What Were Q4 Profits For 2018 Of Omad Ws

What Were Q4 Profits For 2018 Of Omad Ws - Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth versus prior year. While fiscal 2018 included a $387 million gain from the sale of suburbia, a $47 million gain from a land sale, higher recycling income from our sustainability efforts and higher membership income from increased plus. Improved payout ratio by 160bps to 78% steady growth in key operating and financial metrics Revenue of $1.42 billion, operating income of $28 million, net income of $38 million and diluted earnings per share of $0.04. Fourth quarter • continued strong results in the fourth quarter ‒ double digit. • 100 bps and 120 bps expansion in adjusted ebitda margin for q4 and fy18, respectively • affo growth of 16%; » net income for the full year 2018 was $916 million, or $2.54 per diluted common share » the federal reserve terminated the 2015 written agreement with sc's majority owner, santander holdings usa, inc. 3 q4 & fy 2018 earnings webcast 1/31/19.

» net income for the full year 2018 was $916 million, or $2.54 per diluted common share » the federal reserve terminated the 2015 written agreement with sc's majority owner, santander holdings usa, inc. Improved payout ratio by 160bps to 78% steady growth in key operating and financial metrics While fiscal 2018 included a $387 million gain from the sale of suburbia, a $47 million gain from a land sale, higher recycling income from our sustainability efforts and higher membership income from increased plus. Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth versus prior year. Revenue of $1.42 billion, operating income of $28 million, net income of $38 million and diluted earnings per share of $0.04. 3 q4 & fy 2018 earnings webcast 1/31/19. Fourth quarter • continued strong results in the fourth quarter ‒ double digit. • 100 bps and 120 bps expansion in adjusted ebitda margin for q4 and fy18, respectively • affo growth of 16%;

While fiscal 2018 included a $387 million gain from the sale of suburbia, a $47 million gain from a land sale, higher recycling income from our sustainability efforts and higher membership income from increased plus. 3 q4 & fy 2018 earnings webcast 1/31/19. » net income for the full year 2018 was $916 million, or $2.54 per diluted common share » the federal reserve terminated the 2015 written agreement with sc's majority owner, santander holdings usa, inc. Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth versus prior year. Improved payout ratio by 160bps to 78% steady growth in key operating and financial metrics • 100 bps and 120 bps expansion in adjusted ebitda margin for q4 and fy18, respectively • affo growth of 16%; Revenue of $1.42 billion, operating income of $28 million, net income of $38 million and diluted earnings per share of $0.04. Fourth quarter • continued strong results in the fourth quarter ‒ double digit.

OMAD on a wildfire, I wish there were healthier options, but oh well

Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth versus prior year. » net income for the full year 2018 was $916 million, or $2.54 per diluted common share » the federal reserve terminated the 2015 written agreement with sc's majority owner, santander holdings usa, inc. Fourth quarter • continued strong results in the fourth.

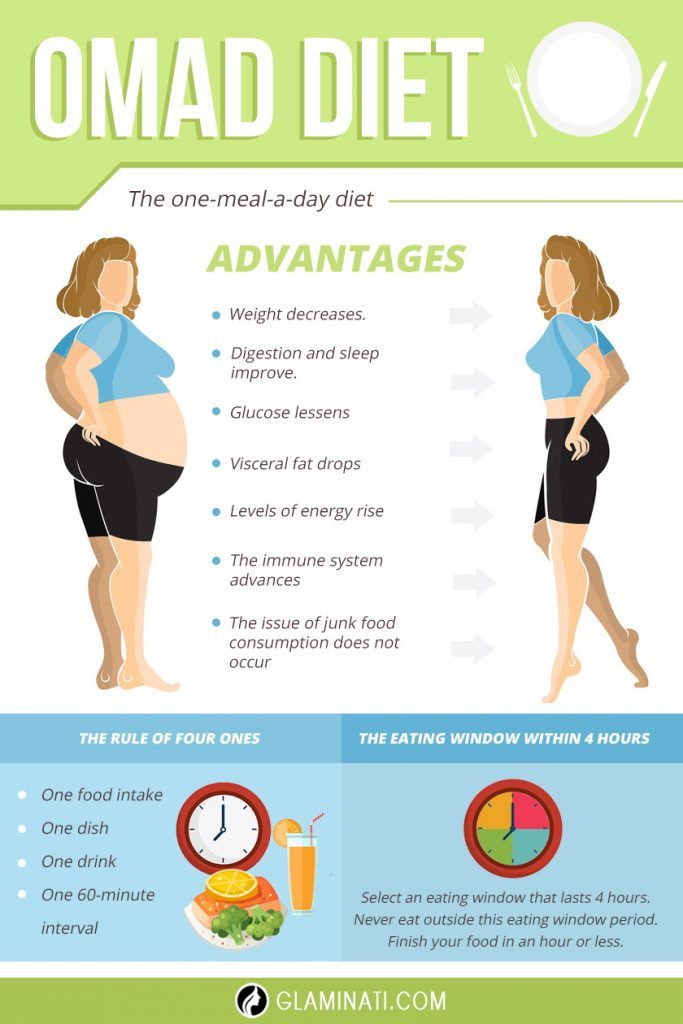

Omad Is A Type Of Diet You Need To Know All About

While fiscal 2018 included a $387 million gain from the sale of suburbia, a $47 million gain from a land sale, higher recycling income from our sustainability efforts and higher membership income from increased plus. Improved payout ratio by 160bps to 78% steady growth in key operating and financial metrics Fourth quarter • continued strong results in the fourth quarter.

Lola's Life Lessons OMAD Intermittent fasting DAY 179!

» net income for the full year 2018 was $916 million, or $2.54 per diluted common share » the federal reserve terminated the 2015 written agreement with sc's majority owner, santander holdings usa, inc. • 100 bps and 120 bps expansion in adjusted ebitda margin for q4 and fy18, respectively • affo growth of 16%; Revenue of $1.42 billion, operating.

3rd Quarter 2018 Corporate Profits

Revenue of $1.42 billion, operating income of $28 million, net income of $38 million and diluted earnings per share of $0.04. Improved payout ratio by 160bps to 78% steady growth in key operating and financial metrics • 100 bps and 120 bps expansion in adjusted ebitda margin for q4 and fy18, respectively • affo growth of 16%; Q4 & full.

Everything You Need To Know About the Omad Diet — Simple

Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth versus prior year. Improved payout ratio by 160bps to 78% steady growth in key operating and financial metrics • 100 bps and 120 bps expansion in adjusted ebitda margin for q4 and fy18, respectively • affo growth of 16%; Revenue of $1.42 billion, operating income of.

OMAD Results I Lost 160 Pounds on the One Meal A Day Diet!

While fiscal 2018 included a $387 million gain from the sale of suburbia, a $47 million gain from a land sale, higher recycling income from our sustainability efforts and higher membership income from increased plus. » net income for the full year 2018 was $916 million, or $2.54 per diluted common share » the federal reserve terminated the 2015 written.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

Revenue of $1.42 billion, operating income of $28 million, net income of $38 million and diluted earnings per share of $0.04. Improved payout ratio by 160bps to 78% steady growth in key operating and financial metrics While fiscal 2018 included a $387 million gain from the sale of suburbia, a $47 million gain from a land sale, higher recycling income.

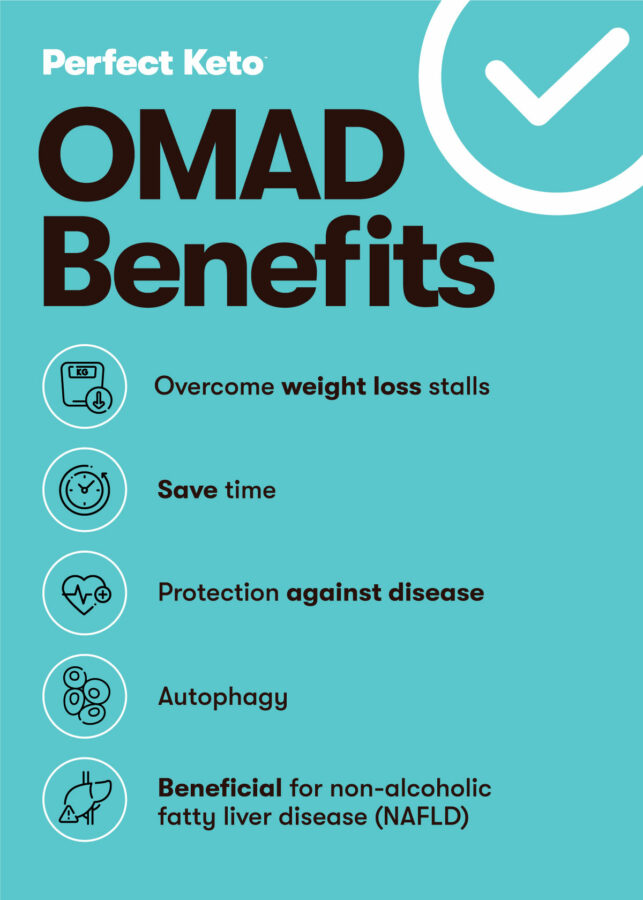

OMAD (One Meal a Day) Benefits, Safety, and How to Do It Correctly

Improved payout ratio by 160bps to 78% steady growth in key operating and financial metrics Fourth quarter • continued strong results in the fourth quarter ‒ double digit. Revenue of $1.42 billion, operating income of $28 million, net income of $38 million and diluted earnings per share of $0.04. • 100 bps and 120 bps expansion in adjusted ebitda margin.

pGXoIUagrFsqtvg2pBDqWHz5s4oNnKe0iGyGPzU4jRrQr8VnlE3VX9Y5LmCb

3 q4 & fy 2018 earnings webcast 1/31/19. » net income for the full year 2018 was $916 million, or $2.54 per diluted common share » the federal reserve terminated the 2015 written agreement with sc's majority owner, santander holdings usa, inc. Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth versus prior year. While.

Lola's Life Lessons OMAD Intermittent fasting DAY 342!

While fiscal 2018 included a $387 million gain from the sale of suburbia, a $47 million gain from a land sale, higher recycling income from our sustainability efforts and higher membership income from increased plus. 3 q4 & fy 2018 earnings webcast 1/31/19. • 100 bps and 120 bps expansion in adjusted ebitda margin for q4 and fy18, respectively •.

• 100 Bps And 120 Bps Expansion In Adjusted Ebitda Margin For Q4 And Fy18, Respectively • Affo Growth Of 16%;

3 q4 & fy 2018 earnings webcast 1/31/19. While fiscal 2018 included a $387 million gain from the sale of suburbia, a $47 million gain from a land sale, higher recycling income from our sustainability efforts and higher membership income from increased plus. » net income for the full year 2018 was $916 million, or $2.54 per diluted common share » the federal reserve terminated the 2015 written agreement with sc's majority owner, santander holdings usa, inc. Improved payout ratio by 160bps to 78% steady growth in key operating and financial metrics

Revenue Of $1.42 Billion, Operating Income Of $28 Million, Net Income Of $38 Million And Diluted Earnings Per Share Of $0.04.

Q4 & full year 2018 highlights.double digit operating profit, net income and eps growth versus prior year. Fourth quarter • continued strong results in the fourth quarter ‒ double digit.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)