What Is Section 951A Income

What Is Section 951A Income - Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Shareholder’s “net tested income” (that is, the excess of the aggregate of its cfcs’ tested. In general, gilti is the excess of a u.s. Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s.

Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s. Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Shareholder’s “net tested income” (that is, the excess of the aggregate of its cfcs’ tested. In general, gilti is the excess of a u.s.

In general, gilti is the excess of a u.s. Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s. Shareholder’s “net tested income” (that is, the excess of the aggregate of its cfcs’ tested. Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of.

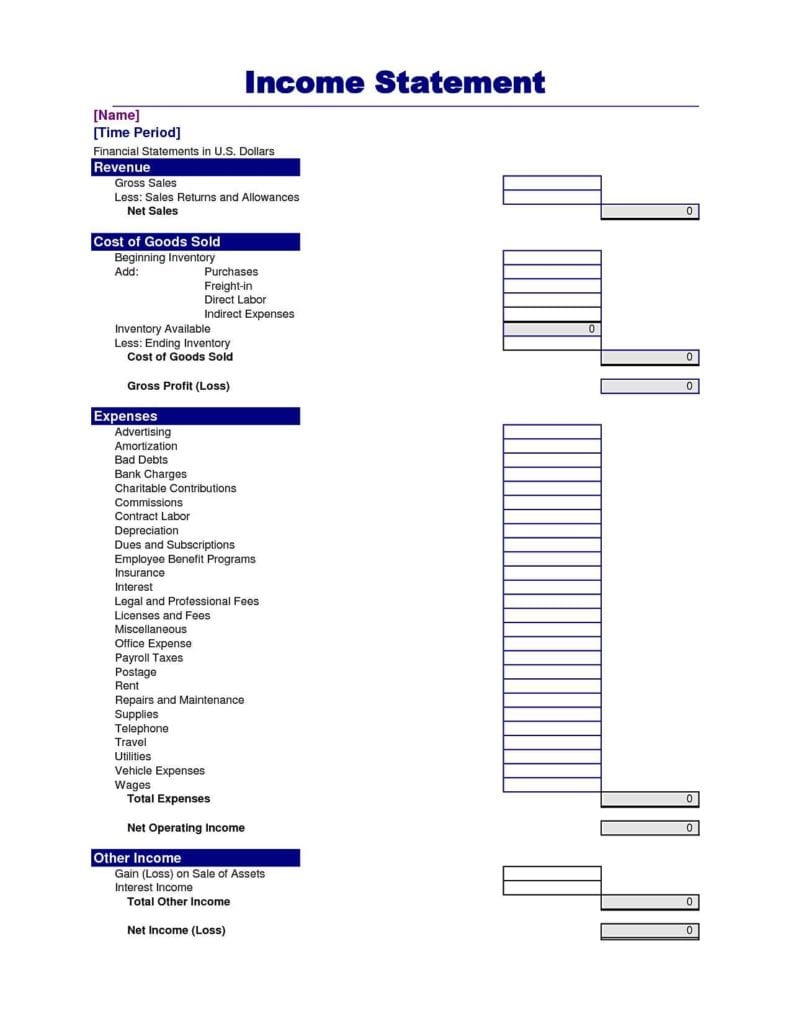

Zero Statement Form Create Fillable document free

Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Shareholder’s “net tested income” (that is, the excess of the aggregate of its cfcs’ tested. Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s..

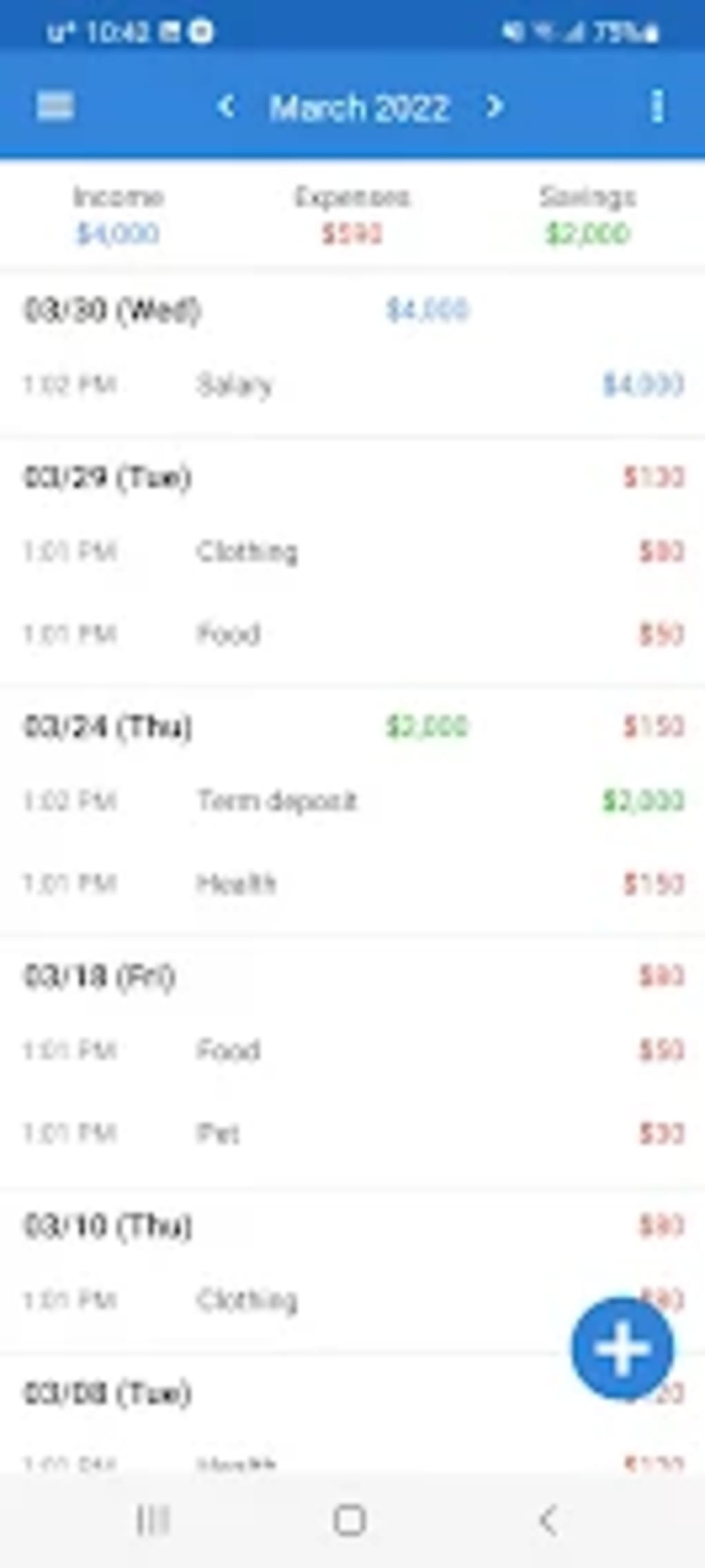

Money Manager expense for Android Download

Shareholder’s “net tested income” (that is, the excess of the aggregate of its cfcs’ tested. Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s..

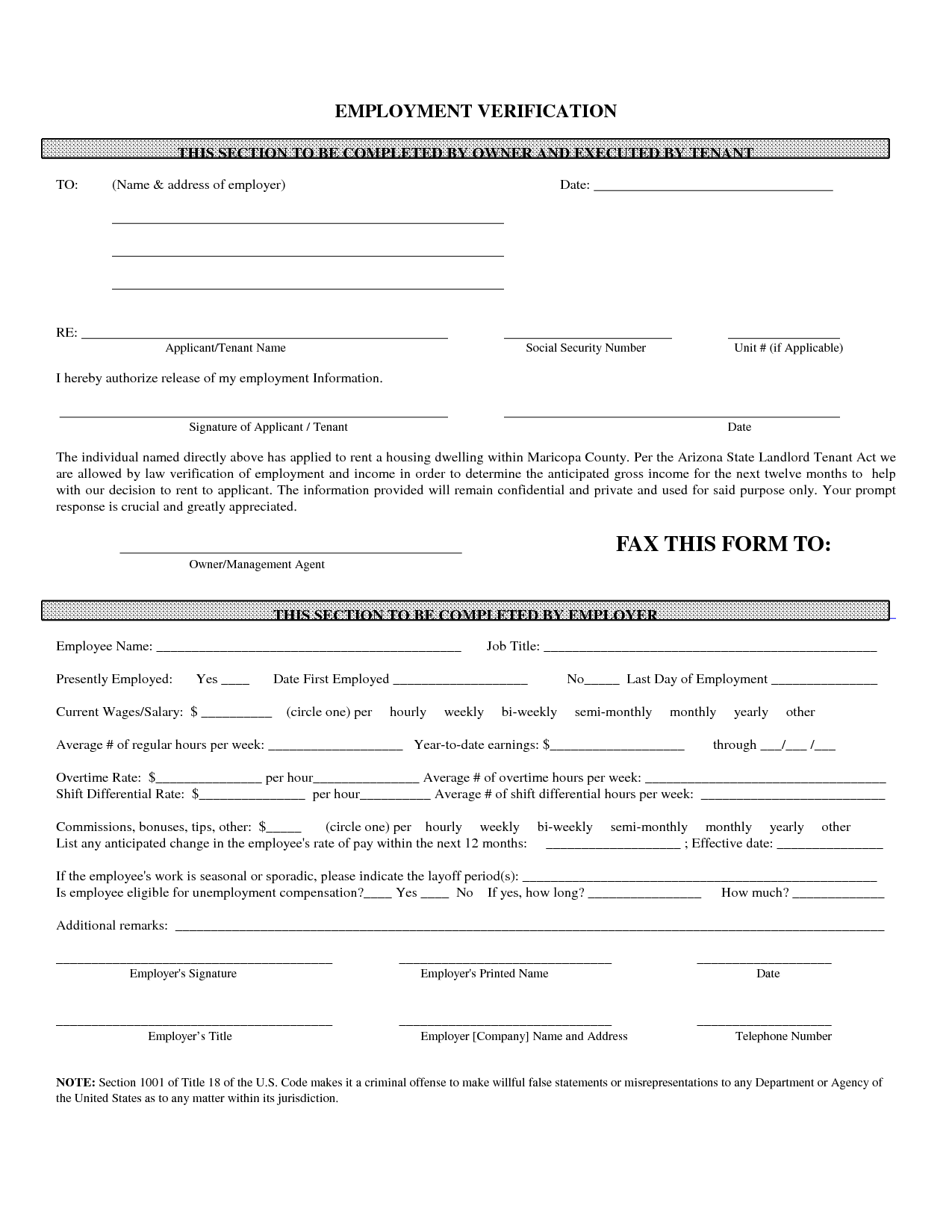

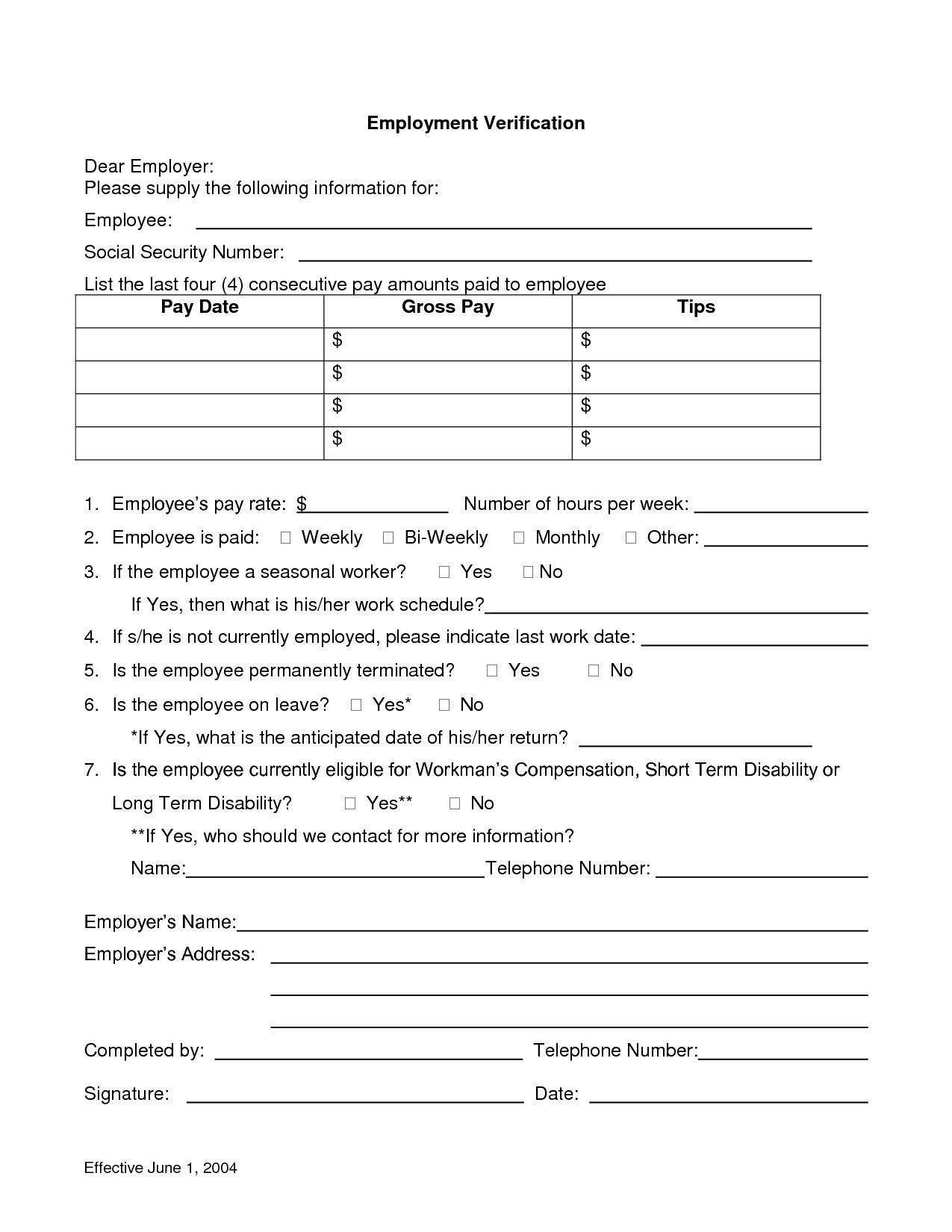

Verification Form Template Free Printable Documents

Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s. In general, gilti is the excess of a u.s. Shareholder’s “net tested income” (that is,.

Ethiopian Tax Calculato for Android Download

Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s. Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Shareholder’s “net tested income” (that is, the excess of the aggregate of its cfcs’ tested..

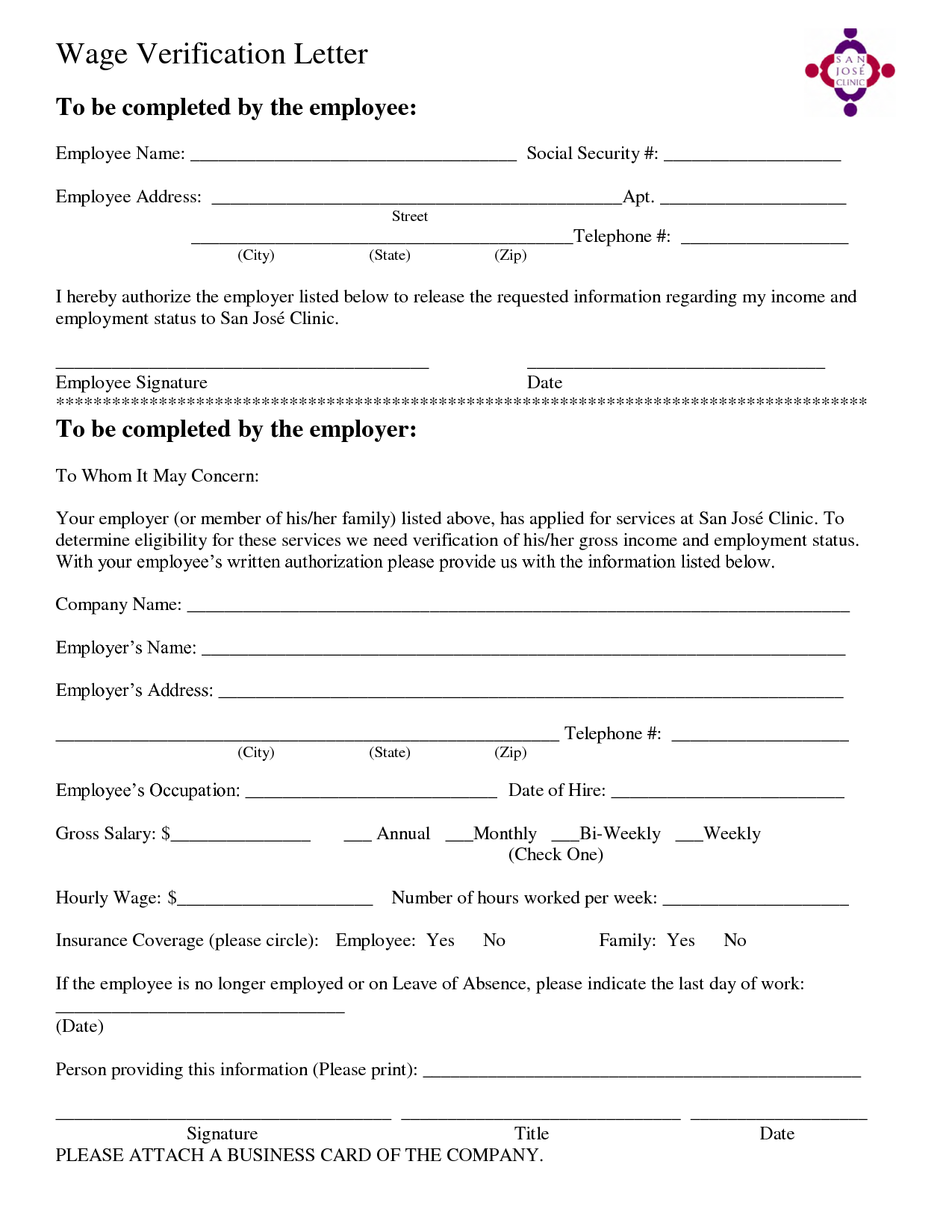

Verification Letter Free Printable Documents

Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s. Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Shareholder’s “net tested income” (that is, the excess of the aggregate of its cfcs’ tested..

Verification Form Template Free Printable Documents

In general, gilti is the excess of a u.s. Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s. Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Shareholder’s “net tested income” (that is,.

Dividend Tax Rate 2024 2025

Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s. Shareholder’s “net tested income” (that is, the excess of the aggregate of its cfcs’ tested..

Digital Project

Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. In general, gilti is the excess of a u.s. Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s. Shareholder’s “net tested income” (that is,.

Bundle Offer Practical Canva Tutorials Sales Page

In general, gilti is the excess of a u.s. Shareholder’s “net tested income” (that is, the excess of the aggregate of its cfcs’ tested. Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Irc 951a applies to taxable years of foreign corporations beginning after.

federal tax deduction worksheet page —

Irc 951a applies to taxable years of foreign corporations beginning after december 31, 2017, and to taxable years of u.s. In general, gilti is the excess of a u.s. Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Shareholder’s “net tested income” (that is,.

Irc 951A Applies To Taxable Years Of Foreign Corporations Beginning After December 31, 2017, And To Taxable Years Of U.s.

Any gross income excluded from the foreign base company income (as defined in section 954) and the insurance income (as defined in section 953) of. Shareholder’s “net tested income” (that is, the excess of the aggregate of its cfcs’ tested. In general, gilti is the excess of a u.s.