? Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. Purchasers must state a valid.

Ohio Sales Tax Manufacturing Exemption Form

Purchasers must state a valid. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner..

Ohio State Tax Form What Does The Exemption Mean

Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. Purchasers must state a valid. What purchases are exempt from the ohio sales tax? This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. There is a special contractor's exemption certificate.

TaxExempt Forms Ohio Wesleyan University

This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Download or print the forms. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Purchasers must state a valid. What purchases are exempt from the ohio sales.

Ohio Tax Exempt Form Welder Service

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax.

blanket certificate of exemption ohio Fill Online, Printable, Fillable

This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Download or print the forms. What purchases are exempt from the ohio sales tax? A sales tax exemption certificate can be used by businesses.

There Is A Special Contractor's Exemption Certificate And A Construction Contract Exemption Certificate Prescribed By The Tax Commissioner.

Download or print the forms. Find out how to claim exemption or exception on sales and use tax in ohio with various forms for different situations. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. What purchases are exempt from the ohio sales tax?

A Sales Tax Exemption Certificate Can Be Used By Businesses (Or In Some Cases, Individuals) Who Are Making Purchases That Are Exempt From The.

This form allows purchasers to claim exception or exemption on certain items or services from vendors in ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Purchasers must state a valid.