Umd Tax Forms

Umd Tax Forms - If you do not receive it in the mail and are unable to access your w2 on posc, you can call maryland’s central payroll bureau directly to. This form is used to verify that you (and your spouse, if applicable) did not file a u.s. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and. Find and download maryland tax forms, booklets and instructions for tax year 2020 to 2024. Learn how to choose the right form based on your. Parents can gain access to their student's information by following these instructions. The accordions below contain the forms required by university human resources for the many programs and services available to.

Find and download maryland tax forms, booklets and instructions for tax year 2020 to 2024. The accordions below contain the forms required by university human resources for the many programs and services available to. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and. This form is used to verify that you (and your spouse, if applicable) did not file a u.s. Parents can gain access to their student's information by following these instructions. Learn how to choose the right form based on your. If you do not receive it in the mail and are unable to access your w2 on posc, you can call maryland’s central payroll bureau directly to.

Learn how to choose the right form based on your. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and. Find and download maryland tax forms, booklets and instructions for tax year 2020 to 2024. The accordions below contain the forms required by university human resources for the many programs and services available to. If you do not receive it in the mail and are unable to access your w2 on posc, you can call maryland’s central payroll bureau directly to. Parents can gain access to their student's information by following these instructions. This form is used to verify that you (and your spouse, if applicable) did not file a u.s.

Students Apply Classroom Knowledge to Client Tax Forms Labovitz

The accordions below contain the forms required by university human resources for the many programs and services available to. Find and download maryland tax forms, booklets and instructions for tax year 2020 to 2024. Learn how to choose the right form based on your. If you do not receive it in the mail and are unable to access your w2.

Tax forms for environmental tax breaks A guide

Find and download maryland tax forms, booklets and instructions for tax year 2020 to 2024. This form is used to verify that you (and your spouse, if applicable) did not file a u.s. Learn how to choose the right form based on your. The accordions below contain the forms required by university human resources for the many programs and services.

1098 Tax Forms for Mortgage Interest IRS Copy A DiscountTaxForms

Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and. If you do not receive it in the mail and are unable to access your w2 on posc, you can call maryland’s central payroll bureau directly to. The accordions below contain the forms required by university.

2021 Tax Season is here! What tax forms do you need? YouTube

This form is used to verify that you (and your spouse, if applicable) did not file a u.s. Learn how to choose the right form based on your. If you do not receive it in the mail and are unable to access your w2 on posc, you can call maryland’s central payroll bureau directly to. Form used to determine the.

Fillable Online uhr umd tax treaty representation letter UMD HR

Parents can gain access to their student's information by following these instructions. If you do not receive it in the mail and are unable to access your w2 on posc, you can call maryland’s central payroll bureau directly to. Learn how to choose the right form based on your. Find and download maryland tax forms, booklets and instructions for tax.

The 5 Most Important Tax Forms You Should Know About The Motley Fool

Find and download maryland tax forms, booklets and instructions for tax year 2020 to 2024. Learn how to choose the right form based on your. If you do not receive it in the mail and are unable to access your w2 on posc, you can call maryland’s central payroll bureau directly to. The accordions below contain the forms required by.

Applicable Forms under Goods & Service Tax Rules, GST form

Find and download maryland tax forms, booklets and instructions for tax year 2020 to 2024. Parents can gain access to their student's information by following these instructions. This form is used to verify that you (and your spouse, if applicable) did not file a u.s. Form used to determine the amount of income tax withholding due on the sale of.

Beginner's guide to filing tax in Canada MoneyTalk

Find and download maryland tax forms, booklets and instructions for tax year 2020 to 2024. Parents can gain access to their student's information by following these instructions. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and. Learn how to choose the right form based on.

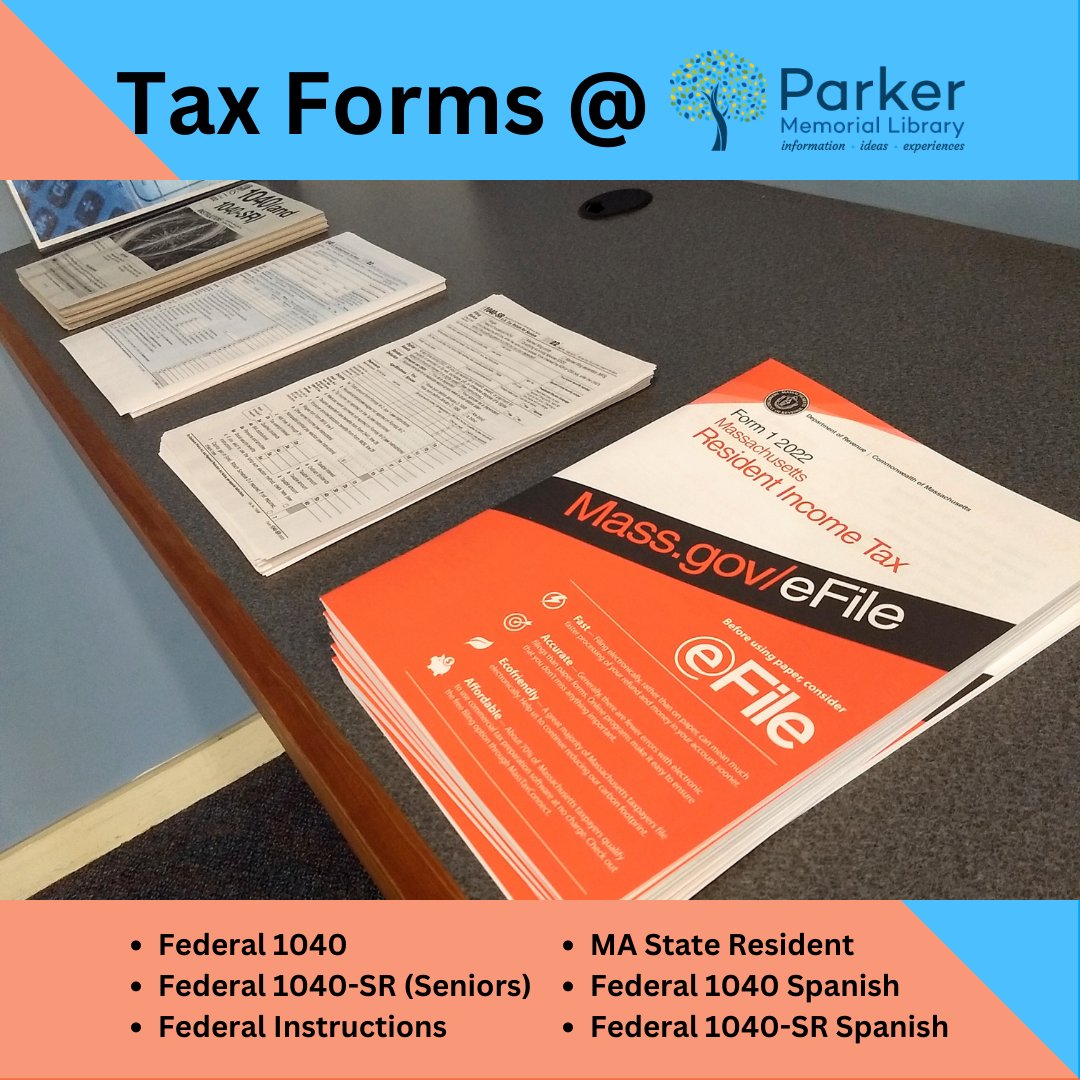

Dracut Library on Twitter "Most tax forms for the 2022 tax year are

If you do not receive it in the mail and are unable to access your w2 on posc, you can call maryland’s central payroll bureau directly to. Find and download maryland tax forms, booklets and instructions for tax year 2020 to 2024. Parents can gain access to their student's information by following these instructions. Learn how to choose the right.

Tax Forms Now Available Paxton, MA

If you do not receive it in the mail and are unable to access your w2 on posc, you can call maryland’s central payroll bureau directly to. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and. The accordions below contain the forms required by university.

Form Used To Determine The Amount Of Income Tax Withholding Due On The Sale Of Property Located In Maryland And Owned By Nonresidents, And.

The accordions below contain the forms required by university human resources for the many programs and services available to. This form is used to verify that you (and your spouse, if applicable) did not file a u.s. Parents can gain access to their student's information by following these instructions. If you do not receive it in the mail and are unable to access your w2 on posc, you can call maryland’s central payroll bureau directly to.

Learn How To Choose The Right Form Based On Your.

Find and download maryland tax forms, booklets and instructions for tax year 2020 to 2024.