What Were Q4 Profits For 2018 Of Xflt

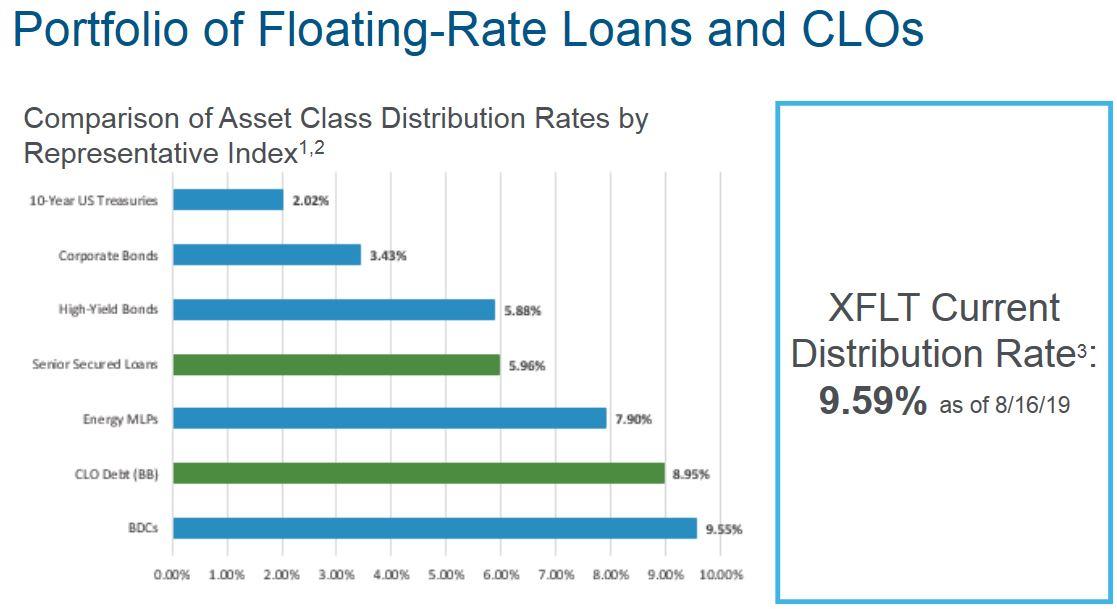

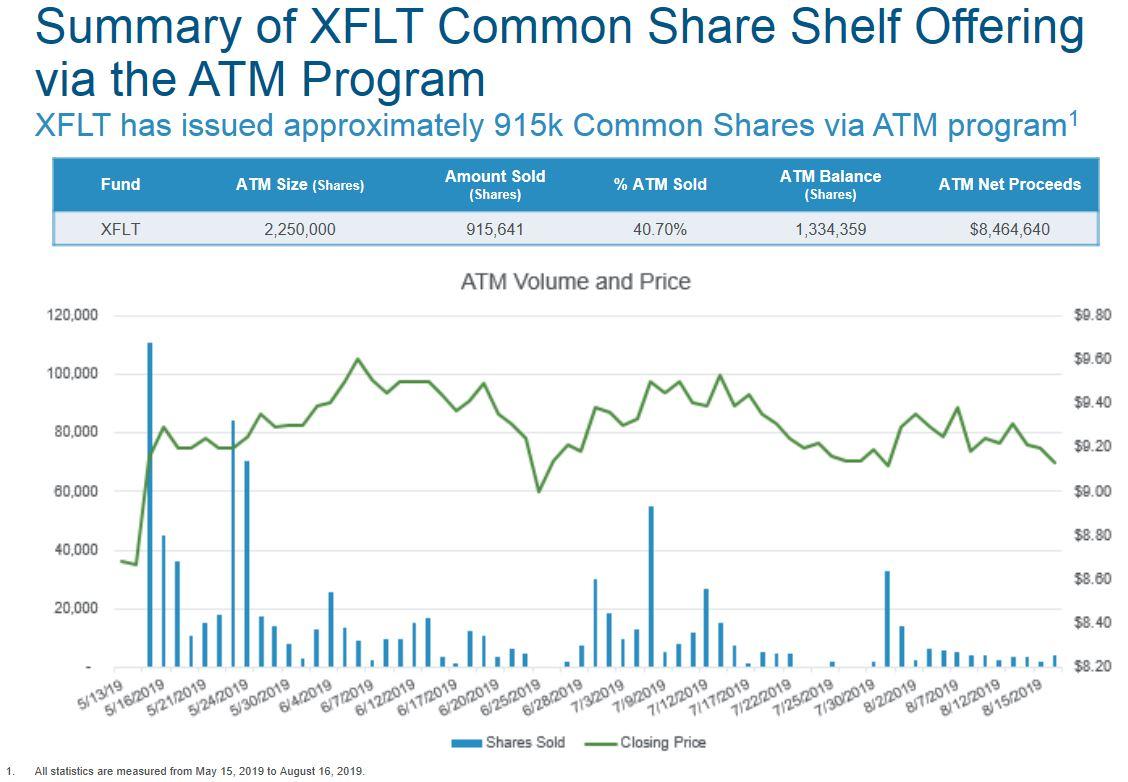

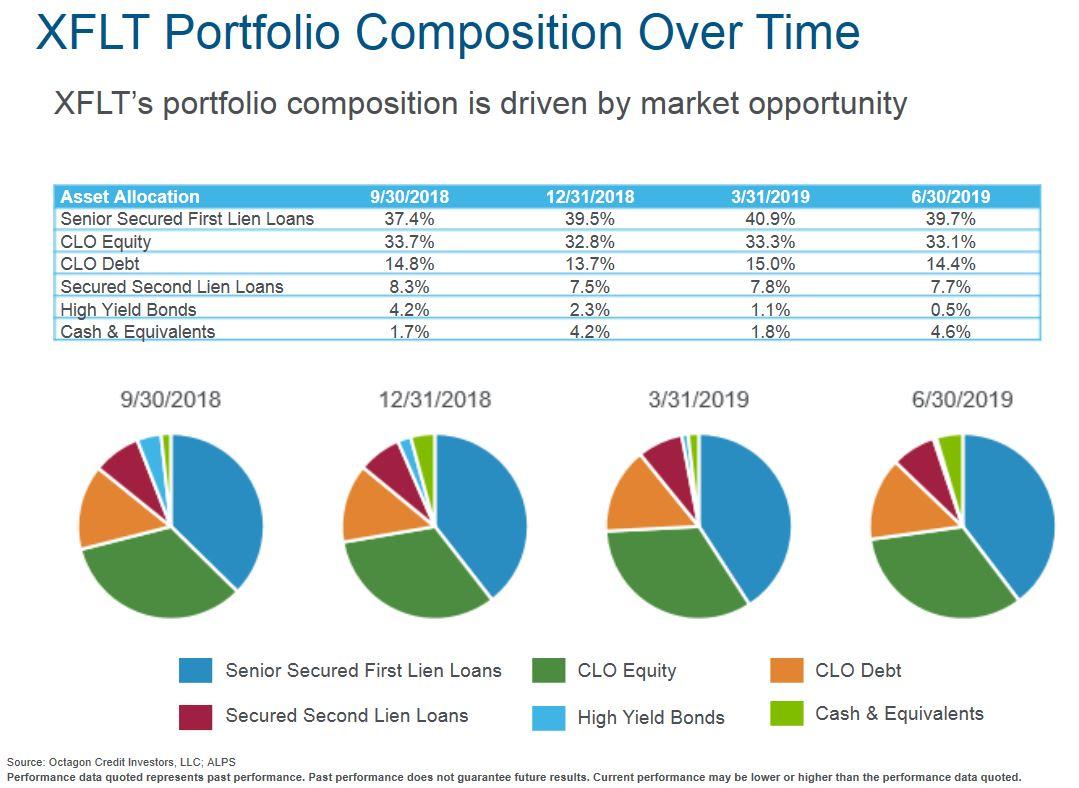

What Were Q4 Profits For 2018 Of Xflt - Reported diluted eps in q4 2018 was eur 0.03, compared to negative eur 0.07 in q4 2017, primarily driven by lower income tax expenses and our gross profit performance, partially. Find the latest xai octagon floating rate & alternative income trust (xflt) stock quote, history, news and other vital information to help you with your stock trading and investing. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. And xflt has traded at an average of approximately 3.4% premium since inception, although we did see a bit of a discount in q4, what do you attribute xflt's superior trading. Fueling this growth was our high member satisfaction, which propelled us to finish 2018. In 2018 we again delivered profitable growth with another year of strong gross margin progression and double digit growth of constant underlying earnings per.

And xflt has traded at an average of approximately 3.4% premium since inception, although we did see a bit of a discount in q4, what do you attribute xflt's superior trading. Fueling this growth was our high member satisfaction, which propelled us to finish 2018. Reported diluted eps in q4 2018 was eur 0.03, compared to negative eur 0.07 in q4 2017, primarily driven by lower income tax expenses and our gross profit performance, partially. In 2018 we again delivered profitable growth with another year of strong gross margin progression and double digit growth of constant underlying earnings per. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Find the latest xai octagon floating rate & alternative income trust (xflt) stock quote, history, news and other vital information to help you with your stock trading and investing.

In 2018 we again delivered profitable growth with another year of strong gross margin progression and double digit growth of constant underlying earnings per. Reported diluted eps in q4 2018 was eur 0.03, compared to negative eur 0.07 in q4 2017, primarily driven by lower income tax expenses and our gross profit performance, partially. And xflt has traded at an average of approximately 3.4% premium since inception, although we did see a bit of a discount in q4, what do you attribute xflt's superior trading. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Find the latest xai octagon floating rate & alternative income trust (xflt) stock quote, history, news and other vital information to help you with your stock trading and investing. Fueling this growth was our high member satisfaction, which propelled us to finish 2018.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

And xflt has traded at an average of approximately 3.4% premium since inception, although we did see a bit of a discount in q4, what do you attribute xflt's superior trading. Find the latest xai octagon floating rate & alternative income trust (xflt) stock quote, history, news and other vital information to help you with your stock trading and investing..

XFLT Continues To Impress (NYSEXFLT) Seeking Alpha

Reported diluted eps in q4 2018 was eur 0.03, compared to negative eur 0.07 in q4 2017, primarily driven by lower income tax expenses and our gross profit performance, partially. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. In 2018 we again delivered profitable growth with another year of strong.

XFLT Continues To Impress (NYSEXFLT) Seeking Alpha

Reported diluted eps in q4 2018 was eur 0.03, compared to negative eur 0.07 in q4 2017, primarily driven by lower income tax expenses and our gross profit performance, partially. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. And xflt has traded at an average of approximately 3.4% premium since.

XFLT Continues To Impress (NYSEXFLT) Seeking Alpha

Reported diluted eps in q4 2018 was eur 0.03, compared to negative eur 0.07 in q4 2017, primarily driven by lower income tax expenses and our gross profit performance, partially. And xflt has traded at an average of approximately 3.4% premium since inception, although we did see a bit of a discount in q4, what do you attribute xflt's superior.

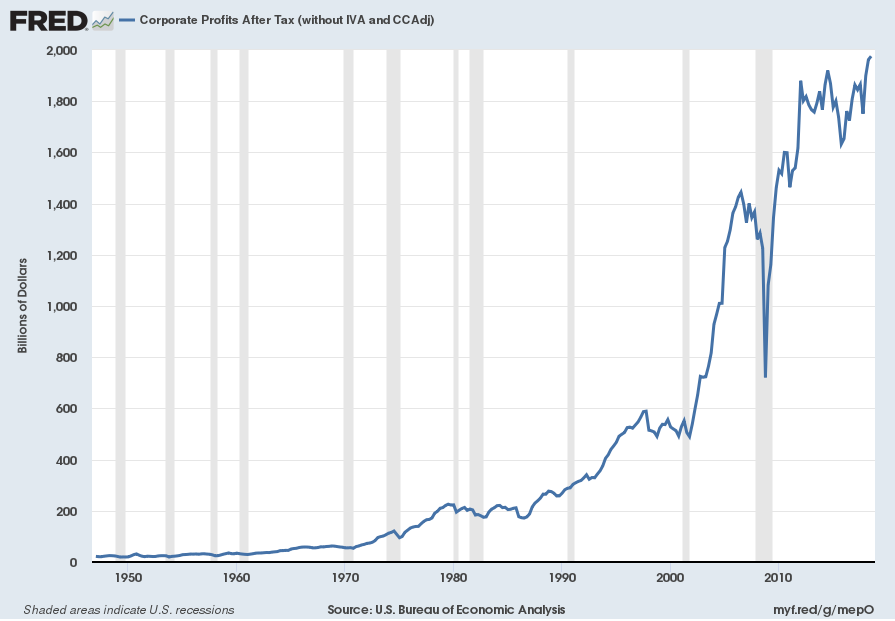

3rd Quarter 2018 Corporate Profits

And xflt has traded at an average of approximately 3.4% premium since inception, although we did see a bit of a discount in q4, what do you attribute xflt's superior trading. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Fueling this growth was our high member satisfaction, which propelled us.

XFLT Stock Fund Price and Chart — NYSEXFLT — TradingView

Find the latest xai octagon floating rate & alternative income trust (xflt) stock quote, history, news and other vital information to help you with your stock trading and investing. And xflt has traded at an average of approximately 3.4% premium since inception, although we did see a bit of a discount in q4, what do you attribute xflt's superior trading..

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

And xflt has traded at an average of approximately 3.4% premium since inception, although we did see a bit of a discount in q4, what do you attribute xflt's superior trading. Find the latest xai octagon floating rate & alternative income trust (xflt) stock quote, history, news and other vital information to help you with your stock trading and investing..

XFLT CLO Pricing Improves Probability Of 6 Annual Returns From Here

Reported diluted eps in q4 2018 was eur 0.03, compared to negative eur 0.07 in q4 2017, primarily driven by lower income tax expenses and our gross profit performance, partially. Find the latest xai octagon floating rate & alternative income trust (xflt) stock quote, history, news and other vital information to help you with your stock trading and investing. We.

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

Reported diluted eps in q4 2018 was eur 0.03, compared to negative eur 0.07 in q4 2017, primarily driven by lower income tax expenses and our gross profit performance, partially. In 2018 we again delivered profitable growth with another year of strong gross margin progression and double digit growth of constant underlying earnings per. And xflt has traded at an.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

Reported diluted eps in q4 2018 was eur 0.03, compared to negative eur 0.07 in q4 2017, primarily driven by lower income tax expenses and our gross profit performance, partially. And xflt has traded at an average of approximately 3.4% premium since inception, although we did see a bit of a discount in q4, what do you attribute xflt's superior.

In 2018 We Again Delivered Profitable Growth With Another Year Of Strong Gross Margin Progression And Double Digit Growth Of Constant Underlying Earnings Per.

Find the latest xai octagon floating rate & alternative income trust (xflt) stock quote, history, news and other vital information to help you with your stock trading and investing. We grew annual revenue 35% to $16 billion in 2018, and nearly doubled operating profits to $1.6 billion. Fueling this growth was our high member satisfaction, which propelled us to finish 2018. And xflt has traded at an average of approximately 3.4% premium since inception, although we did see a bit of a discount in q4, what do you attribute xflt's superior trading.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)