Where To Report Inheritance On 1040

Where To Report Inheritance On 1040 - If you sell the property for more than your basis, you have a taxable gain. The tool is designed for taxpayers who were u.s. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. However, any income earned from an inheritance such as interest, dividends, rent) or. Learn the basics of tax on inheritance, including who pays it and how to report it to the irs. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. If you inherited assets, you may owe inheritance tax. However, any income earned from an inheritance such as interest, dividends, rent) or.

The tool is designed for taxpayers who were u.s. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. If you sell the property for more than your basis, you have a taxable gain. However, any income earned from an inheritance such as interest, dividends, rent) or. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. Learn the basics of tax on inheritance, including who pays it and how to report it to the irs. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. However, any income earned from an inheritance such as interest, dividends, rent) or. If you inherited assets, you may owe inheritance tax.

Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. If you inherited assets, you may owe inheritance tax. However, any income earned from an inheritance such as interest, dividends, rent) or. This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. The tool is designed for taxpayers who were u.s. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. Learn the basics of tax on inheritance, including who pays it and how to report it to the irs. If you sell the property for more than your basis, you have a taxable gain. However, any income earned from an inheritance such as interest, dividends, rent) or.

A1O04 Form 1040 Schedule A Itemized Deductions

The tool is designed for taxpayers who were u.s. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. If you inherited assets, you may owe inheritance tax. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital.

Form 1040 U.

Learn the basics of tax on inheritance, including who pays it and how to report it to the irs. However, any income earned from an inheritance such as interest, dividends, rent) or. If you inherited assets, you may owe inheritance tax. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal.

Form 1040 AOTM

The tool is designed for taxpayers who were u.s. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. However, any income earned from an inheritance such as interest, dividends, rent) or. If you sell the property for more than your basis, you have a taxable gain. However, any income.

IRSFormular 1040 ausfüllen Infos zum IRSFormular 1040ES

If you sell the property for more than your basis, you have a taxable gain. This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. However, any.

1040 Impact Human Trafficking Rescue

Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: However, any income earned from an inheritance such as interest, dividends, rent) or. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. Learn the basics of.

Create any 1040 Form Online Instantly ThePayStubs Worksheets Library

However, any income earned from an inheritance such as interest, dividends, rent) or. However, any income earned from an inheritance such as interest, dividends, rent) or. Learn the basics of tax on inheritance, including who pays it and how to report it to the irs. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on.

104012OC04 Form 1040 Official U.S. Individual Tax Return

Learn the basics of tax on inheritance, including who pays it and how to report it to the irs. The tool is designed for taxpayers who were u.s. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: However, any income earned from an inheritance such as.

Free 1040 eic worksheet, Download Free 1040 eic worksheet png images

Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. If you sell the property for more than your basis, you have a taxable gain. This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. Report the.

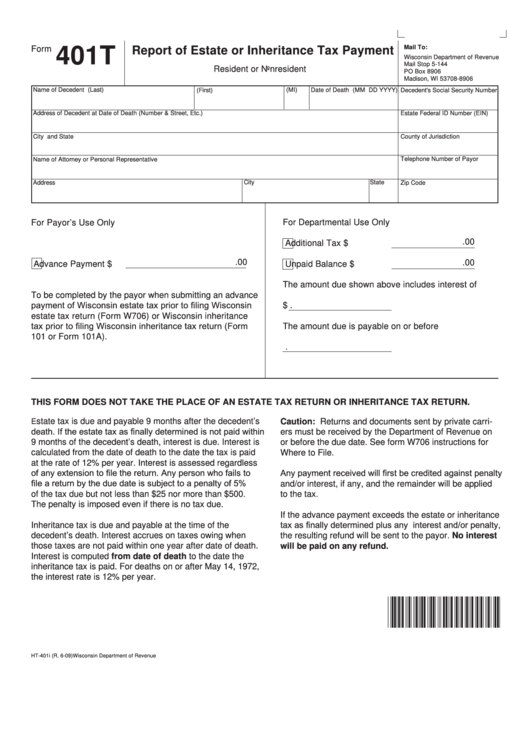

Inheritance Tax Estate Report Form

Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. If you sell the property for more than your basis, you have a taxable gain. However, any income earned from an inheritance such as interest, dividends, rent) or. However, any income earned from an inheritance such as interest, dividends, rent).

Can I Sell My Inheritance? Inheritance Funding

If you sell the property for more than your basis, you have a taxable gain. However, any income earned from an inheritance such as interest, dividends, rent) or. This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. Learn the basics of tax on inheritance, including who.

If You Inherited Assets, You May Owe Inheritance Tax.

Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: However, any income earned from an inheritance such as interest, dividends, rent) or.

Learn The Basics Of Tax On Inheritance, Including Who Pays It And How To Report It To The Irs.

However, any income earned from an inheritance such as interest, dividends, rent) or. This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited is taxable. The tool is designed for taxpayers who were u.s. If you sell the property for more than your basis, you have a taxable gain.