What Is Occ Tax In Illinois

What Is Occ Tax In Illinois - Municipalities that have approved a business district development or redevelopment plan and have elected to impose a tax by ordinance may. This tax, known locally as the retailers’ occupation tax, is imposed on the same general merchandise base as the state sales tax. In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. Basically, it's a fancy way of saying the tax you pay on most things you buy in the state. Occ tax stands for illinois retailers' occupation tax. What is “retailers’ occupation tax”? “retailers’ occupation tax” (rot) is a tax imposed on retailers engaged in the occupation of selling.

Occ tax stands for illinois retailers' occupation tax. Municipalities that have approved a business district development or redevelopment plan and have elected to impose a tax by ordinance may. This tax, known locally as the retailers’ occupation tax, is imposed on the same general merchandise base as the state sales tax. “retailers’ occupation tax” (rot) is a tax imposed on retailers engaged in the occupation of selling. What is “retailers’ occupation tax”? In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. Basically, it's a fancy way of saying the tax you pay on most things you buy in the state.

What is “retailers’ occupation tax”? “retailers’ occupation tax” (rot) is a tax imposed on retailers engaged in the occupation of selling. This tax, known locally as the retailers’ occupation tax, is imposed on the same general merchandise base as the state sales tax. Basically, it's a fancy way of saying the tax you pay on most things you buy in the state. In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. Municipalities that have approved a business district development or redevelopment plan and have elected to impose a tax by ordinance may. Occ tax stands for illinois retailers' occupation tax.

OCC logo. OCC letter. OCC letter logo design. Initials OCC logo linked

This tax, known locally as the retailers’ occupation tax, is imposed on the same general merchandise base as the state sales tax. Basically, it's a fancy way of saying the tax you pay on most things you buy in the state. In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. Occ.

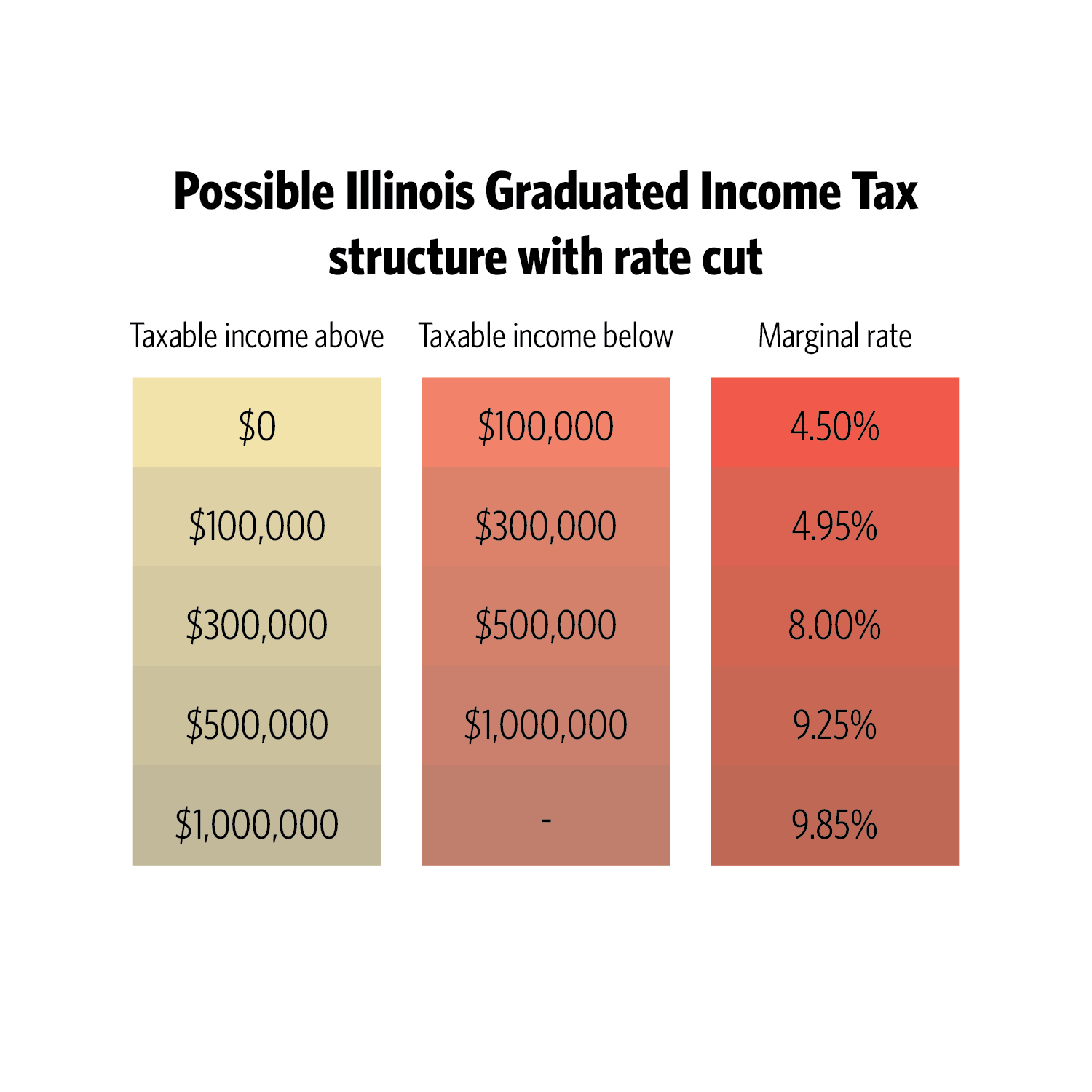

Illinois Tax Tables

Occ tax stands for illinois retailers' occupation tax. What is “retailers’ occupation tax”? Municipalities that have approved a business district development or redevelopment plan and have elected to impose a tax by ordinance may. Basically, it's a fancy way of saying the tax you pay on most things you buy in the state. This tax, known locally as the retailers’.

What Is Occ Tax Little Caesars

“retailers’ occupation tax” (rot) is a tax imposed on retailers engaged in the occupation of selling. In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. What is “retailers’ occupation tax”? Municipalities that have approved a business district development or redevelopment plan and have elected to impose a tax by ordinance may..

OCC Tax on Pizza r/illinois

Occ tax stands for illinois retailers' occupation tax. Municipalities that have approved a business district development or redevelopment plan and have elected to impose a tax by ordinance may. What is “retailers’ occupation tax”? In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. “retailers’ occupation tax” (rot) is a tax imposed.

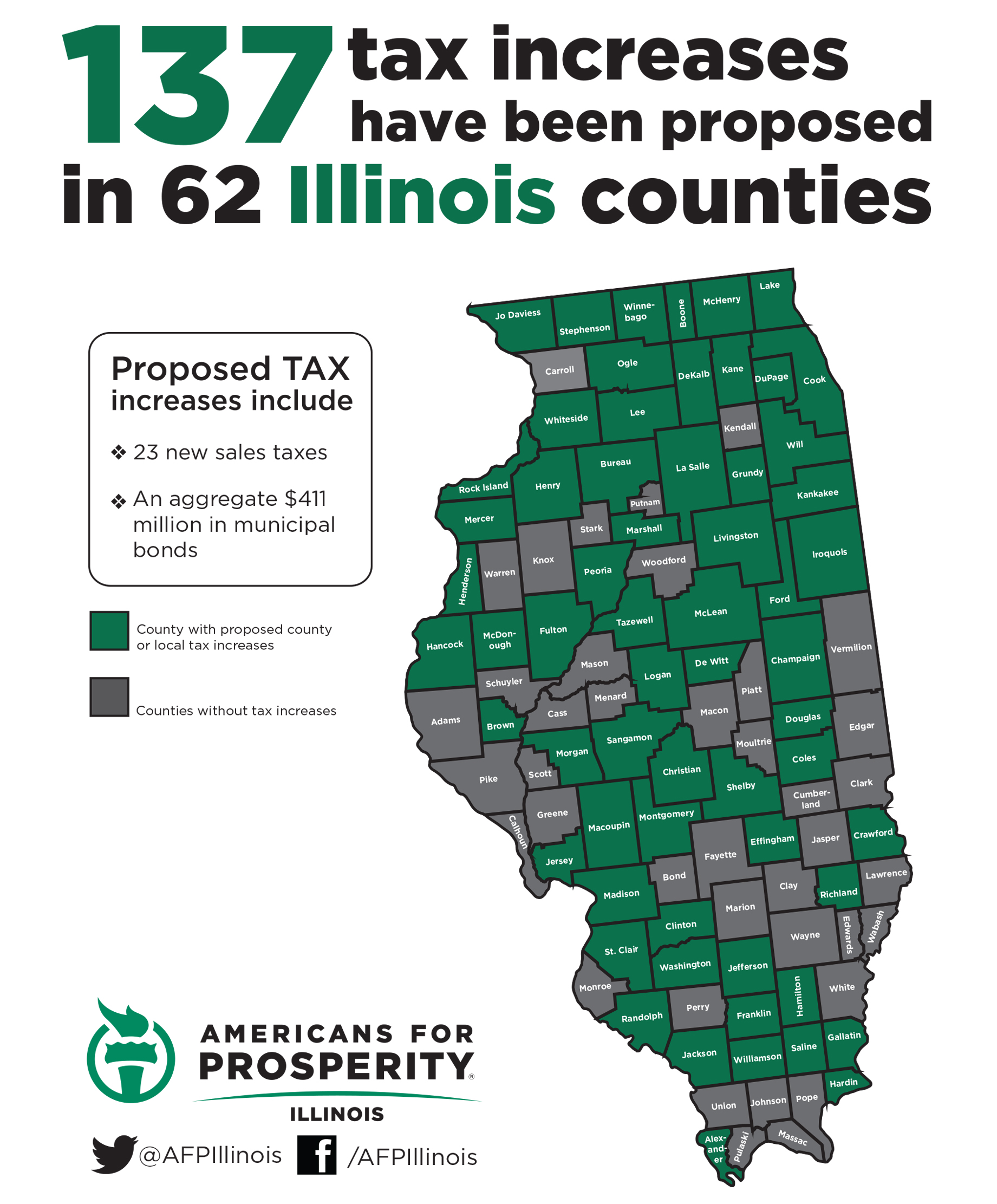

137 tax increases proposed in 62 Illinois counties

Basically, it's a fancy way of saying the tax you pay on most things you buy in the state. In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. “retailers’ occupation tax” (rot) is a tax imposed on retailers engaged in the occupation of selling. Occ tax stands for illinois retailers' occupation.

OCC Clarifies Bank Authority to Engage in Certain Cryptocurrency

Municipalities that have approved a business district development or redevelopment plan and have elected to impose a tax by ordinance may. In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. Occ tax stands for illinois retailers' occupation tax. Basically, it's a fancy way of saying the tax you pay on most.

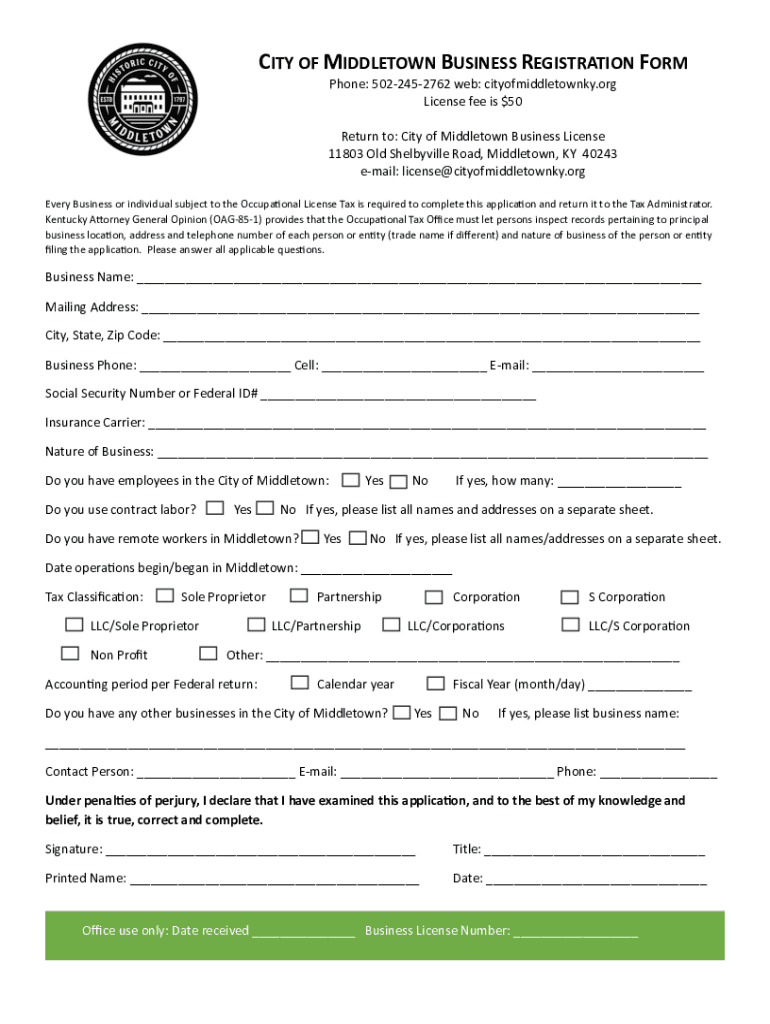

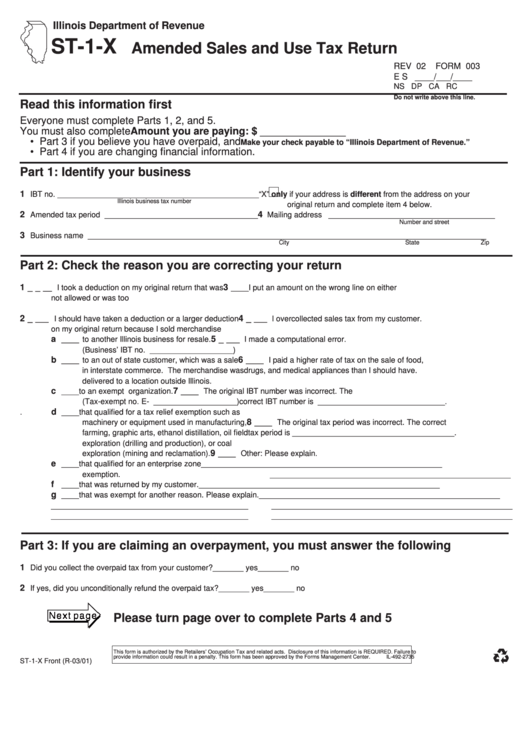

Fillable Online License and OCC Tax Forms Fax Email Print pdfFiller

This tax, known locally as the retailers’ occupation tax, is imposed on the same general merchandise base as the state sales tax. “retailers’ occupation tax” (rot) is a tax imposed on retailers engaged in the occupation of selling. Basically, it's a fancy way of saying the tax you pay on most things you buy in the state. In illinois, there.

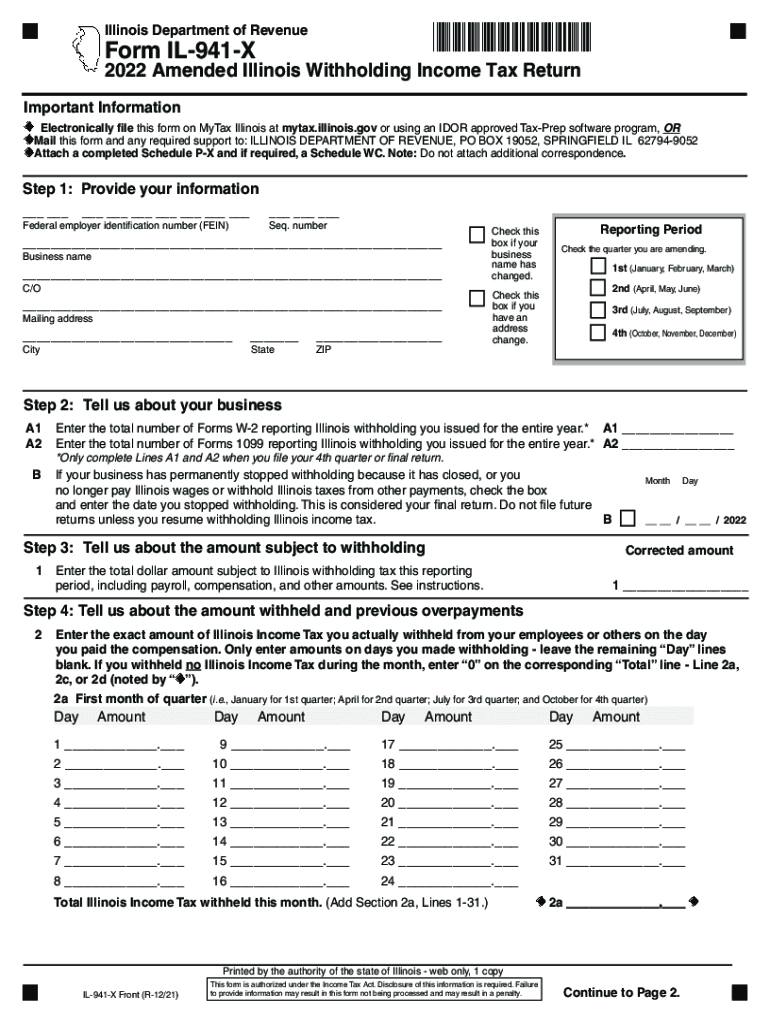

Printable Illinois Tax Forms Printable Form 2024

This tax, known locally as the retailers’ occupation tax, is imposed on the same general merchandise base as the state sales tax. Basically, it's a fancy way of saying the tax you pay on most things you buy in the state. Occ tax stands for illinois retailers' occupation tax. In illinois, there are two separate but complementary taxes upon the.

Tax In Illinois 2024 Alfy Belinda

In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. What is “retailers’ occupation tax”? “retailers’ occupation tax” (rot) is a tax imposed on retailers engaged in the occupation of selling. This tax, known locally as the retailers’ occupation tax, is imposed on the same general merchandise base as the state sales.

Illinois Tax Deductions 2024 Judye Marcile

In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. This tax, known locally as the retailers’ occupation tax, is imposed on the same general merchandise base as the state sales tax. “retailers’ occupation tax” (rot) is a tax imposed on retailers engaged in the occupation of selling. Municipalities that have approved.

Occ Tax Stands For Illinois Retailers' Occupation Tax.

Basically, it's a fancy way of saying the tax you pay on most things you buy in the state. Municipalities that have approved a business district development or redevelopment plan and have elected to impose a tax by ordinance may. In illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property. This tax, known locally as the retailers’ occupation tax, is imposed on the same general merchandise base as the state sales tax.

“Retailers’ Occupation Tax” (Rot) Is A Tax Imposed On Retailers Engaged In The Occupation Of Selling.

What is “retailers’ occupation tax”?