Tax Lien Interest Rates By State

Tax Lien Interest Rates By State - Ted thomas explains the rules, process, and. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. The tax lien certificate may foreclose on the property. The highest bidder gets the lien. If the property owner does not pay all. Some states have strict laws about when you can foreclose, and in some states,. The interest rate is 9% over the prime rate so it varies. Colorado lets people bid more.

Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. Some states have strict laws about when you can foreclose, and in some states,. The tax lien certificate may foreclose on the property. The highest bidder gets the lien. The interest rate is 9% over the prime rate so it varies. Ted thomas explains the rules, process, and. Colorado lets people bid more. If the property owner does not pay all.

If the property owner does not pay all. The highest bidder gets the lien. Ted thomas explains the rules, process, and. The tax lien certificate may foreclose on the property. Some states have strict laws about when you can foreclose, and in some states,. The interest rate is 9% over the prime rate so it varies. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. Colorado lets people bid more. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states.

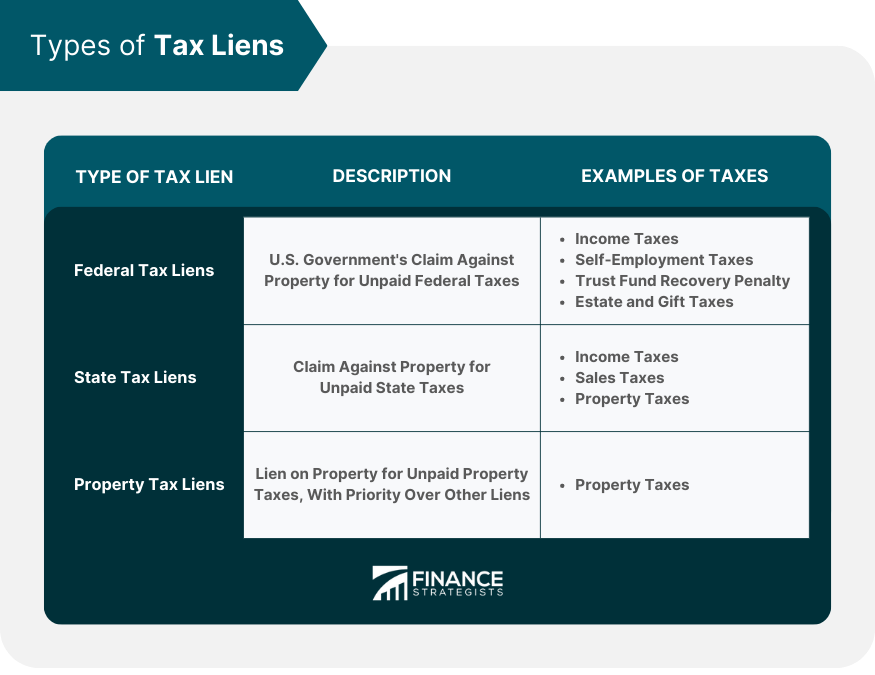

Tax Lien Definition, Process, Consequences, How to Handle

The interest rate is 9% over the prime rate so it varies. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. Some states have strict laws about when you can foreclose, and in some states,. Colorado lets people bid more. Learn how to invest in tax liens and tax deeds with.

Federal tax lien on foreclosed property laderdriver

Ted thomas explains the rules, process, and. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. The interest rate is 9% over the prime rate so it varies. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. If the property owner.

Tax Lien Form Free Word Templates

The tax lien certificate may foreclose on the property. The interest rate is 9% over the prime rate so it varies. Some states have strict laws about when you can foreclose, and in some states,. Colorado lets people bid more. The highest bidder gets the lien.

Federal tax lien on foreclosed property laderdriver

The highest bidder gets the lien. Ted thomas explains the rules, process, and. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. Colorado lets people bid more.

Tax Lien Training Special Expired — Financial Freedom University

Colorado lets people bid more. If the property owner does not pay all. Ted thomas explains the rules, process, and. The interest rate is 9% over the prime rate so it varies. The highest bidder gets the lien.

State Tax Rates 2025 Trish Henrieta

Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. If the property owner does not pay all. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns. Some states have strict laws about when you can foreclose, and in some states,. Colorado.

Tax lien Finschool By 5paisa

The tax lien certificate may foreclose on the property. Ted thomas explains the rules, process, and. Colorado lets people bid more. Some states have strict laws about when you can foreclose, and in some states,. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns.

2024 List Of Tax Lien Percentages By State The Leinlord

Some states have strict laws about when you can foreclose, and in some states,. The tax lien certificate may foreclose on the property. Colorado lets people bid more. Ted thomas explains the rules, process, and. If the property owner does not pay all.

The Importance of Hiring a Tax Lien Attorney for Your Insurance

Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. The tax lien certificate may foreclose on the property. If the property owner does not pay all. Some states have strict laws about when you can foreclose, and in some states,. The interest rate is 9% over the prime rate so.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

Some states have strict laws about when you can foreclose, and in some states,. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. The tax lien certificate may foreclose on the property. If the property owner does not pay all. The interest rate is 9% over the prime rate so.

Ted Thomas Explains The Rules, Process, And.

Colorado lets people bid more. Some states have strict laws about when you can foreclose, and in some states,. Learn how to invest in tax liens and tax deeds with 16% or higher interest rates in different states. If the property owner does not pay all.

The Highest Bidder Gets The Lien.

The interest rate is 9% over the prime rate so it varies. The tax lien certificate may foreclose on the property. Knowing the tax lien certificates interest rates by state can make a big difference in your investment returns.