What Were Q4 Profits For 2018 Of Hcxz

What Were Q4 Profits For 2018 Of Hcxz - S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes. Q4 2018 highlights (1) source: • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Fueling this growth was our high.

Q4 2018 highlights (1) source: Fueling this growth was our high. S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion.

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes. Fueling this growth was our high. Q4 2018 highlights (1) source:

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

Q4 2018 highlights (1) source: We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Q4 2018 highlights (1) source: S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled.

3rd Quarter 2018 Corporate Profits

Fueling this growth was our high. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock.

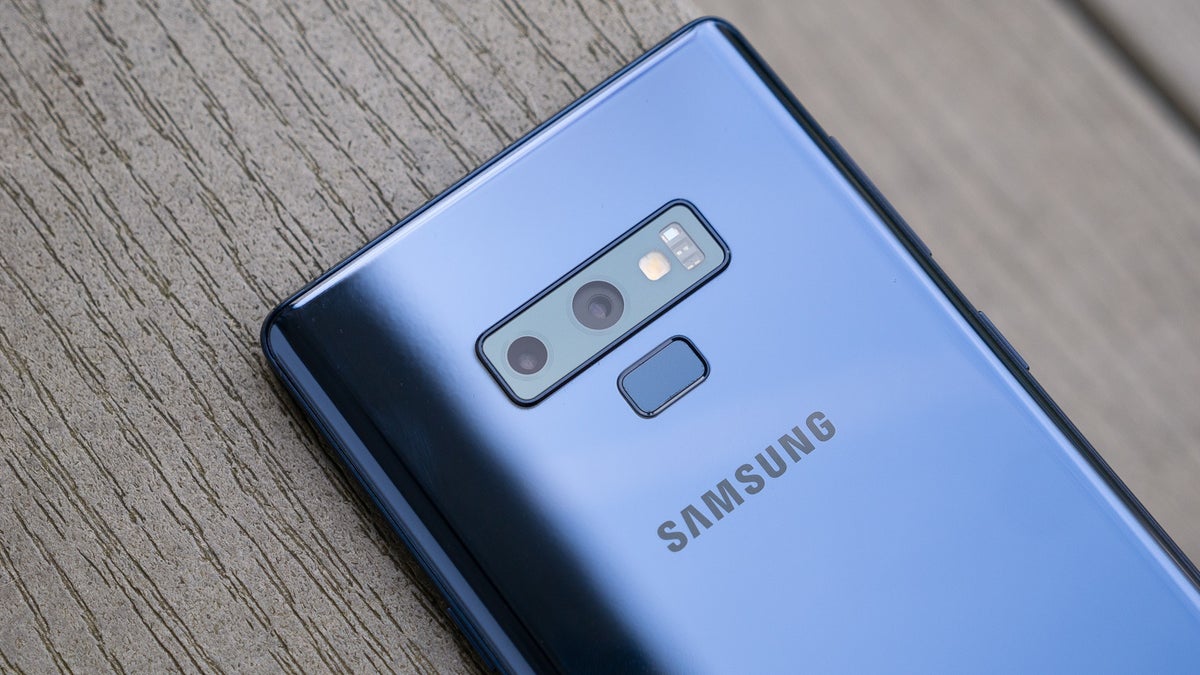

Samsung's Q4 2018 smartphone profits were the lowest in more than two

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes..

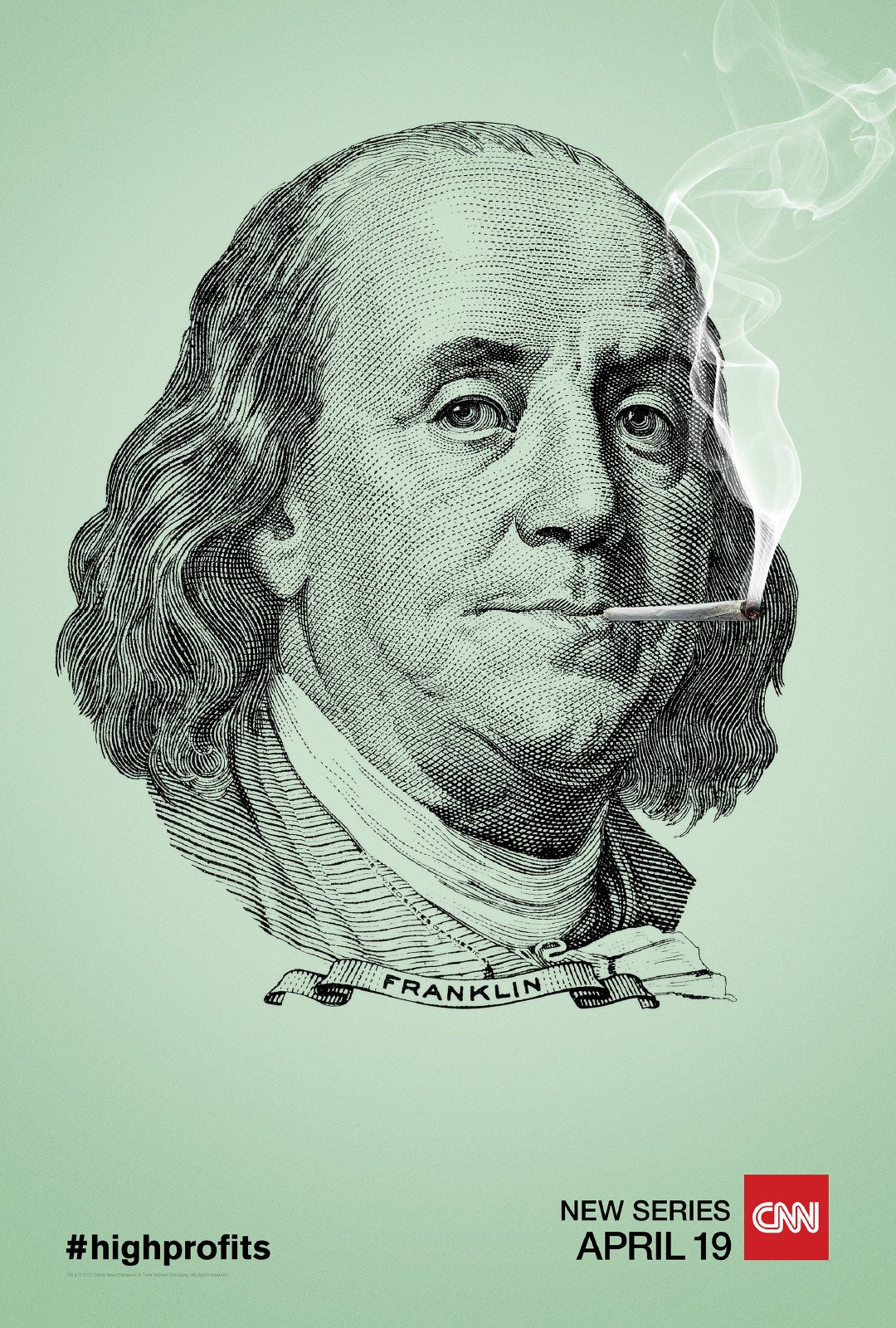

High Profits CNN Creative Marketing

Fueling this growth was our high. S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. We grew annual revenue 35% to $16 billion in 2018, and nearly.

Corporate profits were down slightly in Q2 Kevin Drum

Q4 2018 highlights (1) source: S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Fueling this growth was our high. • strong organic service revenue growth of 6.1% for q4 and 5.4%.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes..

profitsvision scam? Medium

Fueling this growth was our high. Q4 2018 highlights (1) source: • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes. We grew annual revenue 35% to $16.

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes..

Admetrics Profits on Shopify App Store

We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Q4 2018 highlights (1) source: • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Fueling this growth was our high. S&p capiq as of 12/31/18 for dividend and.

Q4 2018 Highlights (1) Source:

We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Fueling this growth was our high. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. S&p capiq as of 12/31/18 for dividend and roae/roaa and 2/5/19 for stock price (2) based on nii, excludes.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)