Tax Foreclosure Texas

Tax Foreclosure Texas - This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. How the owners are served with notice of the. In order to foreclose, the taxing authority must file a lawsuit against the owner of the property. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at.

This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. In order to foreclose, the taxing authority must file a lawsuit against the owner of the property. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. How the owners are served with notice of the. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at.

This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. How the owners are served with notice of the. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. In order to foreclose, the taxing authority must file a lawsuit against the owner of the property. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at.

How to Buy Property with Delinquent Taxes Texas Tax Liens

This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. In order to foreclose, the taxing authority must file a lawsuit against the owner of the property. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which.

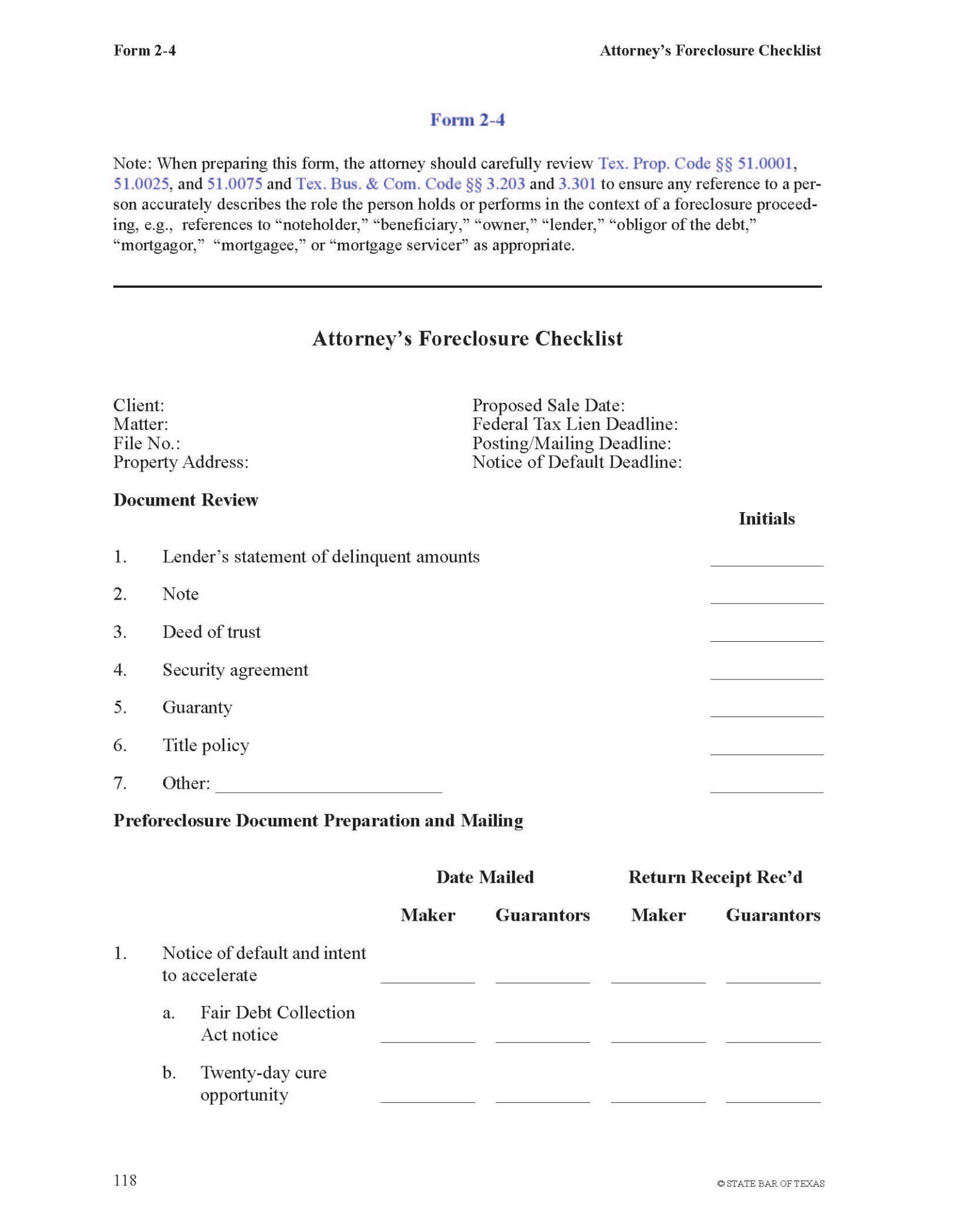

Texas Foreclosure Manual, 2023 ed. Texas Bar Practice

Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. In order to foreclose, the taxing authority must file.

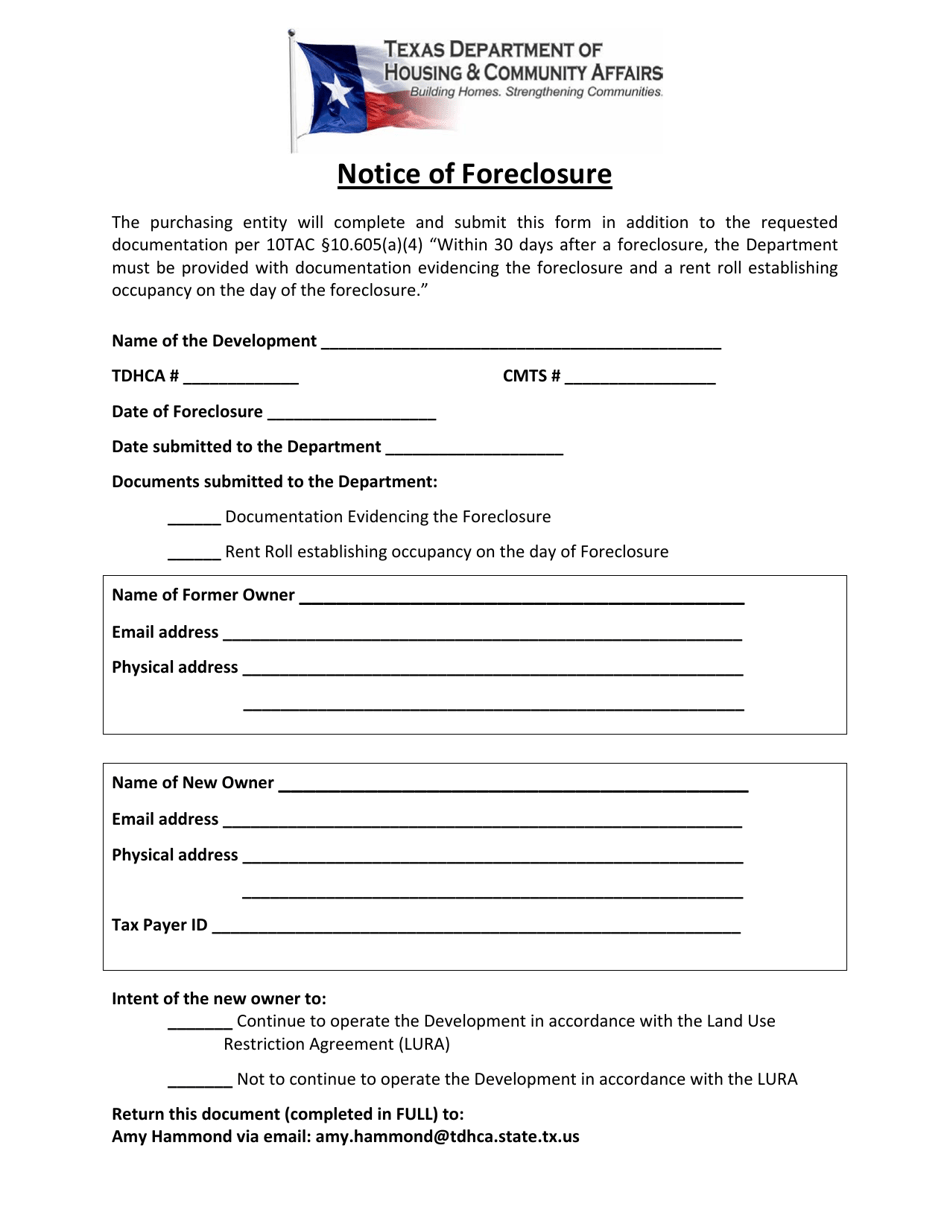

Texas Notice of Foreclosure Fill Out, Sign Online and Download PDF

Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. In order to foreclose, the taxing authority must file a lawsuit against.

Texas Property Tax Basics ppt download

This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. How the owners are served with notice of the. Delinquent tax foreclosure sales and resales.

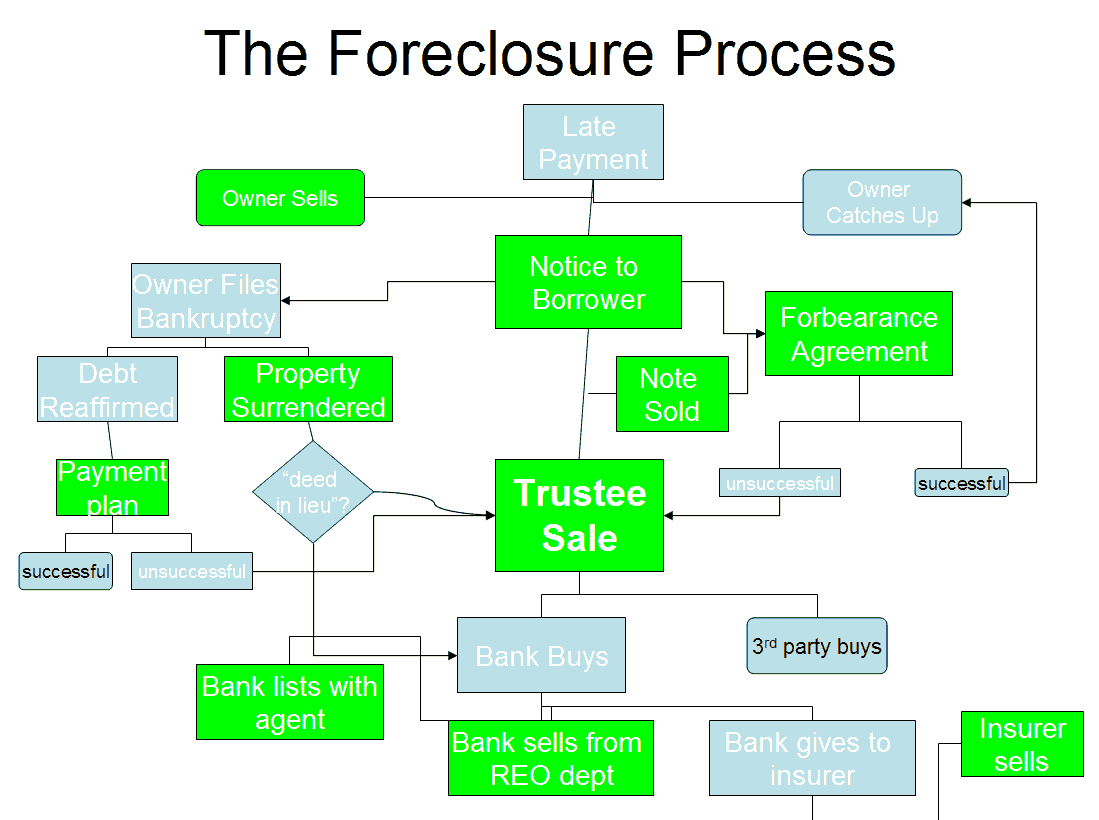

Texas Foreclosure Process

The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. How the owners are served with notice of the. This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. The only way.

Texas Foreclosure Laws & Process Overview [2024]

This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. How the owners are served with notice of the. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. The only way to obtain real estate from tax foreclosures.

Texas Foreclosure Process And Timeline.

This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. The notice of the sale must contain a description of the property to be sold,.

Understanding how the foreclosure process operates in Texas

How the owners are served with notice of the. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue.

Understanding the Texas Property Tax Code Facing Foreclosure Houston

This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. The only way to obtain real estate from tax foreclosures in texas.

What to Know About Tax Lien Foreclosure in Texas Johnson & Starr

How the owners are served with notice of the. Delinquent tax foreclosure sales and resales will be conducted by the county constables through an online platform operated by real auction at. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at. In order to.

In Order To Foreclose, The Taxing Authority Must File A Lawsuit Against The Owner Of The Property.

The notice of the sale must contain a description of the property to be sold, the number and style of the suit under which the property was sold at. How the owners are served with notice of the. This state bar of texas manual covers foreclosure laws and procedures in texas including debt collection, secured loans, bid. The only way to obtain real estate from tax foreclosures in texas is by actual purchase of the property at public venue (tax foreclosure sale at.

![Texas Foreclosure Laws & Process Overview [2024]](https://www.amerinotexchange.com/wp-content/uploads/2024/04/Foreclose-Laws-and-Process-Texas.png)