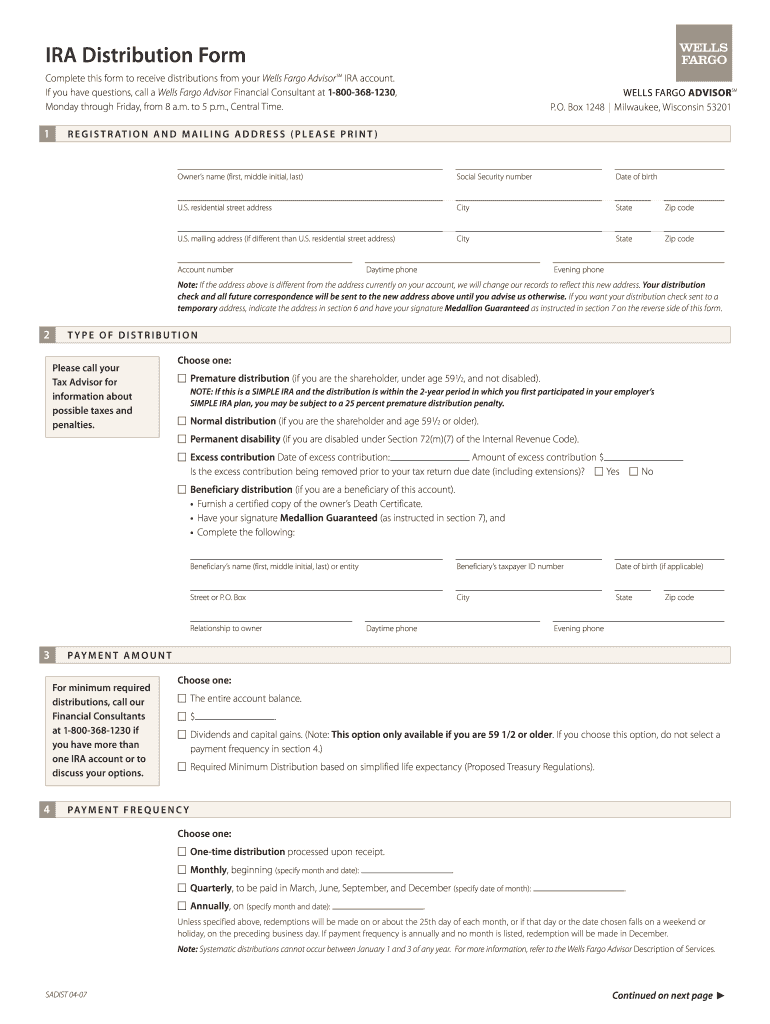

Wells Fargo Ira Distribution Form

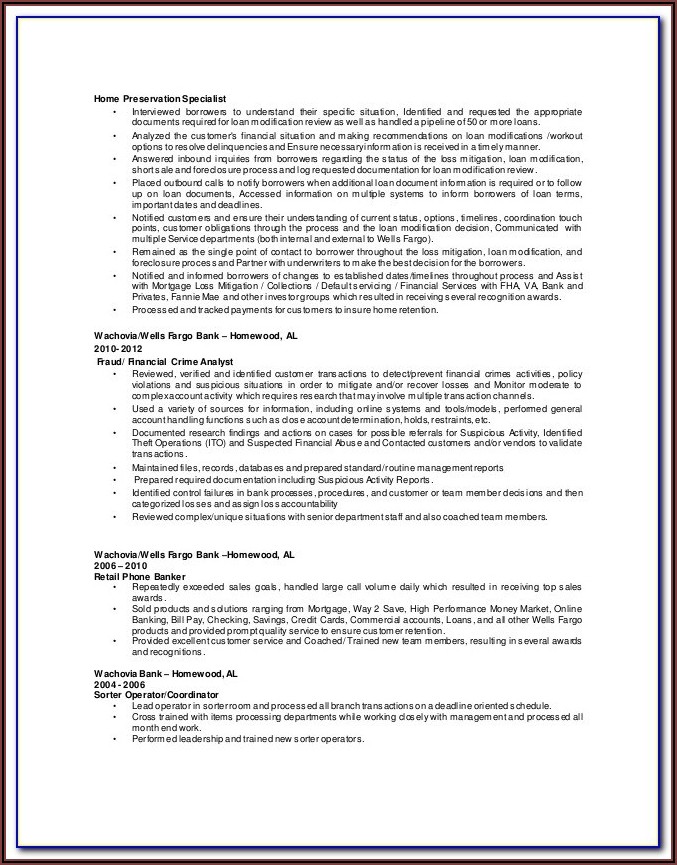

Wells Fargo Ira Distribution Form - Income tax will apply to traditional ira distributions that you have to include in gross income. Learn ira distribution rules including taxes, deadlines and required minimum distributions. Complete this form if you are taking a withdrawal from your ira. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax. It is your responsibility to provide us with accurate information, which will be. The internal revenue code (irc) requires that ira owners and participants in qualified employer sponsored retirement plans (qrps) such as. Contributions come first — the first. Qualified roth ira distributions are not. Unlike traditional iras, there are ordering rules when taking nonqualified distributions from a roth ira.

Contributions come first — the first. Qualified roth ira distributions are not. It is your responsibility to provide us with accurate information, which will be. Income tax will apply to traditional ira distributions that you have to include in gross income. The internal revenue code (irc) requires that ira owners and participants in qualified employer sponsored retirement plans (qrps) such as. Complete this form if you are taking a withdrawal from your ira. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax. Learn ira distribution rules including taxes, deadlines and required minimum distributions. Unlike traditional iras, there are ordering rules when taking nonqualified distributions from a roth ira.

To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax. Qualified roth ira distributions are not. Learn ira distribution rules including taxes, deadlines and required minimum distributions. Complete this form if you are taking a withdrawal from your ira. It is your responsibility to provide us with accurate information, which will be. Unlike traditional iras, there are ordering rules when taking nonqualified distributions from a roth ira. Income tax will apply to traditional ira distributions that you have to include in gross income. Contributions come first — the first. The internal revenue code (irc) requires that ira owners and participants in qualified employer sponsored retirement plans (qrps) such as.

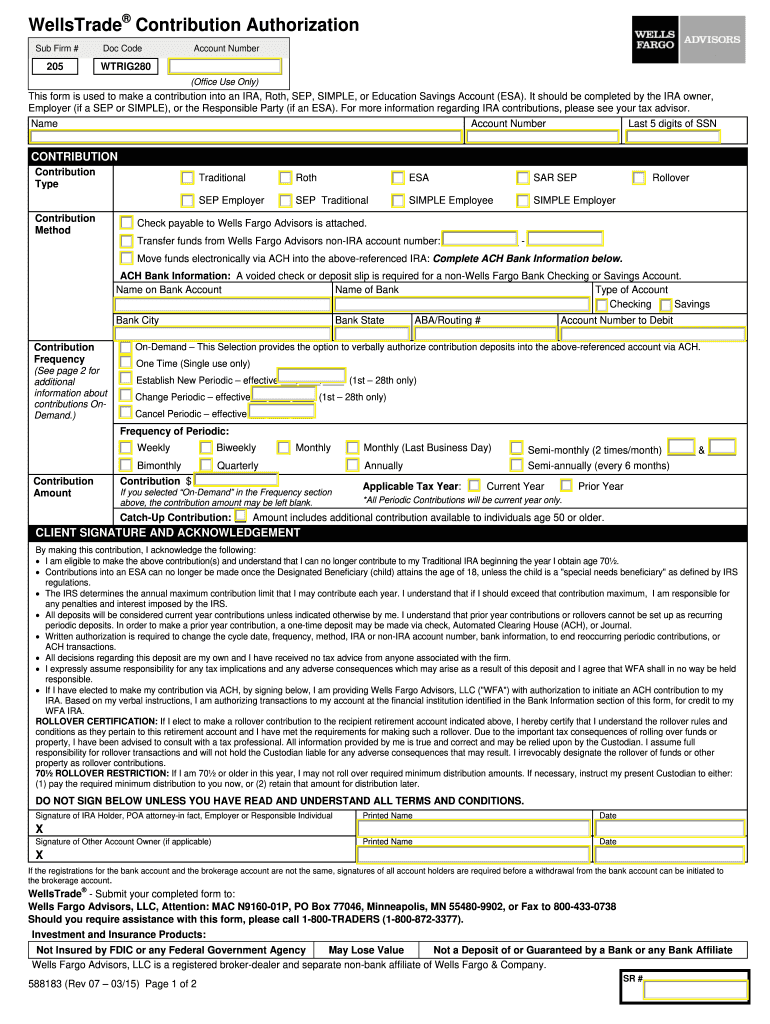

Wells Fargo Advisors 20152024 Form Fill Out and Sign Printable PDF

Qualified roth ira distributions are not. Complete this form if you are taking a withdrawal from your ira. It is your responsibility to provide us with accurate information, which will be. Unlike traditional iras, there are ordering rules when taking nonqualified distributions from a roth ira. The internal revenue code (irc) requires that ira owners and participants in qualified employer.

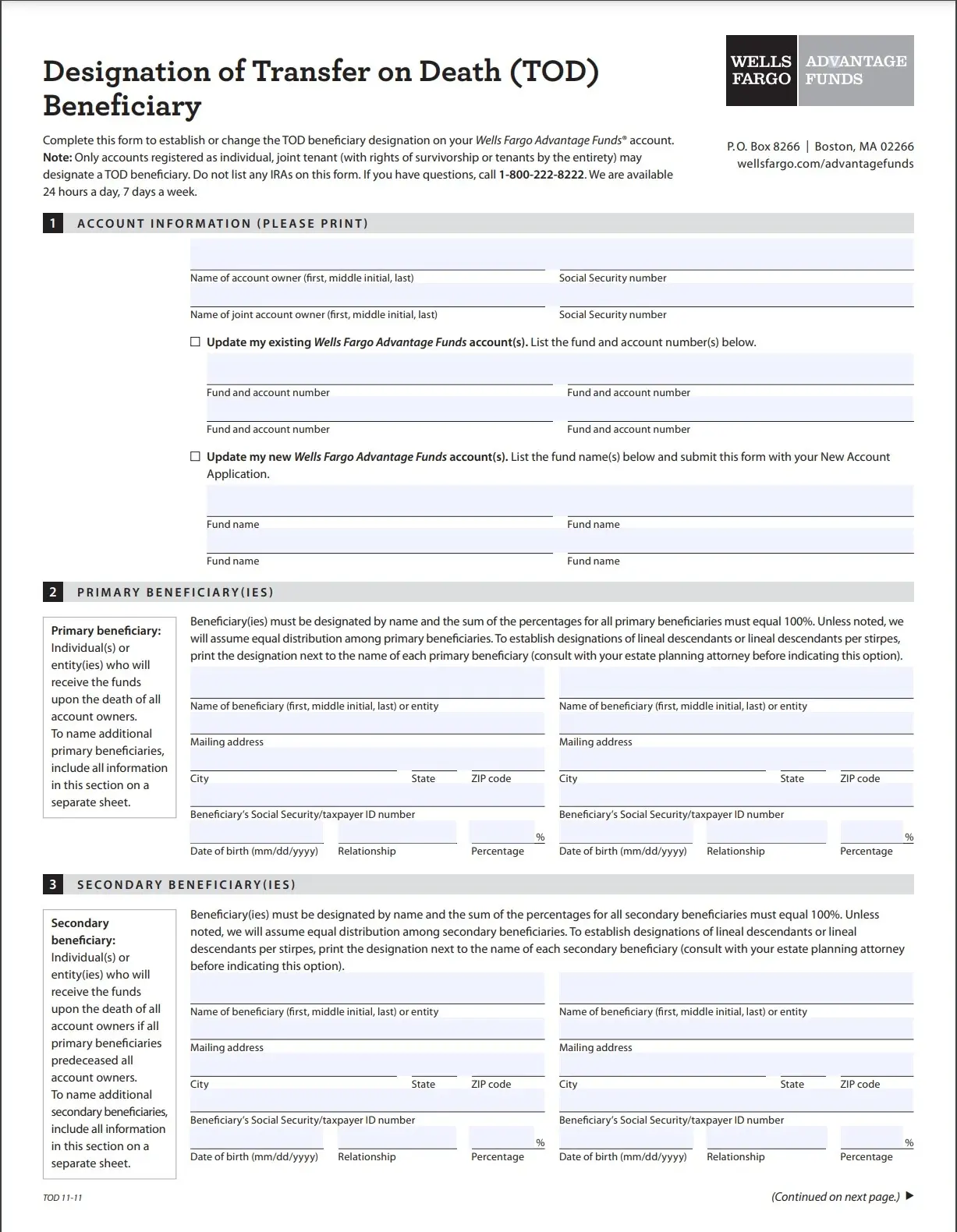

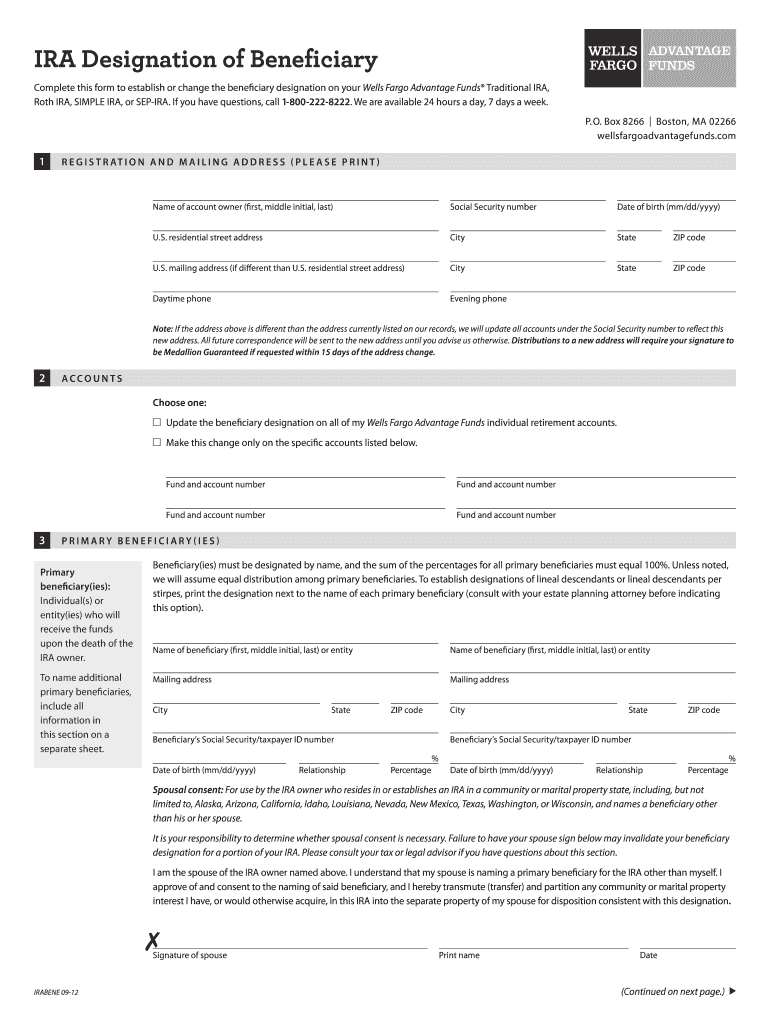

Wells Fargo Checking Beneficiary PDF Form FormsPal

Income tax will apply to traditional ira distributions that you have to include in gross income. Contributions come first — the first. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax. It is your responsibility to provide us with accurate information, which will be..

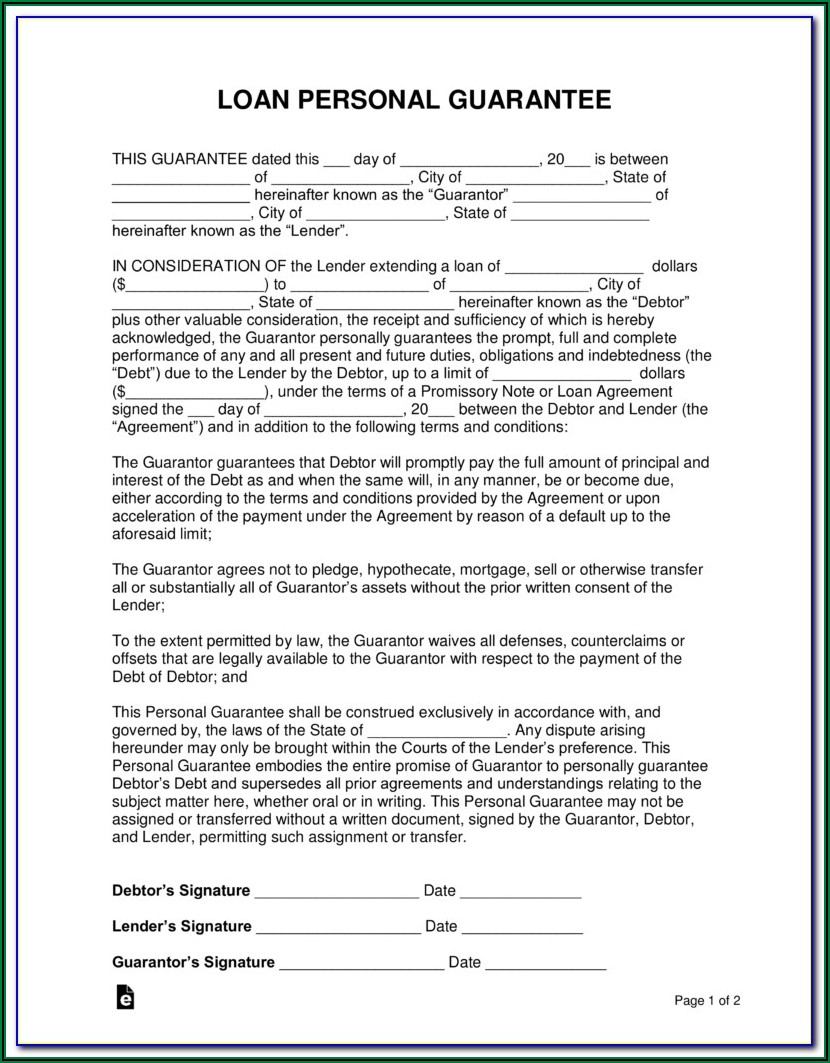

Wells Fargo Medallion Signature Guarantee Form Form Resume Examples

Learn ira distribution rules including taxes, deadlines and required minimum distributions. Income tax will apply to traditional ira distributions that you have to include in gross income. Unlike traditional iras, there are ordering rules when taking nonqualified distributions from a roth ira. Complete this form if you are taking a withdrawal from your ira. To add features to your current.

Fillable Online Wells Fargo Advisors Ira Beneficiary Claim Form Fax

Complete this form if you are taking a withdrawal from your ira. Learn ira distribution rules including taxes, deadlines and required minimum distributions. Unlike traditional iras, there are ordering rules when taking nonqualified distributions from a roth ira. Income tax will apply to traditional ira distributions that you have to include in gross income. The internal revenue code (irc) requires.

Wells Fargo Ira Distribution Forms Form Resume Examples a6Yn8EpW2B

Income tax will apply to traditional ira distributions that you have to include in gross income. Unlike traditional iras, there are ordering rules when taking nonqualified distributions from a roth ira. Qualified roth ira distributions are not. Learn ira distribution rules including taxes, deadlines and required minimum distributions. Complete this form if you are taking a withdrawal from your ira.

Wells Fargo Ira Beneficiary Designation Form Fill Out and Sign

Income tax will apply to traditional ira distributions that you have to include in gross income. Qualified roth ira distributions are not. Learn ira distribution rules including taxes, deadlines and required minimum distributions. Complete this form if you are taking a withdrawal from your ira. The internal revenue code (irc) requires that ira owners and participants in qualified employer sponsored.

Fake Wells Fargo Bank Statement Template Template 1 Resume Examples

The internal revenue code (irc) requires that ira owners and participants in qualified employer sponsored retirement plans (qrps) such as. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax. It is your responsibility to provide us with accurate information, which will be. Complete this.

Ira Distribution Forms Form Resume Examples emVKnmweYr

Qualified roth ira distributions are not. To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax. It is your responsibility to provide us with accurate information, which will be. Learn ira distribution rules including taxes, deadlines and required minimum distributions. Income tax will apply to.

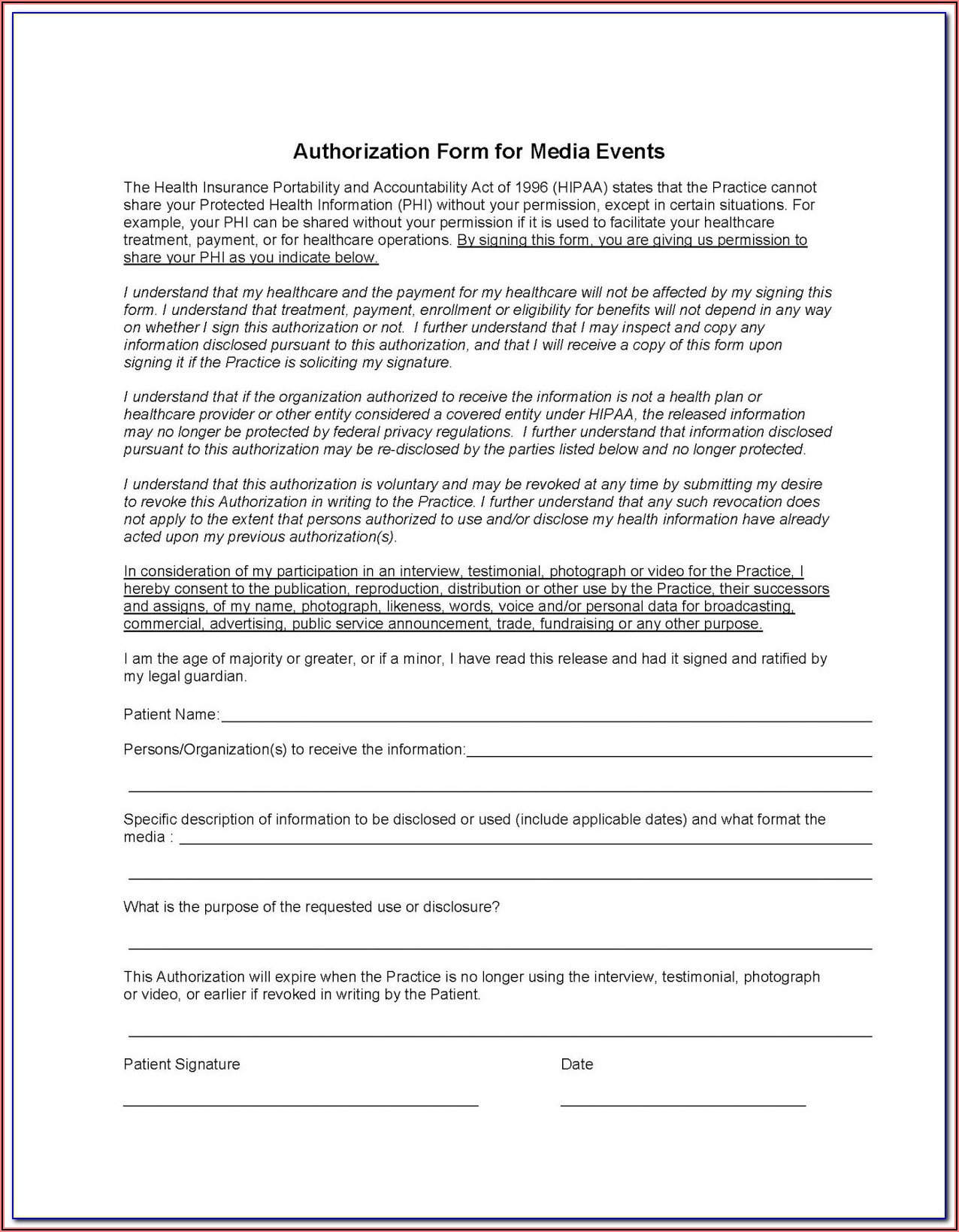

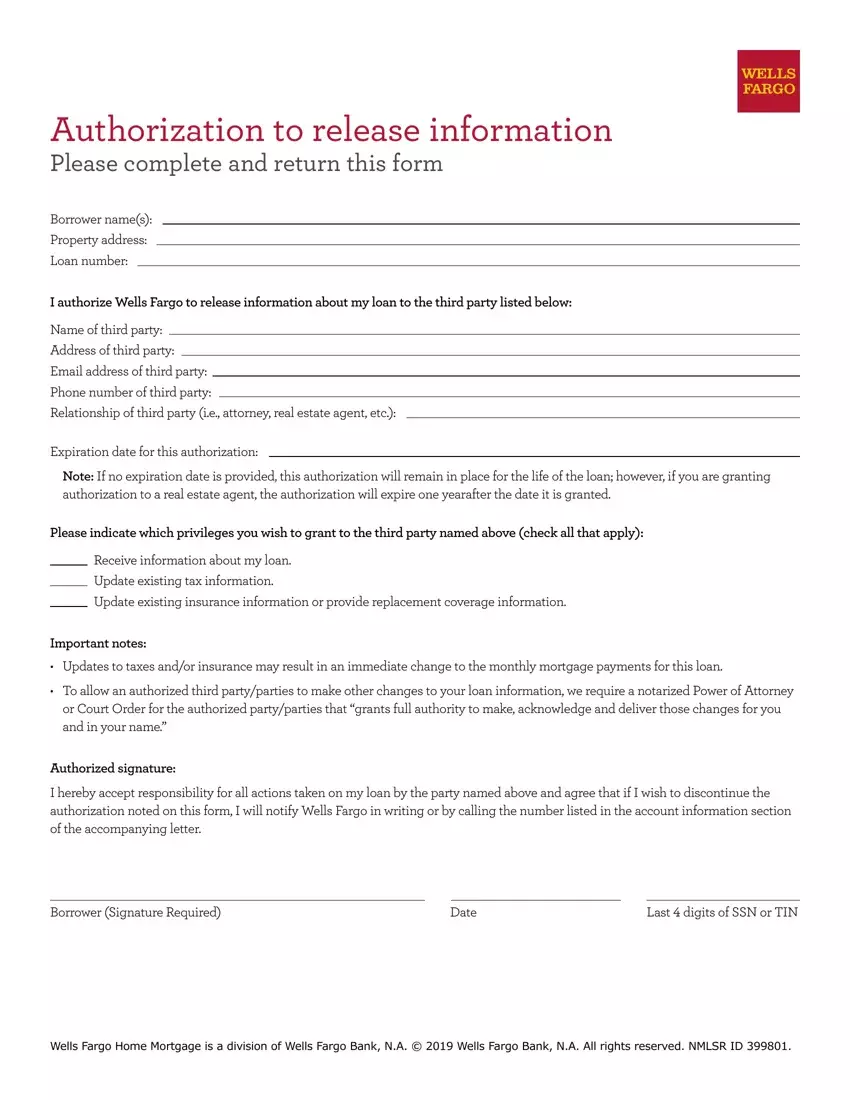

Form Authorization Wells Fargo Fill Online, Printable, Fillable, Blank

Qualified roth ira distributions are not. Complete this form if you are taking a withdrawal from your ira. The internal revenue code (irc) requires that ira owners and participants in qualified employer sponsored retirement plans (qrps) such as. Learn ira distribution rules including taxes, deadlines and required minimum distributions. Income tax will apply to traditional ira distributions that you have.

Wells Fargo Ira Distribution Form Fill Out and Sign Printable PDF

To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax. Unlike traditional iras, there are ordering rules when taking nonqualified distributions from a roth ira. Income tax will apply to traditional ira distributions that you have to include in gross income. Qualified roth ira distributions.

Complete This Form If You Are Taking A Withdrawal From Your Ira.

Qualified roth ira distributions are not. Unlike traditional iras, there are ordering rules when taking nonqualified distributions from a roth ira. The internal revenue code (irc) requires that ira owners and participants in qualified employer sponsored retirement plans (qrps) such as. It is your responsibility to provide us with accurate information, which will be.

Learn Ira Distribution Rules Including Taxes, Deadlines And Required Minimum Distributions.

To add features to your current account, simply download, print, and fill out the appropriate form or application and submit it via the provided fax. Income tax will apply to traditional ira distributions that you have to include in gross income. Contributions come first — the first.