Value Of An Ordinary Annuity

Value Of An Ordinary Annuity - Use our annuity calculator to calculate the present or future value of an annuity, or to calculate a payout. Given these variables, the present value of an ordinary annuity is: Plus, learn the formulas used. The future value of an annuity is the total value of payments at a. For example, if an ordinary annuity pays $50,000 per year for five years and the interest rate is. The formula for calculating the present value of an ordinary annuity is: Ordinary annuities and annuities due differ in the timing of those recurring payments. Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred annuity):

Plus, learn the formulas used. Use our annuity calculator to calculate the present or future value of an annuity, or to calculate a payout. The future value of an annuity is the total value of payments at a. Ordinary annuities and annuities due differ in the timing of those recurring payments. The formula for calculating the present value of an ordinary annuity is: Given these variables, the present value of an ordinary annuity is: For example, if an ordinary annuity pays $50,000 per year for five years and the interest rate is. Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred annuity):

The formula for calculating the present value of an ordinary annuity is: Ordinary annuities and annuities due differ in the timing of those recurring payments. For example, if an ordinary annuity pays $50,000 per year for five years and the interest rate is. The future value of an annuity is the total value of payments at a. Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred annuity): Plus, learn the formulas used. Given these variables, the present value of an ordinary annuity is: Use our annuity calculator to calculate the present or future value of an annuity, or to calculate a payout.

estanque admiración Fanático npv annuity calculator Perjudicial

For example, if an ordinary annuity pays $50,000 per year for five years and the interest rate is. Given these variables, the present value of an ordinary annuity is: The future value of an annuity is the total value of payments at a. Use our annuity calculator to calculate the present or future value of an annuity, or to calculate.

8 Photos Present Value Of Ordinary Annuity Due Table And View Alqu Blog

Use our annuity calculator to calculate the present or future value of an annuity, or to calculate a payout. Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred annuity): The formula for calculating the present value of an ordinary annuity is: Given these variables, the present value of an ordinary annuity is:.

AnnuityF Simple Annuity And Ordinary Annuity

Given these variables, the present value of an ordinary annuity is: The formula for calculating the present value of an ordinary annuity is: Ordinary annuities and annuities due differ in the timing of those recurring payments. Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred annuity): For example, if an ordinary annuity.

How To Use Present Value Of Ordinary Annuity Table Bruin Blog

The future value of an annuity is the total value of payments at a. Plus, learn the formulas used. Use our annuity calculator to calculate the present or future value of an annuity, or to calculate a payout. Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred annuity): Given these variables, the.

Annuity Ordinary and Annuity Due Present & Future Value Financial

Given these variables, the present value of an ordinary annuity is: For example, if an ordinary annuity pays $50,000 per year for five years and the interest rate is. The formula for calculating the present value of an ordinary annuity is: Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred annuity): Plus,.

The MindBlowing Math of Money The Solver Blog Rimwe Educational

The future value of an annuity is the total value of payments at a. Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred annuity): Plus, learn the formulas used. Use our annuity calculator to calculate the present or future value of an annuity, or to calculate a payout. For example, if an.

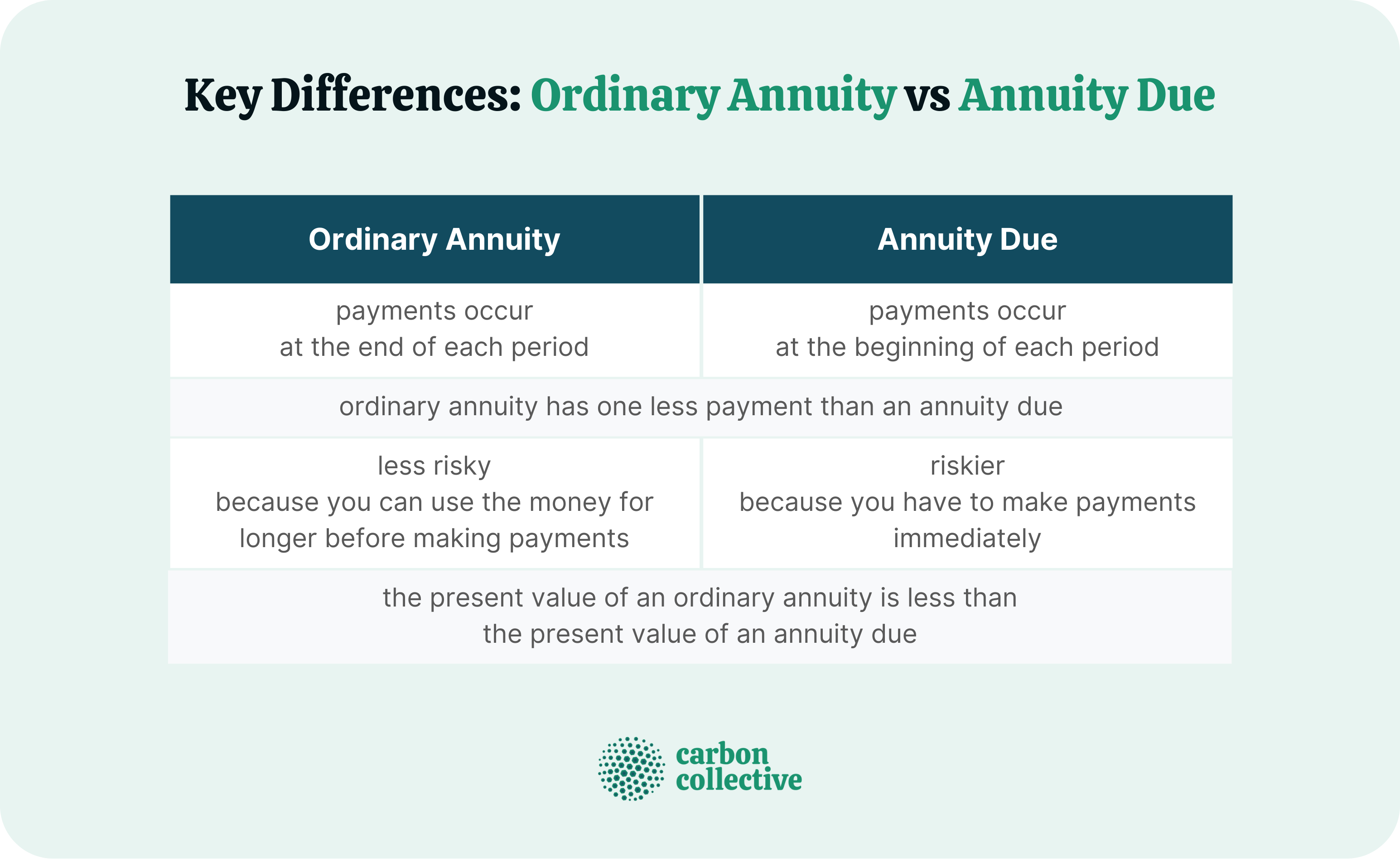

The Key Differences Between Ordinary & Annuity Due

The formula for calculating the present value of an ordinary annuity is: Given these variables, the present value of an ordinary annuity is: For example, if an ordinary annuity pays $50,000 per year for five years and the interest rate is. Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred annuity): Plus,.

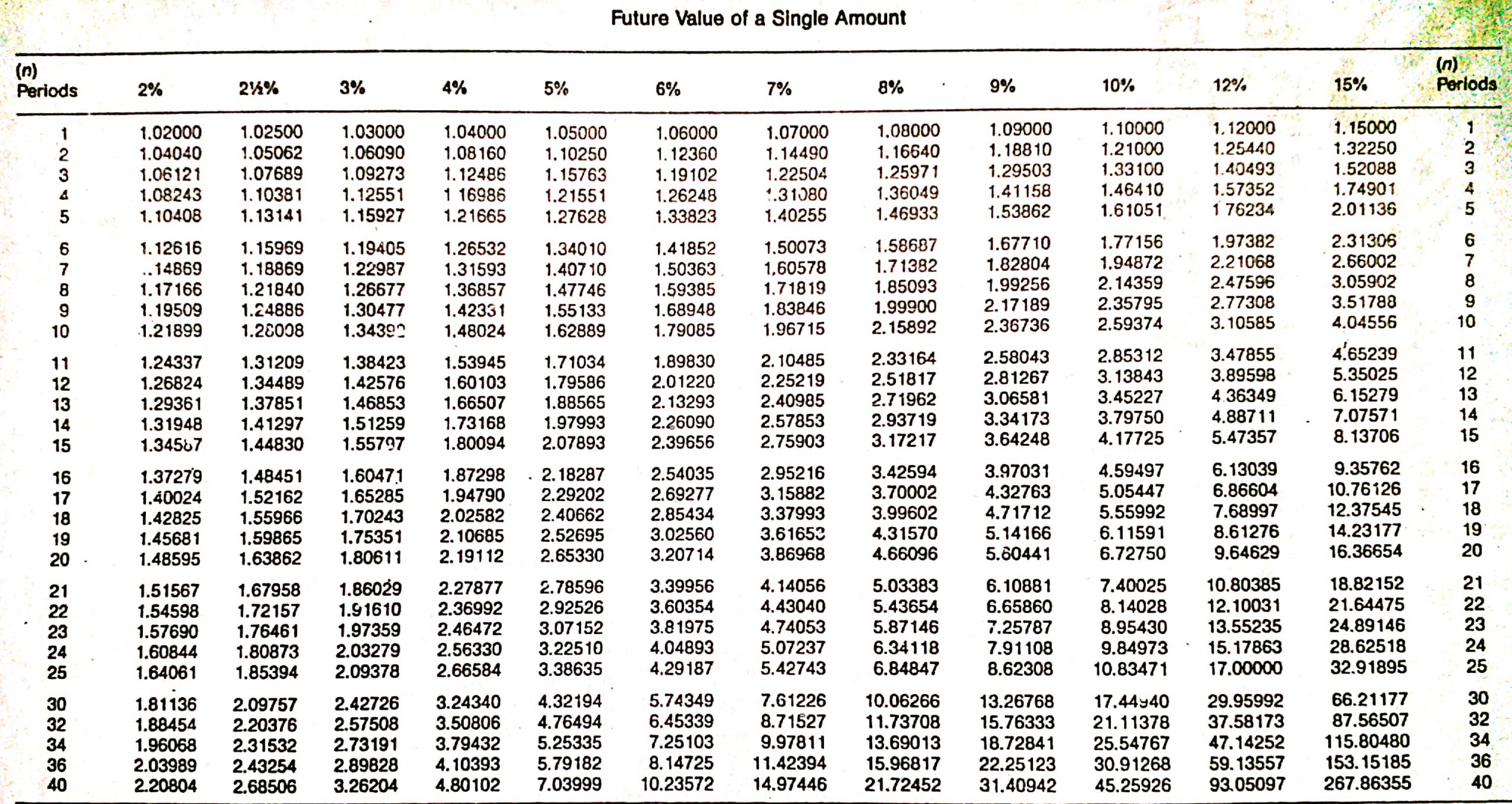

Future Value Annuity

Plus, learn the formulas used. Use our annuity calculator to calculate the present or future value of an annuity, or to calculate a payout. The formula for calculating the present value of an ordinary annuity is: For example, if an ordinary annuity pays $50,000 per year for five years and the interest rate is. Ordinary annuities and annuities due differ.

Calculating Present and Future Value of Annuities

Given these variables, the present value of an ordinary annuity is: For example, if an ordinary annuity pays $50,000 per year for five years and the interest rate is. The future value of an annuity is the total value of payments at a. Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred.

Present Value of an Ordinary Annuity YouTube

The future value of an annuity is the total value of payments at a. For example, if an ordinary annuity pays $50,000 per year for five years and the interest rate is. The formula for calculating the present value of an ordinary annuity is: Use our annuity calculator to calculate the present or future value of an annuity, or to.

Ordinary Annuities And Annuities Due Differ In The Timing Of Those Recurring Payments.

Use our annuity calculator to calculate the present or future value of an annuity, or to calculate a payout. The formula for calculating the present value of an ordinary annuity is: For example, if an ordinary annuity pays $50,000 per year for five years and the interest rate is. Given these variables, the present value of an ordinary annuity is:

The Future Value Of An Annuity Is The Total Value Of Payments At A.

Here’s how the formula looks if you’re applying it to an ordinary annuity (also called a deferred annuity): Plus, learn the formulas used.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)