Ymca Tax Form

Ymca Tax Form - Annually, the ymca provides documentation to our childcare participants for tax purposes. Learn more about the ymca's mission, programs and finances. Irs instructions state if the care provider is an individual, enter. Nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have. The ymca accounts for uncertain tax provisions under fasb asc 740, income taxes, which provides a framework for how entities should recognize,. If they do not, the irs will not allow. Return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private. Read information on our irs form 990, related financial. When you enter information for child and dependent care in form 2441: I have included a link below for you to check your ymca to see if they really do have an ein.

If they do not, the irs will not allow. Irs instructions state if the care provider is an individual, enter. Annually, the ymca provides documentation to our childcare participants for tax purposes. Nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have. When you enter information for child and dependent care in form 2441: I have included a link below for you to check your ymca to see if they really do have an ein. Read information on our irs form 990, related financial. Learn more about the ymca's mission, programs and finances. Return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private. The ymca accounts for uncertain tax provisions under fasb asc 740, income taxes, which provides a framework for how entities should recognize,.

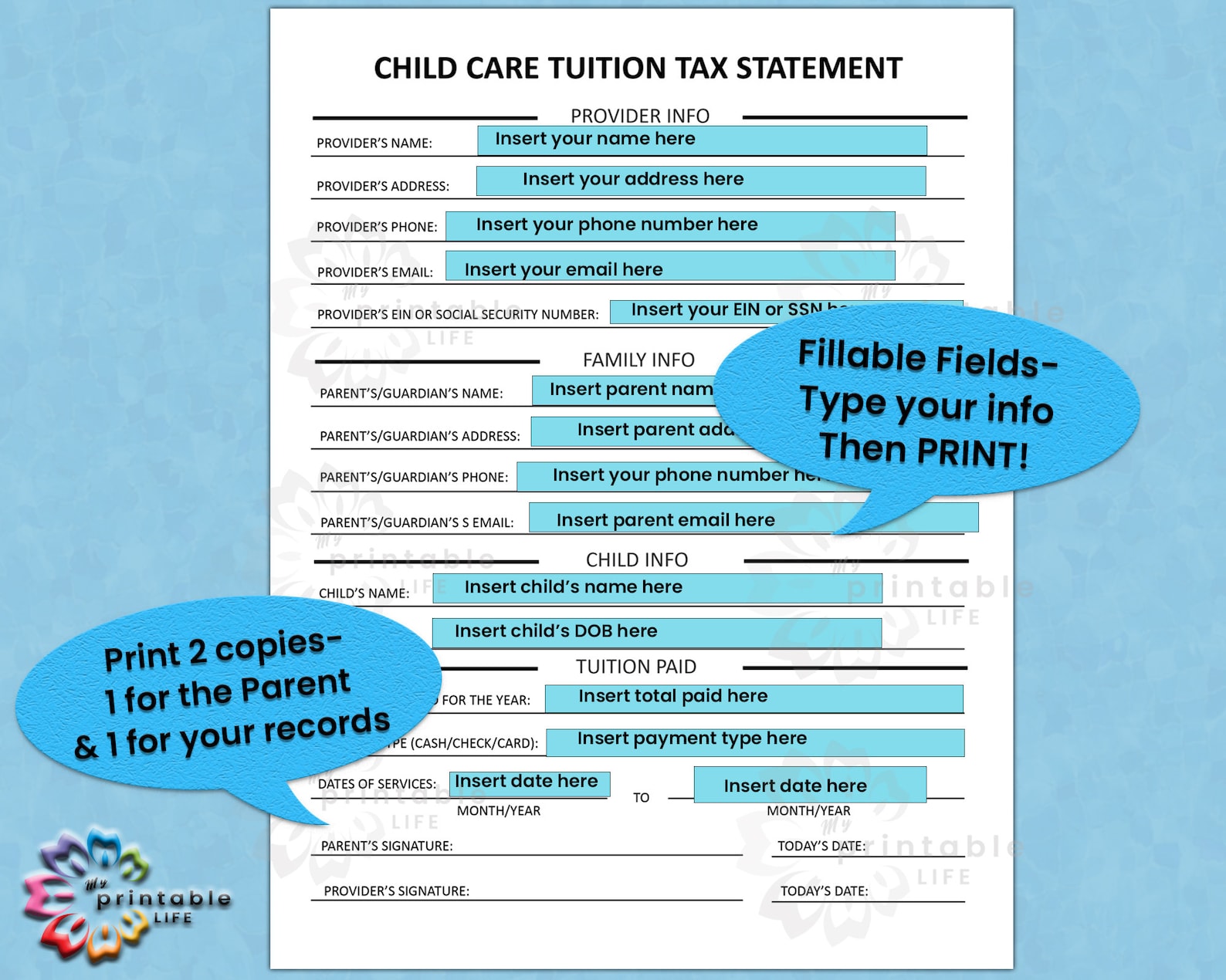

Read information on our irs form 990, related financial. Irs instructions state if the care provider is an individual, enter. Learn more about the ymca's mission, programs and finances. I have included a link below for you to check your ymca to see if they really do have an ein. If they do not, the irs will not allow. Return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private. Documentation generally includes the total. Annually, the ymca provides documentation to our childcare participants for tax purposes. Nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have. The ymca accounts for uncertain tax provisions under fasb asc 740, income taxes, which provides a framework for how entities should recognize,.

Is the YMCA tax exempt? StepbyStep Guide

When you enter information for child and dependent care in form 2441: Nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have. Return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private. Annually, the ymca provides.

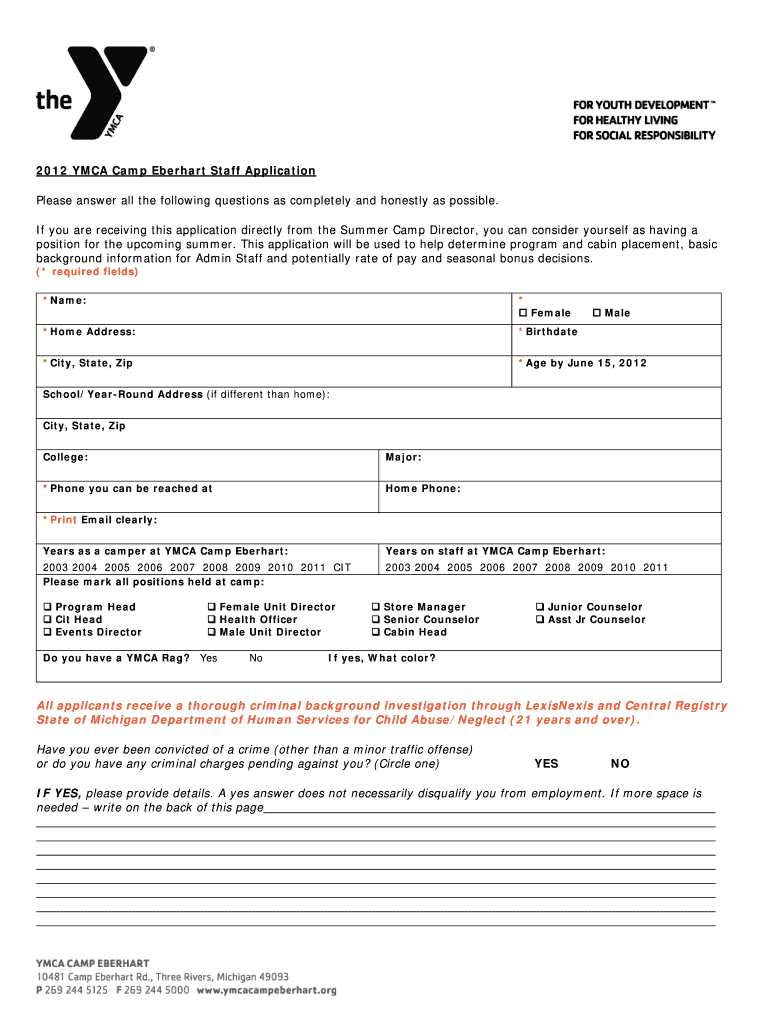

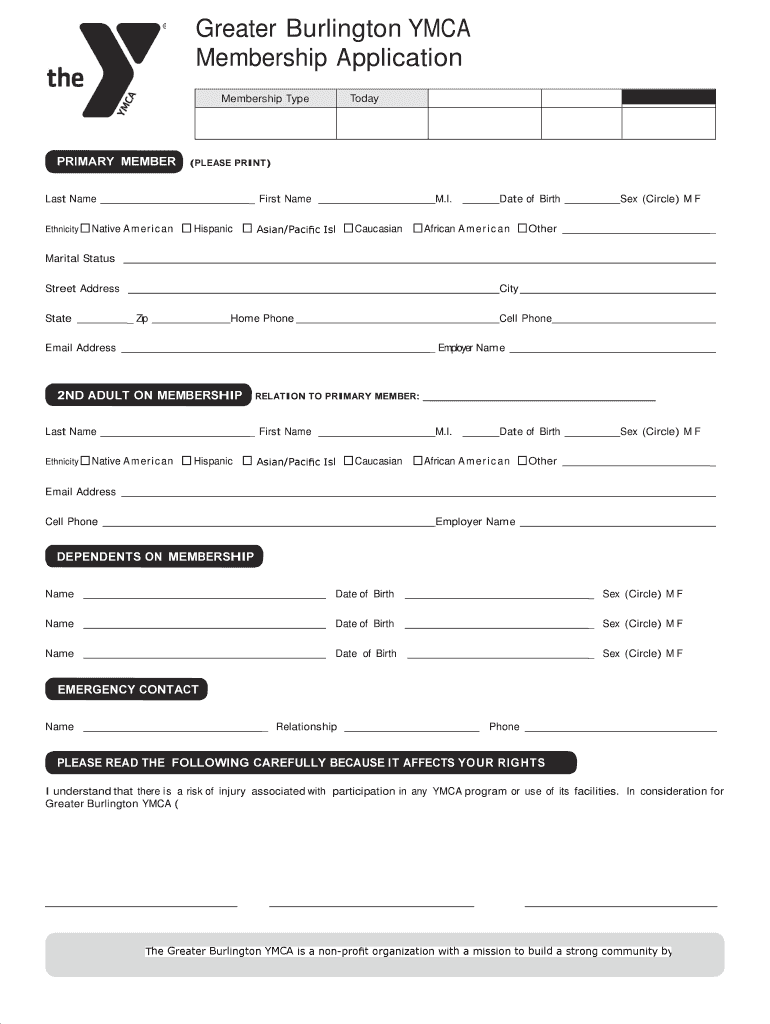

Ymca Job Application Form Online Fill Online, Printable, Fillable

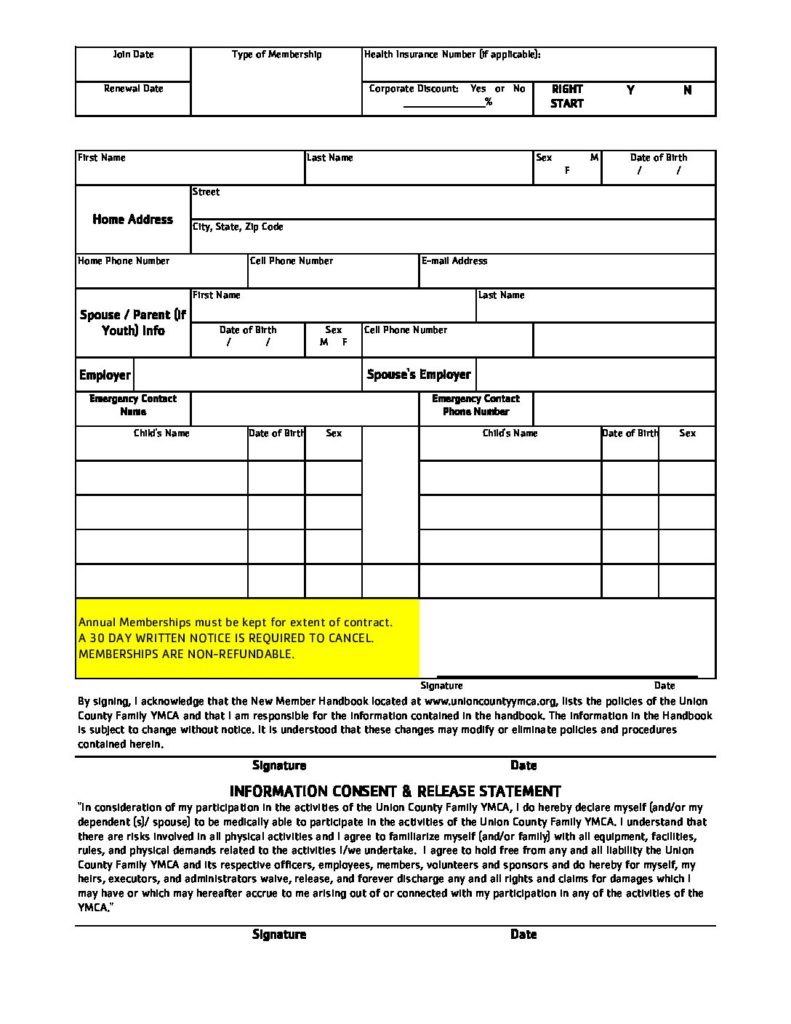

Return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private. Nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have. Documentation generally includes the total. Irs instructions state if the care provider is an individual, enter..

Is YMCA a TaxExempt Organization? Guide) The Handy Tax Guy

Irs instructions state if the care provider is an individual, enter. Documentation generally includes the total. Annually, the ymca provides documentation to our childcare participants for tax purposes. The ymca accounts for uncertain tax provisions under fasb asc 740, income taxes, which provides a framework for how entities should recognize,. Return of organization exempt from income tax under section 501(c),.

CIR V CA, CTA, YMCA PDF Tax Exemption Taxes

Documentation generally includes the total. The ymca accounts for uncertain tax provisions under fasb asc 740, income taxes, which provides a framework for how entities should recognize,. If they do not, the irs will not allow. Learn more about the ymca's mission, programs and finances. Return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the.

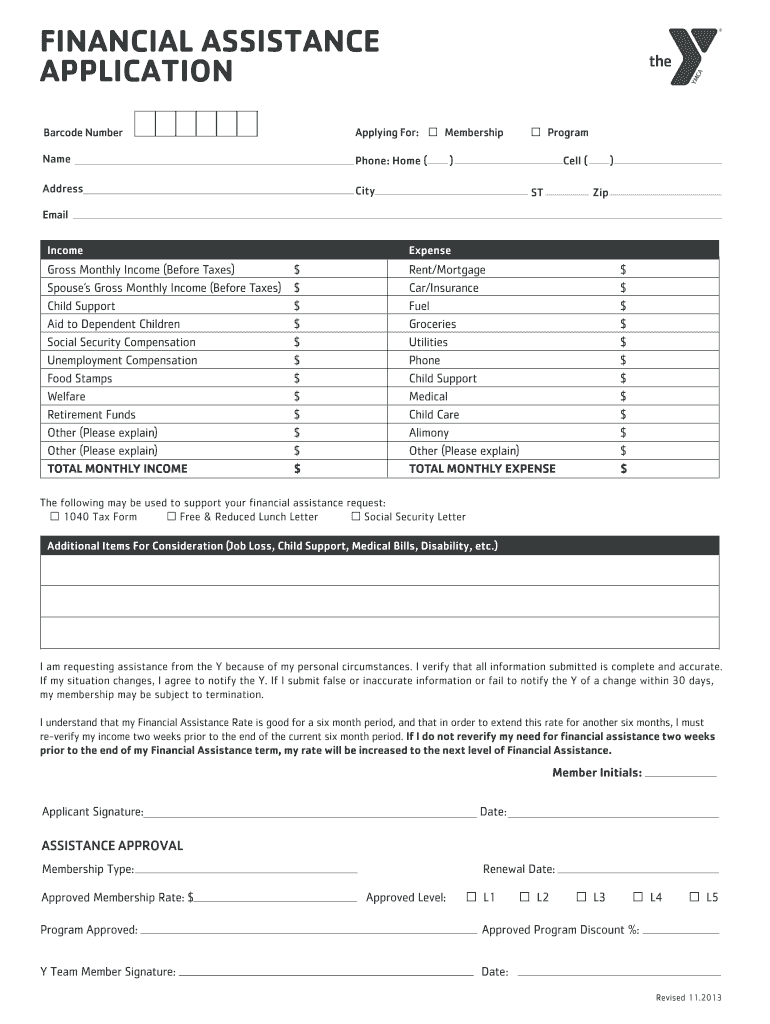

Ymca financial assistance application Fill out & sign online DocHub

I have included a link below for you to check your ymca to see if they really do have an ein. The ymca accounts for uncertain tax provisions under fasb asc 740, income taxes, which provides a framework for how entities should recognize,. If they do not, the irs will not allow. Learn more about the ymca's mission, programs and.

Ymca Assistance Application 20132024 Form Fill Out and Sign

I have included a link below for you to check your ymca to see if they really do have an ein. If they do not, the irs will not allow. Irs instructions state if the care provider is an individual, enter. Documentation generally includes the total. The ymca accounts for uncertain tax provisions under fasb asc 740, income taxes, which.

CHILD CARE TAX Statement Form Daycare or Childcare Printable, Tuition

Return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private. I have included a link below for you to check your ymca to see if they really do have an ein. When you enter information for child and dependent care in form 2441: If they do not, the irs will.

YMCA Membership Form Card Application 2020 UNION COUNTY FAMILY YMCA

Learn more about the ymca's mission, programs and finances. Read information on our irs form 990, related financial. Annually, the ymca provides documentation to our childcare participants for tax purposes. If they do not, the irs will not allow. Documentation generally includes the total.

Burlington Ymca Application Complete with ease airSlate SignNow

I have included a link below for you to check your ymca to see if they really do have an ein. Learn more about the ymca's mission, programs and finances. When you enter information for child and dependent care in form 2441: Documentation generally includes the total. Nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections.

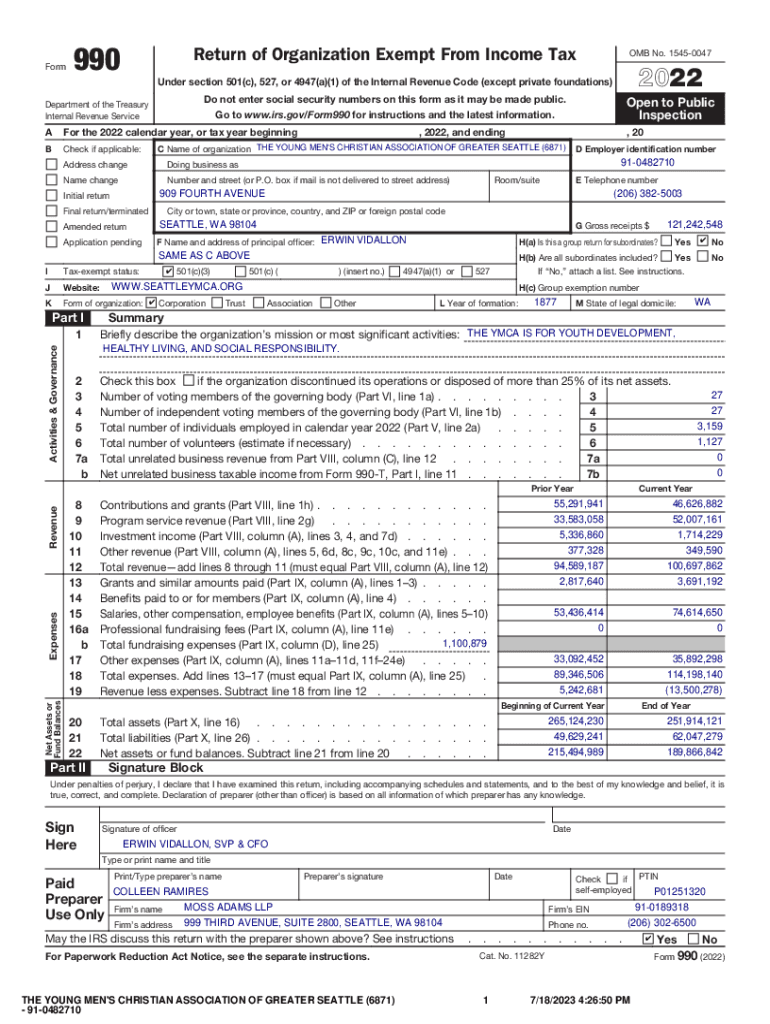

Fillable Online 2022 YMCA 990 Tax Return Fax Email Print pdfFiller

Documentation generally includes the total. Annually, the ymca provides documentation to our childcare participants for tax purposes. Return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private. When you enter information for child and dependent care in form 2441: Nonprofit explorer has organizations claiming tax exemption in each of the.

Learn More About The Ymca's Mission, Programs And Finances.

Nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have. Documentation generally includes the total. When you enter information for child and dependent care in form 2441: Irs instructions state if the care provider is an individual, enter.

Read Information On Our Irs Form 990, Related Financial.

I have included a link below for you to check your ymca to see if they really do have an ein. Annually, the ymca provides documentation to our childcare participants for tax purposes. The ymca accounts for uncertain tax provisions under fasb asc 740, income taxes, which provides a framework for how entities should recognize,. Return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private.