Wv Tax Lien Sale

Wv Tax Lien Sale - After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. Sale of tax liens and nonentered, escheated and waste and unappropriated lands. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,.

After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. Sale of tax liens and nonentered, escheated and waste and unappropriated lands. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other.

Sale of tax liens and nonentered, escheated and waste and unappropriated lands. After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,.

Tax Lien Training Special Expired — Financial Freedom University

After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. Sale of tax liens and nonentered, escheated and waste and unappropriated lands. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. All.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. All payments for delinquent real estate taxes received within fourteen business days prior.

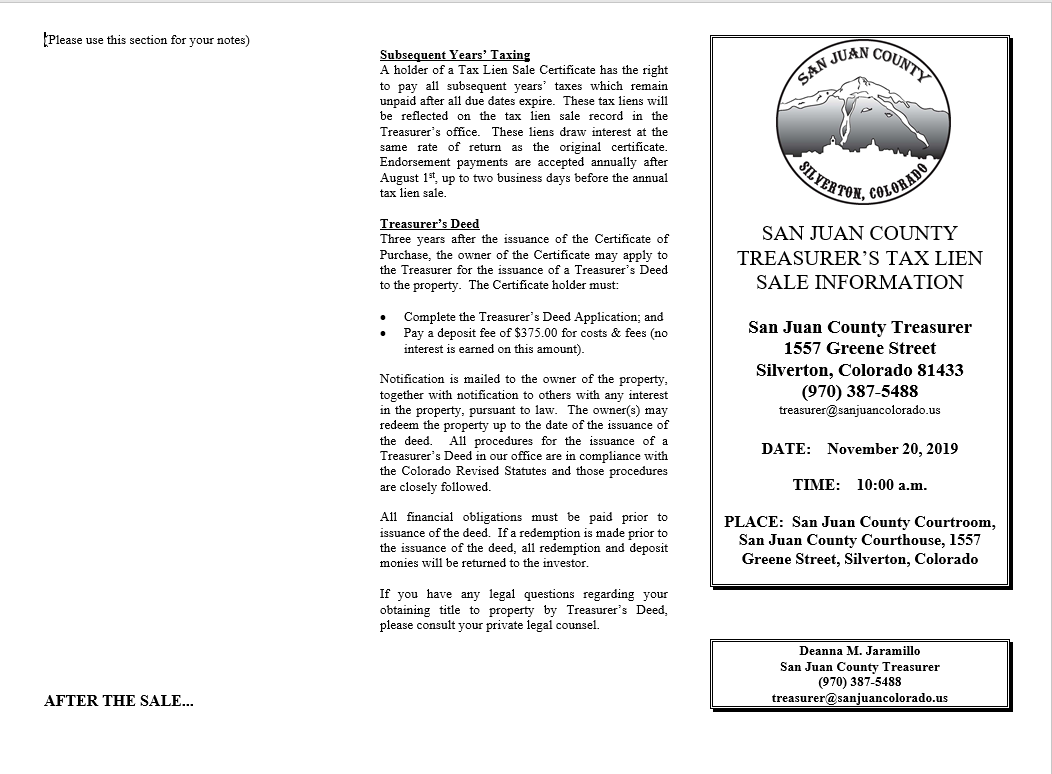

Tax Lien Sale San Juan County

All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. After the sale of any tax lien on any real property purchased at the delinquent land.

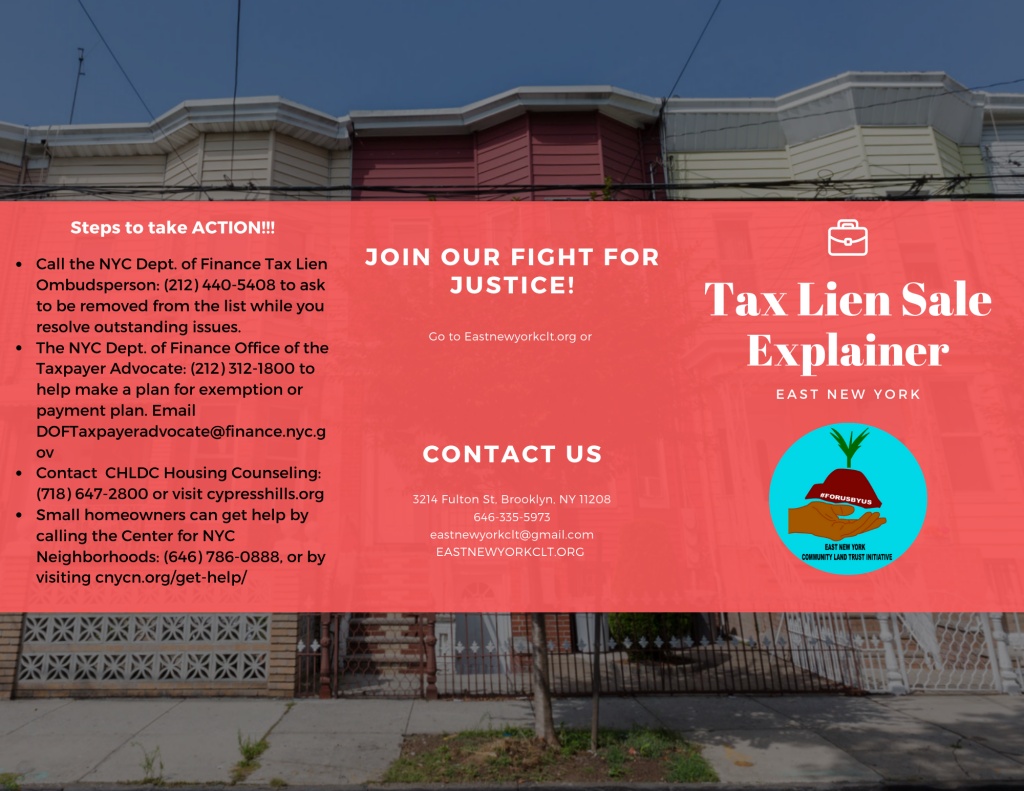

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. Sale of tax liens and nonentered, escheated and waste and unappropriated lands. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid.

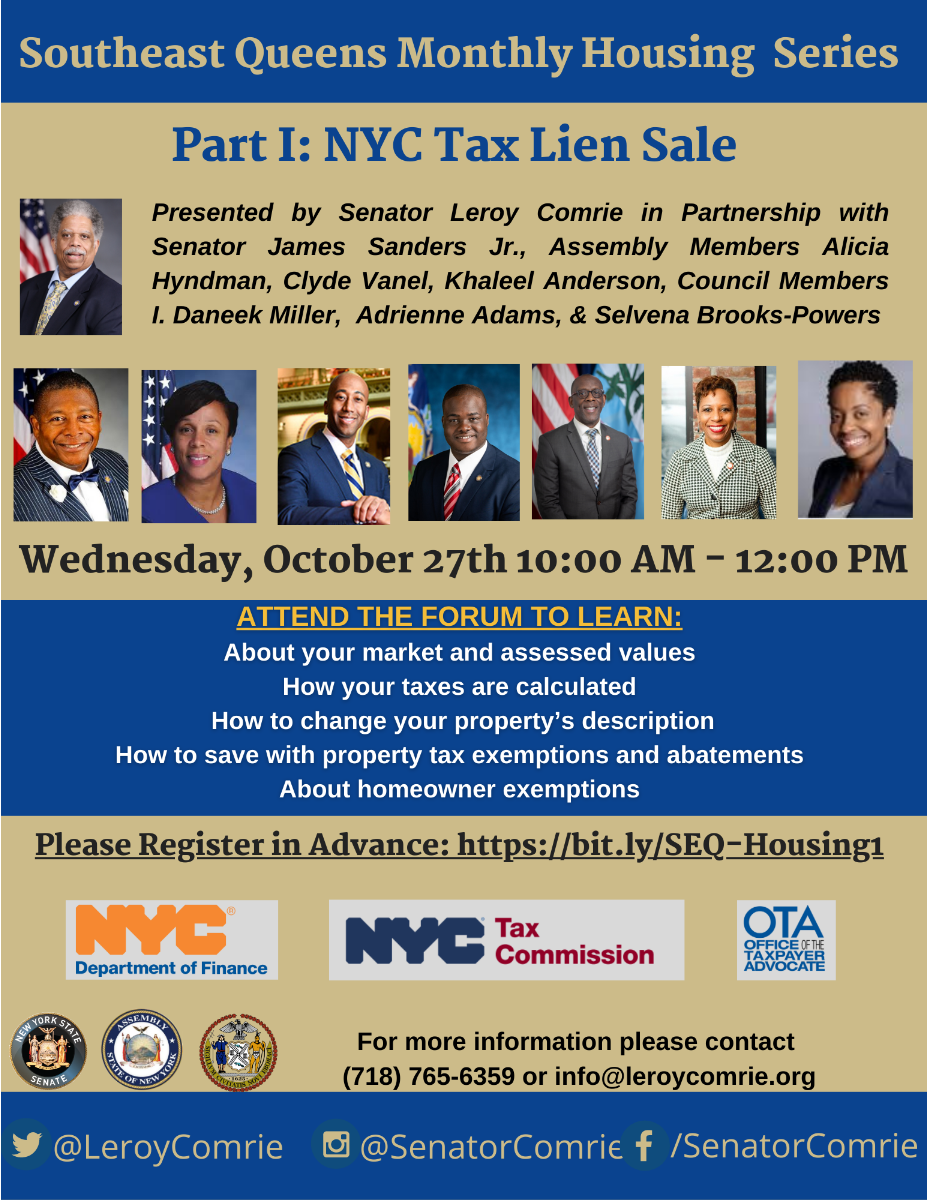

NYC Tax Lien Sale Information Session Jamaica311

After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. Sale of tax liens and nonentered, escheated and waste and unappropriated lands. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid.

Analysis of Bulk Tax Lien Sale Center for Community Progress

After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. Sale of tax liens and nonentered, escheated and waste and unappropriated lands. All.

TAX2 TSN (REMEDIES) PDF Taxes Tax Lien

All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. Sale of tax liens and nonentered, escheated and waste and unappropriated lands. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. After the sale of.

Informational Brochure About the Tax Lien Sale EastNewYorkCLT

After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. Sale of tax liens and nonentered, escheated and waste and unappropriated lands. After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. All.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. Sale of tax liens and nonentered, escheated and waste and unappropriated lands. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. After the sale of.

Informational Brochure About the Tax Lien Sale EastNewYorkCLT

After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. Sale of tax liens and nonentered, escheated and waste and unappropriated lands. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. All.

After The Sale Of Any Tax Lien On Any Real Property Purchased At The Delinquent Land Sales Conducted By The Sheriffs, The Owner Of, Or Any Other.

Sale of tax liens and nonentered, escheated and waste and unappropriated lands. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,.