Buying Properties With Tax Liens

Buying Properties With Tax Liens - Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Anyone interested in purchasing a tax lien should start by deciding on the type of property they'd like to bid on—residential, commercial, undeveloped land, or property with. These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. The lien is the amount owed and must be paid in order for the. Once an investor buys that claim, they. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government.

A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. The lien is the amount owed and must be paid in order for the. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Once an investor buys that claim, they. Anyone interested in purchasing a tax lien should start by deciding on the type of property they'd like to bid on—residential, commercial, undeveloped land, or property with. These certificates give investors the right to collect unpaid property taxes, interest.

Once an investor buys that claim, they. Anyone interested in purchasing a tax lien should start by deciding on the type of property they'd like to bid on—residential, commercial, undeveloped land, or property with. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. These certificates give investors the right to collect unpaid property taxes, interest. The lien is the amount owed and must be paid in order for the. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government.

Tax Liens Cash for Properties

Once an investor buys that claim, they. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. Anyone interested in purchasing a tax lien should start by deciding on the type of property they'd like to bid on—residential, commercial, undeveloped land, or property with. Tax lien investing is.

Tax Source Group Inc. Southfield MI

Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. The lien is the amount owed and must be paid in order for the. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government..

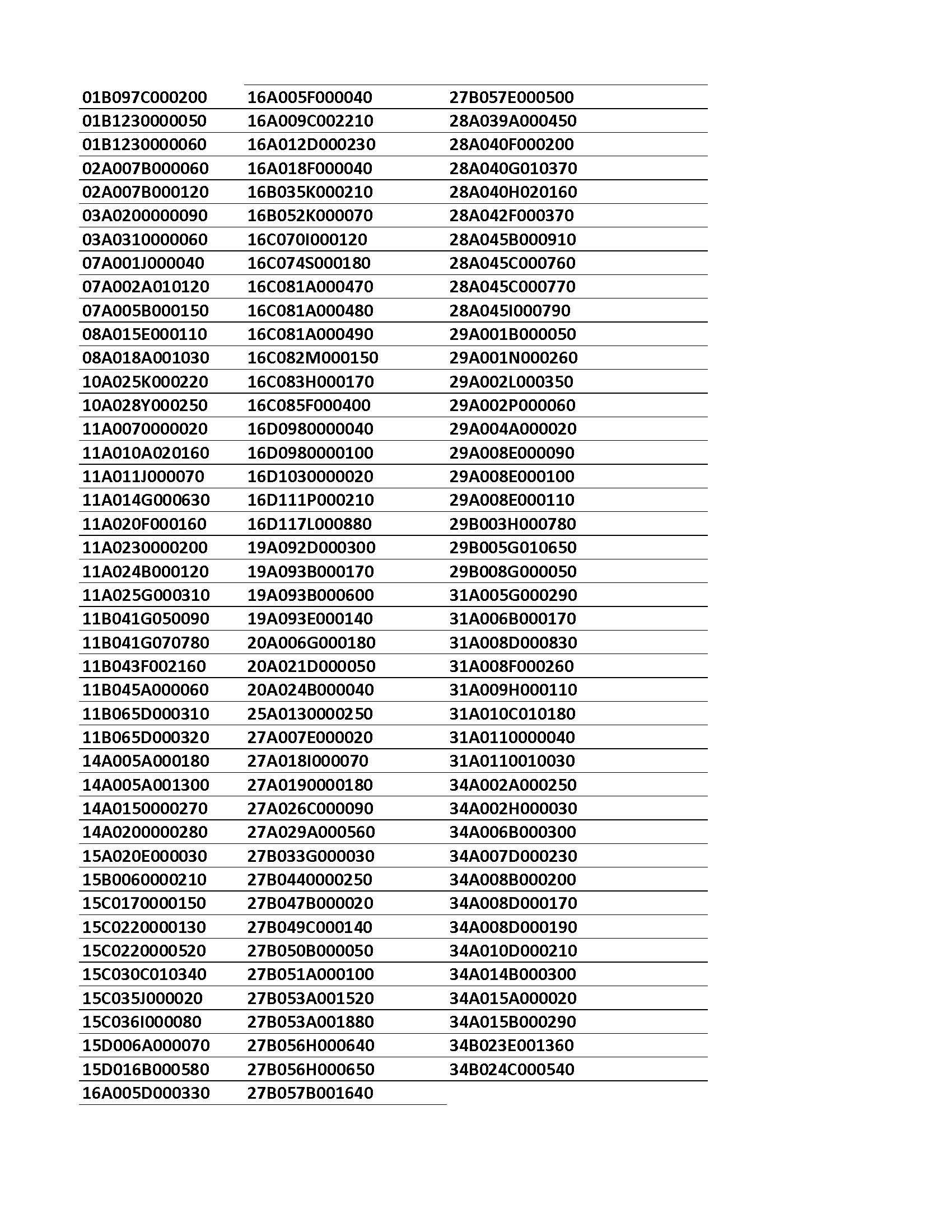

TAX LIENS PENDING CERTIFICATE FILING Treasurer

These certificates give investors the right to collect unpaid property taxes, interest. Once an investor buys that claim, they. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. The lien is the amount owed and must be paid in order for the. Tax lien investing involves buying the claim that a.

Financial Worth Tax Services Bryan TX

Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Anyone interested in purchasing a tax.

Read This before Buying Tax Liens Michael Schuett

Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. The lien is the amount owed and must be paid in order for the. These certificates give investors.

Sparks Tax and Accounting Services Topeka KS

A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. Anyone interested in purchasing a tax lien should start by deciding on the type of property they'd like to bid on—residential, commercial, undeveloped land, or property with. The lien is the amount owed and must be paid in.

What To Know When Buying Properties With Tax Exemptions Invested Agents

Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. The lien is the amount owed and must be paid in order for the. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Once an investor buys.

Tax Liens An Overview CheckBook IRA LLC

Anyone interested in purchasing a tax lien should start by deciding on the type of property they'd like to bid on—residential, commercial, undeveloped land, or property with. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. Tax lien investing involves buying the claim that a local government.

Things to Know about Buying a House with Tax Liens Tax Lien Code

Anyone interested in purchasing a tax lien should start by deciding on the type of property they'd like to bid on—residential, commercial, undeveloped land, or property with. The lien is the amount owed and must be paid in order for the. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state.

Tax Preparation Business Startup

These certificates give investors the right to collect unpaid property taxes, interest. Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes. Once an investor buys that claim, they. The lien is the amount owed and must be paid in order for the. A lien is.

These Certificates Give Investors The Right To Collect Unpaid Property Taxes, Interest.

Anyone interested in purchasing a tax lien should start by deciding on the type of property they'd like to bid on—residential, commercial, undeveloped land, or property with. Once an investor buys that claim, they. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government. The lien is the amount owed and must be paid in order for the.

Tax Lien Investing Is A Type Of Real Estate Investing Where You Purchase Tax Lien Certificates At Auctions.

Tax lien investing involves buying the claim that a local government makes on a property when an owner fails to pay their property taxes.