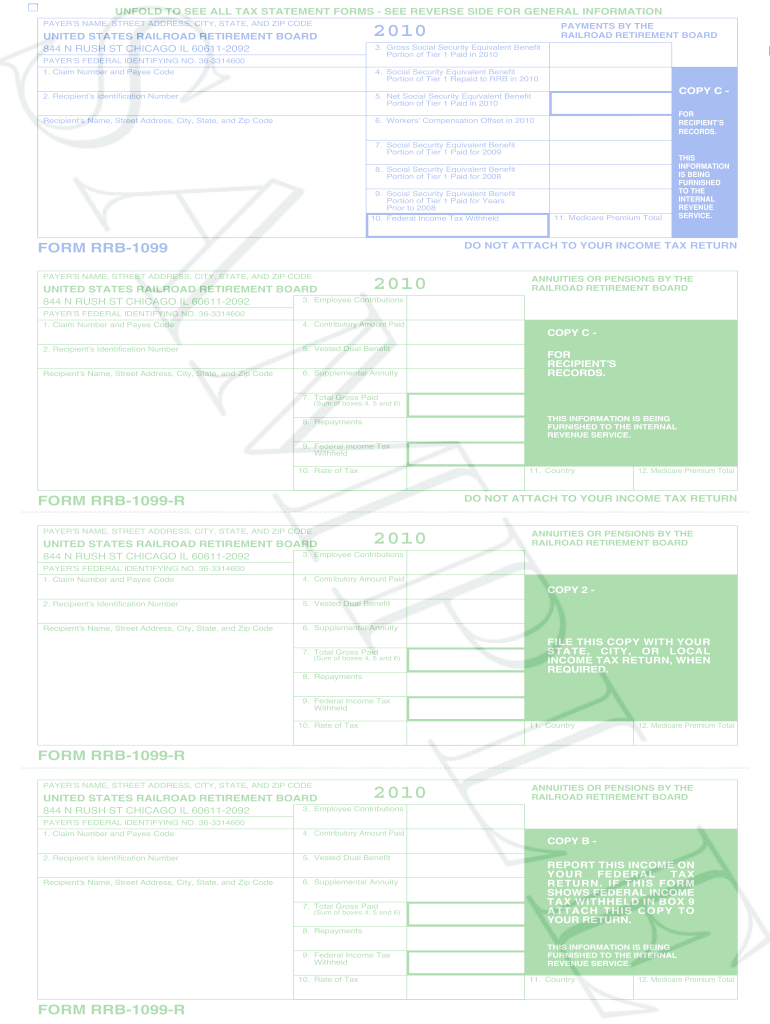

What Is The Difference Between Rrb 1099 And Rrb 1099 R

What Is The Difference Between Rrb 1099 And Rrb 1099 R - Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable. The part that represents net cost. Railroad retirement board (rrb) and represents payments made to you in the tax. According to the irs, the.

Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable. The part that represents net cost. Railroad retirement board (rrb) and represents payments made to you in the tax. According to the irs, the.

According to the irs, the. The part that represents net cost. Railroad retirement board (rrb) and represents payments made to you in the tax. Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable.

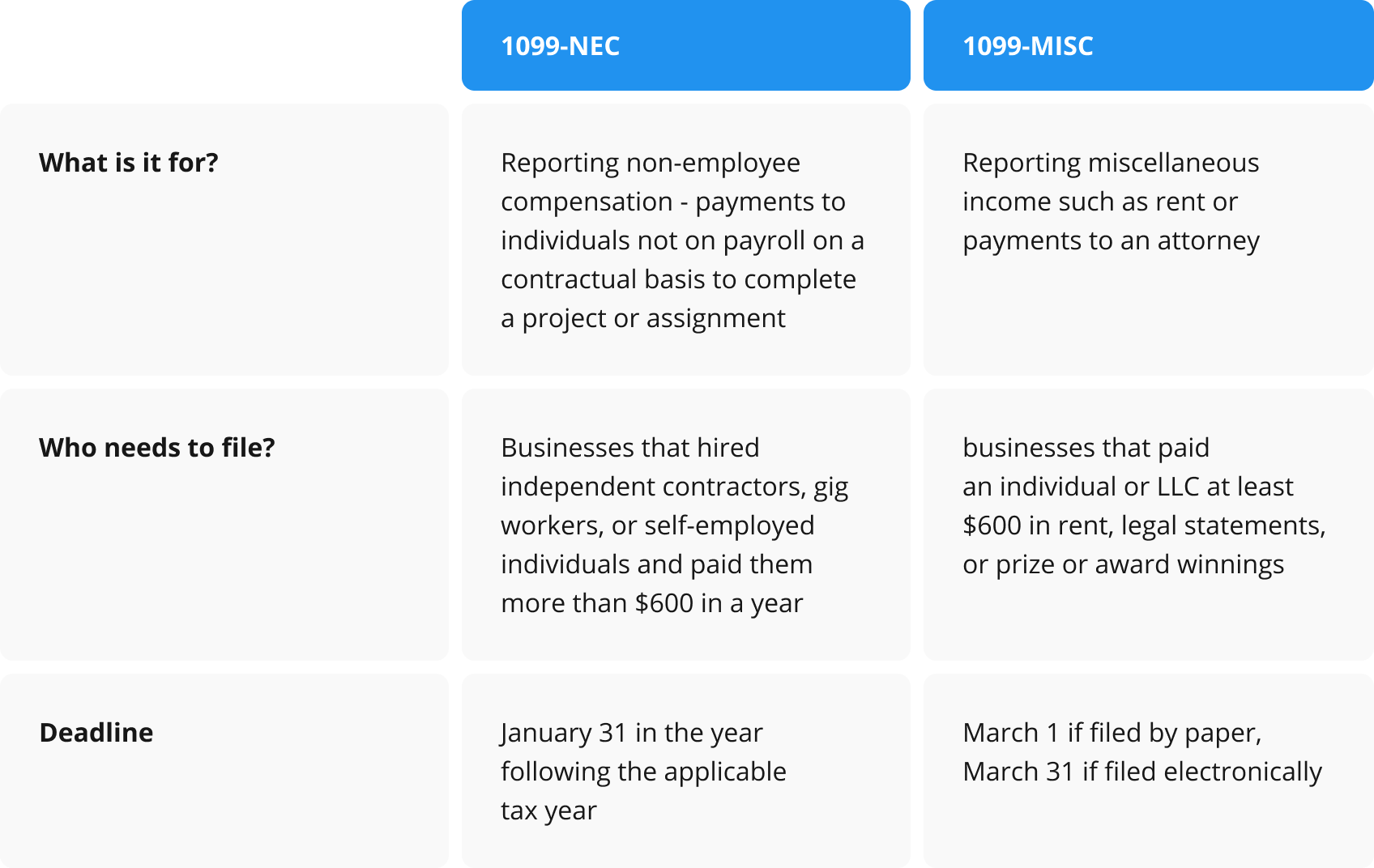

The Difference Between W2 and 1099 Workers

Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable. The part that represents net cost. Railroad retirement board (rrb) and represents payments made to you in the tax. According to the irs, the.

Simplified Method Worksheet Rrb1099r

According to the irs, the. Railroad retirement board (rrb) and represents payments made to you in the tax. The part that represents net cost. Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable.

1099r Simplified Method Worksheet Fillable

Railroad retirement board (rrb) and represents payments made to you in the tax. Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable. According to the irs, the. The part that represents net cost.

Form 1099MISC vs. 1099NEC Differences, Deadlines, & More

According to the irs, the. Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable. The part that represents net cost. Railroad retirement board (rrb) and represents payments made to you in the tax.

2023 Form 1099 R Printable Forms Free Online

The part that represents net cost. Railroad retirement board (rrb) and represents payments made to you in the tax. According to the irs, the. Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable.

How To Report Railroad Retirement Benefits On 1040

Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable. The part that represents net cost. According to the irs, the. Railroad retirement board (rrb) and represents payments made to you in the tax.

1099 vs. W2 Key Differences for Employers QuickBooks

Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable. Railroad retirement board (rrb) and represents payments made to you in the tax. The part that represents net cost. According to the irs, the.

Form 1099MISC How to report your Miscellaneous pdfFiller Blog

The part that represents net cost. Railroad retirement board (rrb) and represents payments made to you in the tax. According to the irs, the. Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable.

Selecting the Correct IRS Form 1099R Box 7 Distribution Codes — Ascensus

The part that represents net cost. Railroad retirement board (rrb) and represents payments made to you in the tax. According to the irs, the. Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable.

2023 Form 1099 R Printable Forms Free Online

According to the irs, the. Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable. Railroad retirement board (rrb) and represents payments made to you in the tax. The part that represents net cost.

The Part That Represents Net Cost.

According to the irs, the. Under the general rule, the amount of each payment that is more than the part that represents the net cost is taxable. Railroad retirement board (rrb) and represents payments made to you in the tax.

.png?width=1080&height=1080&name=MicrosoftTeams-image (52).png)