What Were Q4 Profits For 2018 Of Cii

What Were Q4 Profits For 2018 Of Cii - 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. The return to group revenues above the £40 million milestone demonstrates the continued progress. Ing from weak results in 2016. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. Me of £40.5 million in 2022, up 4% from 2021.

The return to group revenues above the £40 million milestone demonstrates the continued progress. Ing from weak results in 2016. The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for Me of £40.5 million in 2022, up 4% from 2021. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends.

The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. The return to group revenues above the £40 million milestone demonstrates the continued progress. Ing from weak results in 2016. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Me of £40.5 million in 2022, up 4% from 2021. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for

3rd Quarter 2018 Corporate Profits

1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for Ing from weak results in 2016. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. The financial year ending 30 june 2018 was a challenging one for ci resources and.

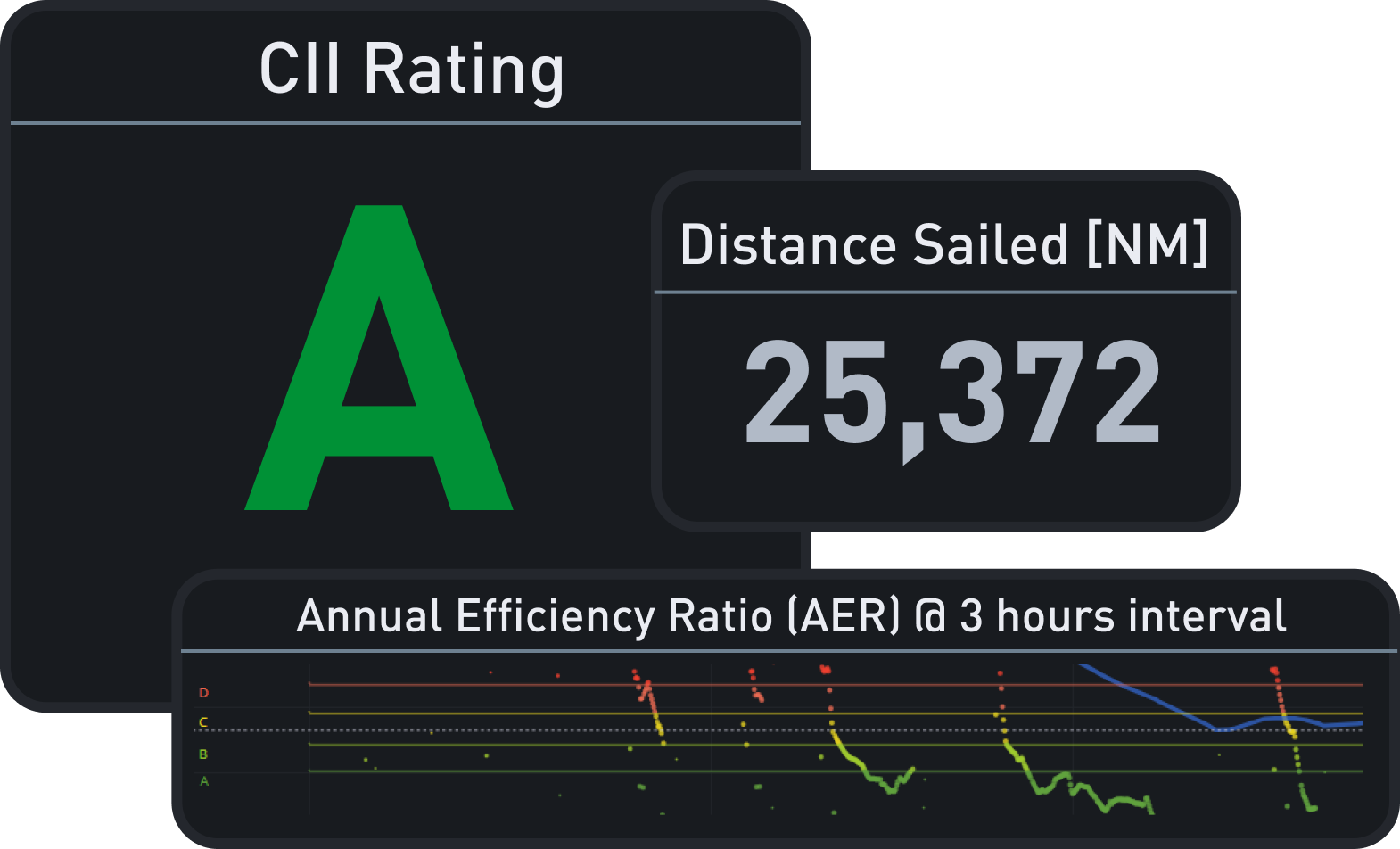

CII Carbon Intensity Indicator — Sustainable Ships

1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. Me of £40.5 million.

CII

Me of £40.5 million in 2022, up 4% from 2021. Ing from weak results in 2016. The return to group revenues above the £40 million milestone demonstrates the continued progress. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. In the fourth quarter of 2018, ci.

Cii polygon hires stock photography and images Alamy

The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Me of £40.5 million in 2022, up 4% from 2021. 1finafcl ilisntemslce2intem 0 s i.

CII Rating

Ing from weak results in 2016. The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for The return to group revenues above the £40 million milestone demonstrates the continued progress. In the.

CII

The return to group revenues above the £40 million milestone demonstrates the continued progress. The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. • strong organic service revenue growth.

Cii 24 PDF

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for The return to group revenues above the £40 million milestone demonstrates the continued progress. Me of £40.5 million in 2022, up.

CII Carbon Intensity Indicator — Sustainable Ships

1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for Me of £40.5 million in 2022, up 4% from 2021. The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. • strong organic service revenue growth of 6.1% for q4 and 5.4%.

CII

Ing from weak results in 2016. Me of £40.5 million in 2022, up 4% from 2021. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. The financial year.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

The return to group revenues above the £40 million milestone demonstrates the continued progress. The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for • strong organic service revenue growth of 6.1%.

The Financial Year Ending 30 June 2018 Was A Challenging One For Ci Resources And Its Main Operating Entity Phosphate Resources Limited.

1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for Me of £40.5 million in 2022, up 4% from 2021. The return to group revenues above the £40 million milestone demonstrates the continued progress. Ing from weak results in 2016.

In The Fourth Quarter Of 2018, Ci Repurchased $159.9 Million Of Shares And Paid $45.4 Million In Dividends.

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)