What Were Q4 Profits For 2018 Of Mpo

What Were Q4 Profits For 2018 Of Mpo - Core return on assets improved to 1.39% in the fourth quarter. The core efficiency ratio of 57.45% improved as well, but was. • reported sales were up 1%, organic sales were up 2% (flat in the u.s., up 5% in canada, and up 11% in international) • organic. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. In 2018, irtip implementation resulted in $184 million in federal funds being obligated for projects in the indianapolis metropolitan. The 2018 milestones were numerous record production growth, we produced a record 175,640 ounces of gold equivalent,. Operating profit margin increased 160 basis. • adjusted net asset value (nav) was us$200.2 million,. As at 30 september 2018, the key indicators of mpo’s performance were as follows: Full year 2018 combined loe and workover expenses totaled $54.2 million or $8.14 per boe compared to $63.3 million or $7.83 per.

In 2018, irtip implementation resulted in $184 million in federal funds being obligated for projects in the indianapolis metropolitan. Operating profit margin increased 160 basis. • reported sales were up 1%, organic sales were up 2% (flat in the u.s., up 5% in canada, and up 11% in international) • organic. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. The core efficiency ratio of 57.45% improved as well, but was. As at 30 september 2018, the key indicators of mpo’s performance were as follows: • adjusted net asset value (nav) was us$200.2 million,. Core return on assets improved to 1.39% in the fourth quarter. The 2018 milestones were numerous record production growth, we produced a record 175,640 ounces of gold equivalent,. Full year 2018 combined loe and workover expenses totaled $54.2 million or $8.14 per boe compared to $63.3 million or $7.83 per.

As at 30 september 2018, the key indicators of mpo’s performance were as follows: Core return on assets improved to 1.39% in the fourth quarter. • reported sales were up 1%, organic sales were up 2% (flat in the u.s., up 5% in canada, and up 11% in international) • organic. The core efficiency ratio of 57.45% improved as well, but was. Full year 2018 combined loe and workover expenses totaled $54.2 million or $8.14 per boe compared to $63.3 million or $7.83 per. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. As at the end of june 2018, mpo’s closing share price was 194 pence, an increase of 24% over the year and a 25% discount to adjusted nav per. The 2018 milestones were numerous record production growth, we produced a record 175,640 ounces of gold equivalent,. In 2018, irtip implementation resulted in $184 million in federal funds being obligated for projects in the indianapolis metropolitan. • adjusted net asset value (nav) was us$200.2 million,.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

The 2018 milestones were numerous record production growth, we produced a record 175,640 ounces of gold equivalent,. Core return on assets improved to 1.39% in the fourth quarter. Operating profit margin increased 160 basis. In 2018, irtip implementation resulted in $184 million in federal funds being obligated for projects in the indianapolis metropolitan. The core efficiency ratio of 57.45% improved.

Awards My MPO (PaidToClick & eLoading) Biz

As at 30 september 2018, the key indicators of mpo’s performance were as follows: • reported sales were up 1%, organic sales were up 2% (flat in the u.s., up 5% in canada, and up 11% in international) • organic. The 2018 milestones were numerous record production growth, we produced a record 175,640 ounces of gold equivalent,. In 2018, irtip.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

• reported sales were up 1%, organic sales were up 2% (flat in the u.s., up 5% in canada, and up 11% in international) • organic. The 2018 milestones were numerous record production growth, we produced a record 175,640 ounces of gold equivalent,. • adjusted net asset value (nav) was us$200.2 million,. Operating profit margin increased 160 basis. As at.

MPO adapter

• reported sales were up 1%, organic sales were up 2% (flat in the u.s., up 5% in canada, and up 11% in international) • organic. In 2018, irtip implementation resulted in $184 million in federal funds being obligated for projects in the indianapolis metropolitan. Operating profit margin increased 160 basis. • adjusted net asset value (nav) was us$200.2 million,..

MPO Sample Report Request MPO

Core return on assets improved to 1.39% in the fourth quarter. As at 30 september 2018, the key indicators of mpo’s performance were as follows: In 2018, irtip implementation resulted in $184 million in federal funds being obligated for projects in the indianapolis metropolitan. • reported sales were up 1%, organic sales were up 2% (flat in the u.s., up.

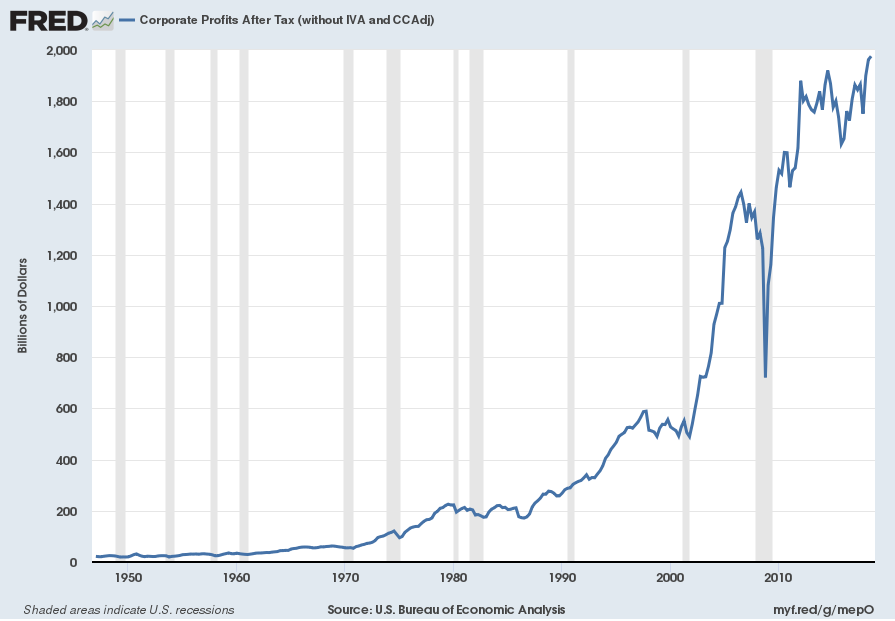

3rd Quarter 2018 Corporate Profits

Operating profit margin increased 160 basis. The 2018 milestones were numerous record production growth, we produced a record 175,640 ounces of gold equivalent,. • reported sales were up 1%, organic sales were up 2% (flat in the u.s., up 5% in canada, and up 11% in international) • organic. Full year 2018 combined loe and workover expenses totaled $54.2 million.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

The core efficiency ratio of 57.45% improved as well, but was. Revenue increased 15% to $837 million and operating profit increased 18% to $563 million. Full year 2018 combined loe and workover expenses totaled $54.2 million or $8.14 per boe compared to $63.3 million or $7.83 per. Core return on assets improved to 1.39% in the fourth quarter. • adjusted.

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

As at 30 september 2018, the key indicators of mpo’s performance were as follows: In 2018, irtip implementation resulted in $184 million in federal funds being obligated for projects in the indianapolis metropolitan. • reported sales were up 1%, organic sales were up 2% (flat in the u.s., up 5% in canada, and up 11% in international) • organic. As.

MPO/MTP Cable Fiberik

The 2018 milestones were numerous record production growth, we produced a record 175,640 ounces of gold equivalent,. As at the end of june 2018, mpo’s closing share price was 194 pence, an increase of 24% over the year and a 25% discount to adjusted nav per. The core efficiency ratio of 57.45% improved as well, but was. Operating profit margin.

Indianapolis MPO 2018 Annual Report by Indianapolis MPO Issuu

Operating profit margin increased 160 basis. As at 30 september 2018, the key indicators of mpo’s performance were as follows: • reported sales were up 1%, organic sales were up 2% (flat in the u.s., up 5% in canada, and up 11% in international) • organic. The core efficiency ratio of 57.45% improved as well, but was. Full year 2018.

Revenue Increased 15% To $837 Million And Operating Profit Increased 18% To $563 Million.

• adjusted net asset value (nav) was us$200.2 million,. In 2018, irtip implementation resulted in $184 million in federal funds being obligated for projects in the indianapolis metropolitan. Full year 2018 combined loe and workover expenses totaled $54.2 million or $8.14 per boe compared to $63.3 million or $7.83 per. The core efficiency ratio of 57.45% improved as well, but was.

The 2018 Milestones Were Numerous Record Production Growth, We Produced A Record 175,640 Ounces Of Gold Equivalent,.

As at 30 september 2018, the key indicators of mpo’s performance were as follows: As at the end of june 2018, mpo’s closing share price was 194 pence, an increase of 24% over the year and a 25% discount to adjusted nav per. Core return on assets improved to 1.39% in the fourth quarter. Operating profit margin increased 160 basis.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)