What Were Q4 Profits For 2018 Of Apo

What Were Q4 Profits For 2018 Of Apo - During the fourth quarter, we generated strong growth inflows of $22 billion, which brought full year gross inflows to $60 billion, including more than $35 billion among. Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31, 2018. This distribution will be paid on february 28, 2019 to. Detailed annual and quarterly income statement for apollo global management (apo). As of q4 2024, apollo global management's revenue has grown 20.57% year over year. See many years of revenue, expenses and profits or losses. This is 3.57 percentage points lower than the us asset management industry revenue growth rate of.

Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31, 2018. Detailed annual and quarterly income statement for apollo global management (apo). This is 3.57 percentage points lower than the us asset management industry revenue growth rate of. See many years of revenue, expenses and profits or losses. During the fourth quarter, we generated strong growth inflows of $22 billion, which brought full year gross inflows to $60 billion, including more than $35 billion among. This distribution will be paid on february 28, 2019 to. As of q4 2024, apollo global management's revenue has grown 20.57% year over year.

See many years of revenue, expenses and profits or losses. As of q4 2024, apollo global management's revenue has grown 20.57% year over year. This is 3.57 percentage points lower than the us asset management industry revenue growth rate of. Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31, 2018. During the fourth quarter, we generated strong growth inflows of $22 billion, which brought full year gross inflows to $60 billion, including more than $35 billion among. This distribution will be paid on february 28, 2019 to. Detailed annual and quarterly income statement for apollo global management (apo).

APOAB grants accreditation to MPO Certification Body APO

This is 3.57 percentage points lower than the us asset management industry revenue growth rate of. Detailed annual and quarterly income statement for apollo global management (apo). This distribution will be paid on february 28, 2019 to. See many years of revenue, expenses and profits or losses. During the fourth quarter, we generated strong growth inflows of $22 billion, which.

APO.PO (apo.po94) on Threads

This is 3.57 percentage points lower than the us asset management industry revenue growth rate of. Detailed annual and quarterly income statement for apollo global management (apo). As of q4 2024, apollo global management's revenue has grown 20.57% year over year. Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31,.

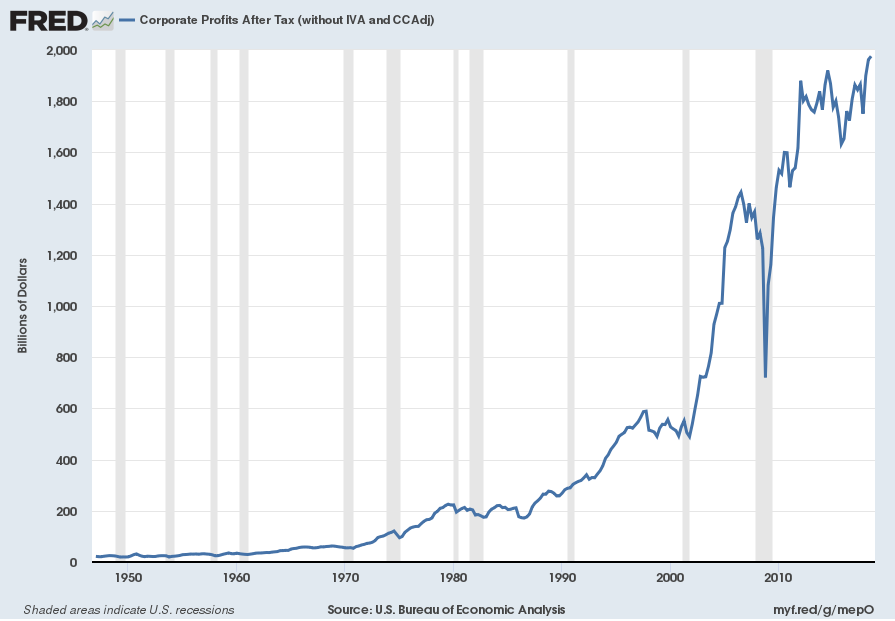

3rd Quarter 2018 Corporate Profits

This is 3.57 percentage points lower than the us asset management industry revenue growth rate of. Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31, 2018. As of q4 2024, apollo global management's revenue has grown 20.57% year over year. See many years of revenue, expenses and profits or losses..

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

During the fourth quarter, we generated strong growth inflows of $22 billion, which brought full year gross inflows to $60 billion, including more than $35 billion among. See many years of revenue, expenses and profits or losses. Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31, 2018. This is 3.57.

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31, 2018. This is 3.57 percentage points lower than the us asset management industry revenue growth rate of. As of q4 2024, apollo global management's revenue has grown 20.57% year over year. Detailed annual and quarterly income statement for apollo global management.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

During the fourth quarter, we generated strong growth inflows of $22 billion, which brought full year gross inflows to $60 billion, including more than $35 billion among. See many years of revenue, expenses and profits or losses. Detailed annual and quarterly income statement for apollo global management (apo). This distribution will be paid on february 28, 2019 to. This is.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

This is 3.57 percentage points lower than the us asset management industry revenue growth rate of. See many years of revenue, expenses and profits or losses. Detailed annual and quarterly income statement for apollo global management (apo). During the fourth quarter, we generated strong growth inflows of $22 billion, which brought full year gross inflows to $60 billion, including more.

Apo AI Latest product information,Latest pricing and options 2024

Detailed annual and quarterly income statement for apollo global management (apo). This distribution will be paid on february 28, 2019 to. Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31, 2018. As of q4 2024, apollo global management's revenue has grown 20.57% year over year. This is 3.57 percentage points.

APO 2019 Season Launch Auckland Philharmonia

Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31, 2018. See many years of revenue, expenses and profits or losses. This distribution will be paid on february 28, 2019 to. During the fourth quarter, we generated strong growth inflows of $22 billion, which brought full year gross inflows to $60.

Corporate profits were down slightly in Q2 Kevin Drum

See many years of revenue, expenses and profits or losses. As of q4 2024, apollo global management's revenue has grown 20.57% year over year. This is 3.57 percentage points lower than the us asset management industry revenue growth rate of. Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31, 2018..

Detailed Annual And Quarterly Income Statement For Apollo Global Management (Apo).

This is 3.57 percentage points lower than the us asset management industry revenue growth rate of. As of q4 2024, apollo global management's revenue has grown 20.57% year over year. See many years of revenue, expenses and profits or losses. Apollo has declared a cash distribution of $0.56 per class a share for the fourth quarter ended december 31, 2018.

During The Fourth Quarter, We Generated Strong Growth Inflows Of $22 Billion, Which Brought Full Year Gross Inflows To $60 Billion, Including More Than $35 Billion Among.

This distribution will be paid on february 28, 2019 to.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)