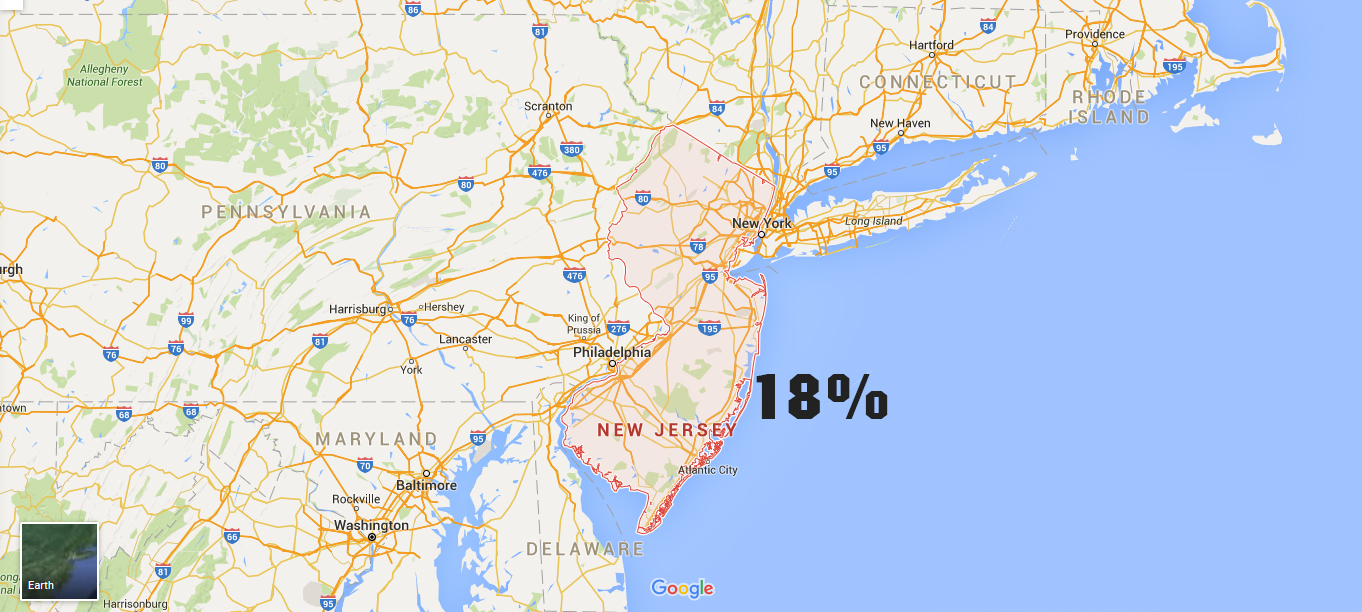

Tax Liens New Jersey

Tax Liens New Jersey - In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. A tax lien is filed against you with the clerk of the new jersey superior court. Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties. All detail provided on our website is public information as. In new jersey, a cod is a tax lien filed against you. Cods are filed to secure tax debt and to protect the. The winning buyer will be. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. We publish information pertaining to the largest uncollected tax liabilities owed to us.

A tax lien is filed against you with the clerk of the new jersey superior court. Cods are filed to secure tax debt and to protect the. The winning buyer will be. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. We publish information pertaining to the largest uncollected tax liabilities owed to us. In new jersey, a cod is a tax lien filed against you. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties. Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. All detail provided on our website is public information as.

A tax lien is filed against you with the clerk of the new jersey superior court. Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. In new jersey, a cod is a tax lien filed against you. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. Cods are filed to secure tax debt and to protect the. We publish information pertaining to the largest uncollected tax liabilities owed to us. All detail provided on our website is public information as. The winning buyer will be. In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

In new jersey, a cod is a tax lien filed against you. We publish information pertaining to the largest uncollected tax liabilities owed to us. The winning buyer will be. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. Learn how tax foreclosure and tax sales work in new jersey, and.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

All detail provided on our website is public information as. Cods are filed to secure tax debt and to protect the. Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. A tax lien is filed against you with the clerk of the new jersey superior court. We publish information.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

In new jersey, a cod is a tax lien filed against you. Cods are filed to secure tax debt and to protect the. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties. The winning buyer will be. Every municipality in new jersey is required to.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties. All detail provided on our website is public information as. Every municipality in new jersey is required to.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

Cods are filed to secure tax debt and to protect the. The winning buyer will be. We publish information pertaining to the largest uncollected tax liabilities owed to us. A tax lien is filed against you with the clerk of the new jersey superior court. In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt).

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. Cods are filed to secure tax debt and to protect the. A tax lien is filed against you with the clerk.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

We publish information pertaining to the largest uncollected tax liabilities owed to us. A tax lien is filed against you with the clerk of the new jersey superior court. Cods are filed to secure tax debt and to protect the. In new jersey, a cod is a tax lien filed against you. A tax lien is the state's legal claim.

How to Buy Tax Liens in New Jersey (with Pictures) wikiHow

We publish information pertaining to the largest uncollected tax liabilities owed to us. In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. The winning buyer will be. In new jersey, a cod is a tax lien filed against you. A tax lien is filed against you with the.

Philippine Tax Academy

In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. We publish information pertaining to the largest uncollected tax liabilities owed to us. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties. In new.

New Jersey Tax Liens Tax Lien & Deed Investment

In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. We publish information pertaining to the largest uncollected tax liabilities owed to us. The winning buyer will be. Every municipality in new jersey is required to have at least one sale of unpaid real estate taxes a year. A.

Every Municipality In New Jersey Is Required To Have At Least One Sale Of Unpaid Real Estate Taxes A Year.

In new jersey, unpaid property taxes become a lien (a legal claim for unpaid debt) against the property at 18% interest. Cods are filed to secure tax debt and to protect the. A tax lien is the state's legal claim to your assets in relation to your unpaid tax liability. Learn how tax foreclosure and tax sales work in new jersey, and how they can be used as a redevelopment tool for abandoned properties.

We Publish Information Pertaining To The Largest Uncollected Tax Liabilities Owed To Us.

A tax lien is filed against you with the clerk of the new jersey superior court. The winning buyer will be. All detail provided on our website is public information as. In new jersey, a cod is a tax lien filed against you.