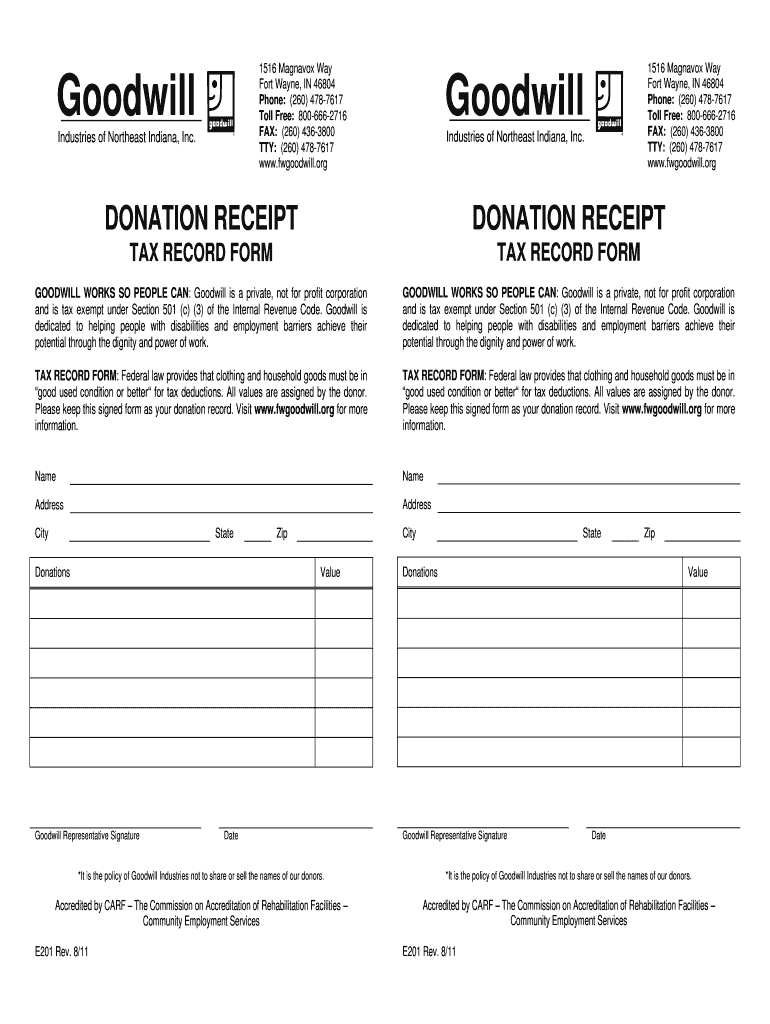

Goodwill Tax Receipt Form

Goodwill Tax Receipt Form - A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. Once you register, and every time you donate. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Goods or services were not exchanged. Learn how to value and deduct your donations to goodwill on your taxes. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Download a pdf guide, find a donation location, and consult a tax. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant.

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. Learn how to value and deduct your donations to goodwill on your taxes. Goods or services were not exchanged. Once you register, and every time you donate. Download a pdf guide, find a donation location, and consult a tax.

Learn how to value and deduct your donations to goodwill on your taxes. Goods or services were not exchanged. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Download a pdf guide, find a donation location, and consult a tax. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Once you register, and every time you donate.

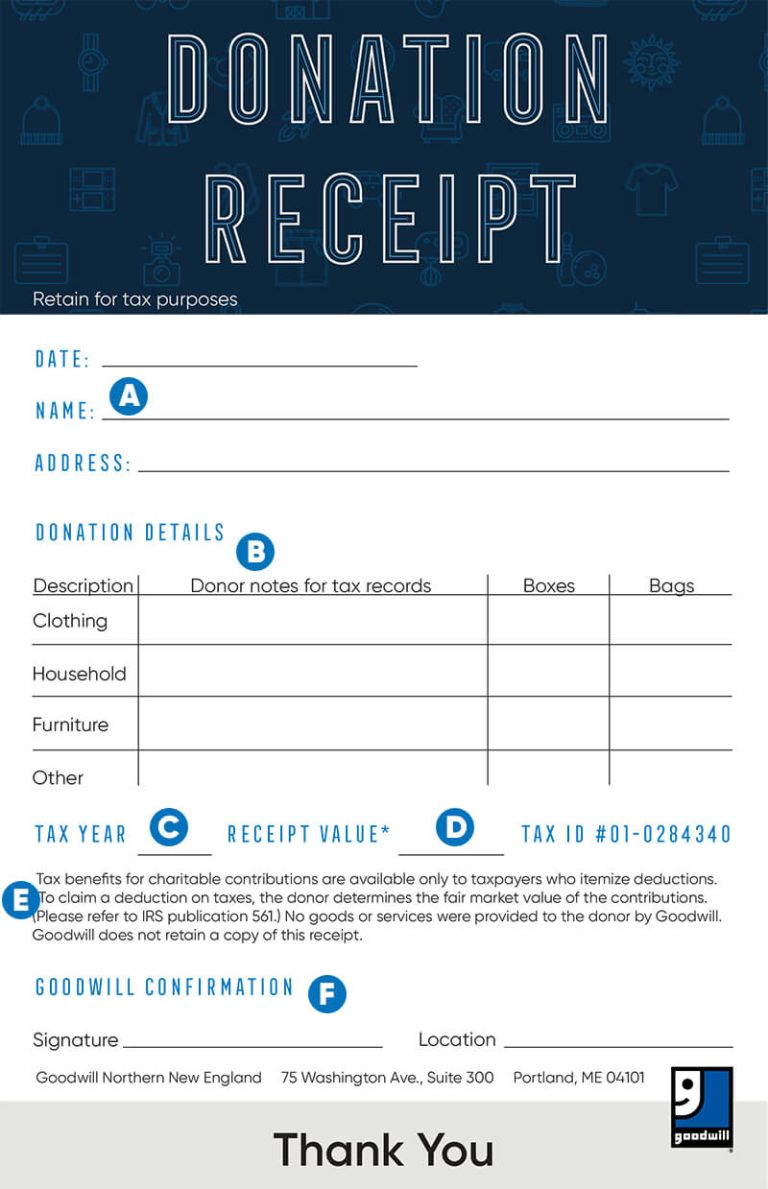

How to fill out a Goodwill Donation Tax Receipt Goodwill NNE

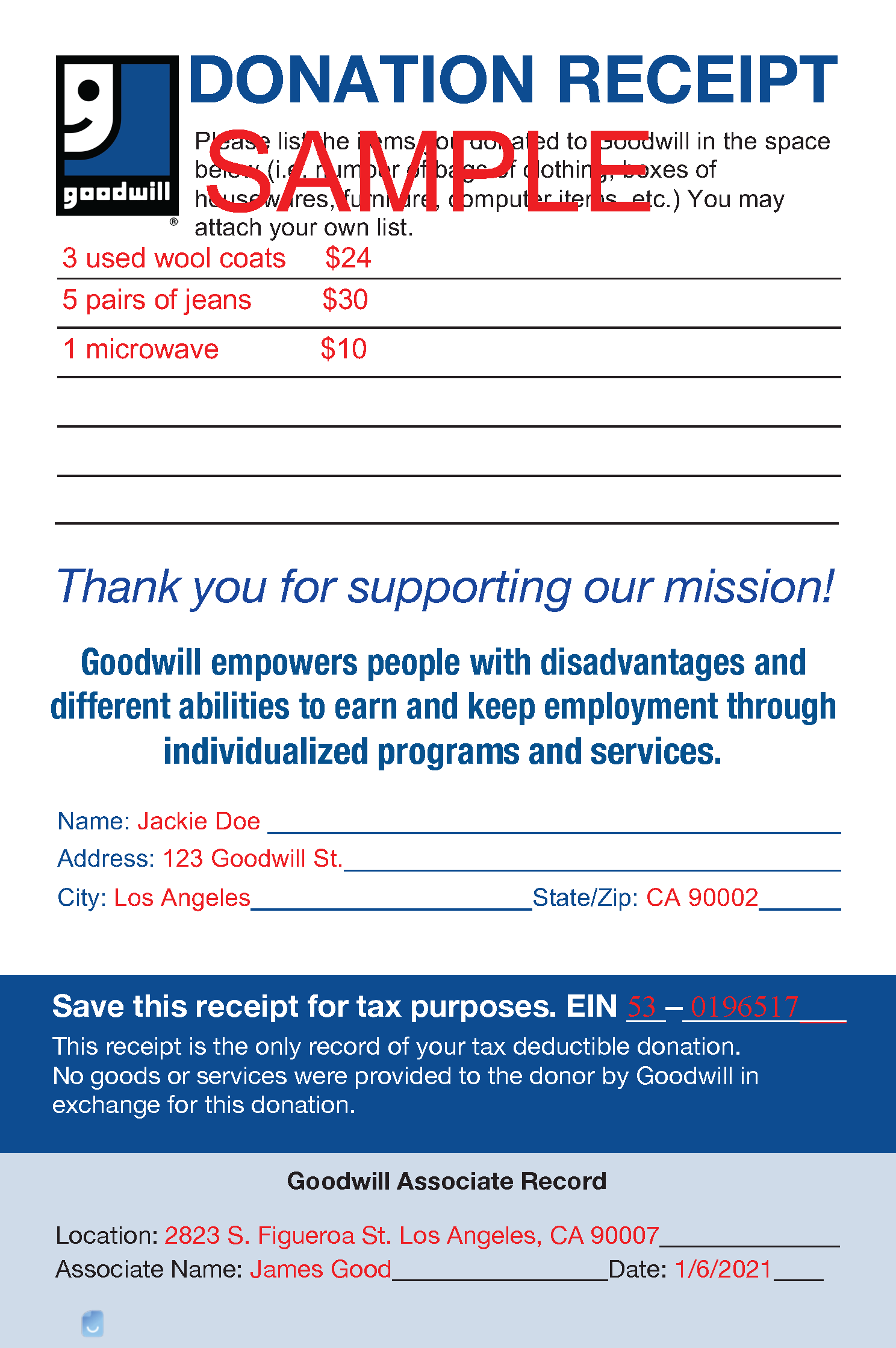

Goods or services were not exchanged. Learn how to value and deduct your donations to goodwill on your taxes. Download a pdf guide, find a donation location, and consult a tax. It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Once you register, and every time you donate.

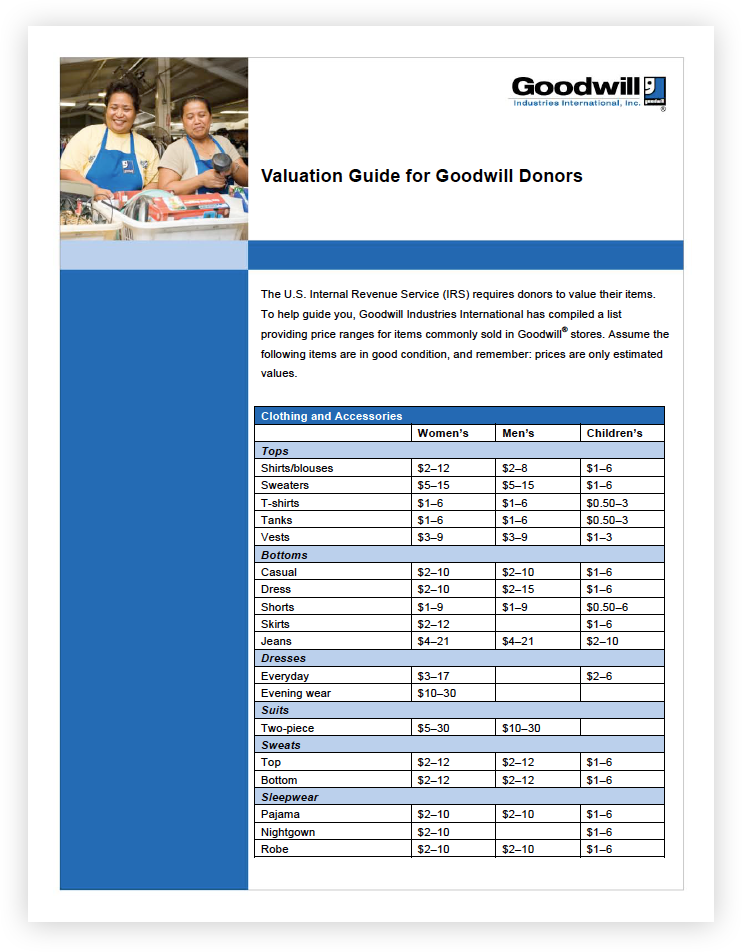

Tax Valuation Guide Goodwill of Southwestern Pennsylvania

Learn how to value and deduct your donations to goodwill on your taxes. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. It’s easier than ever to track your goodwill donations.

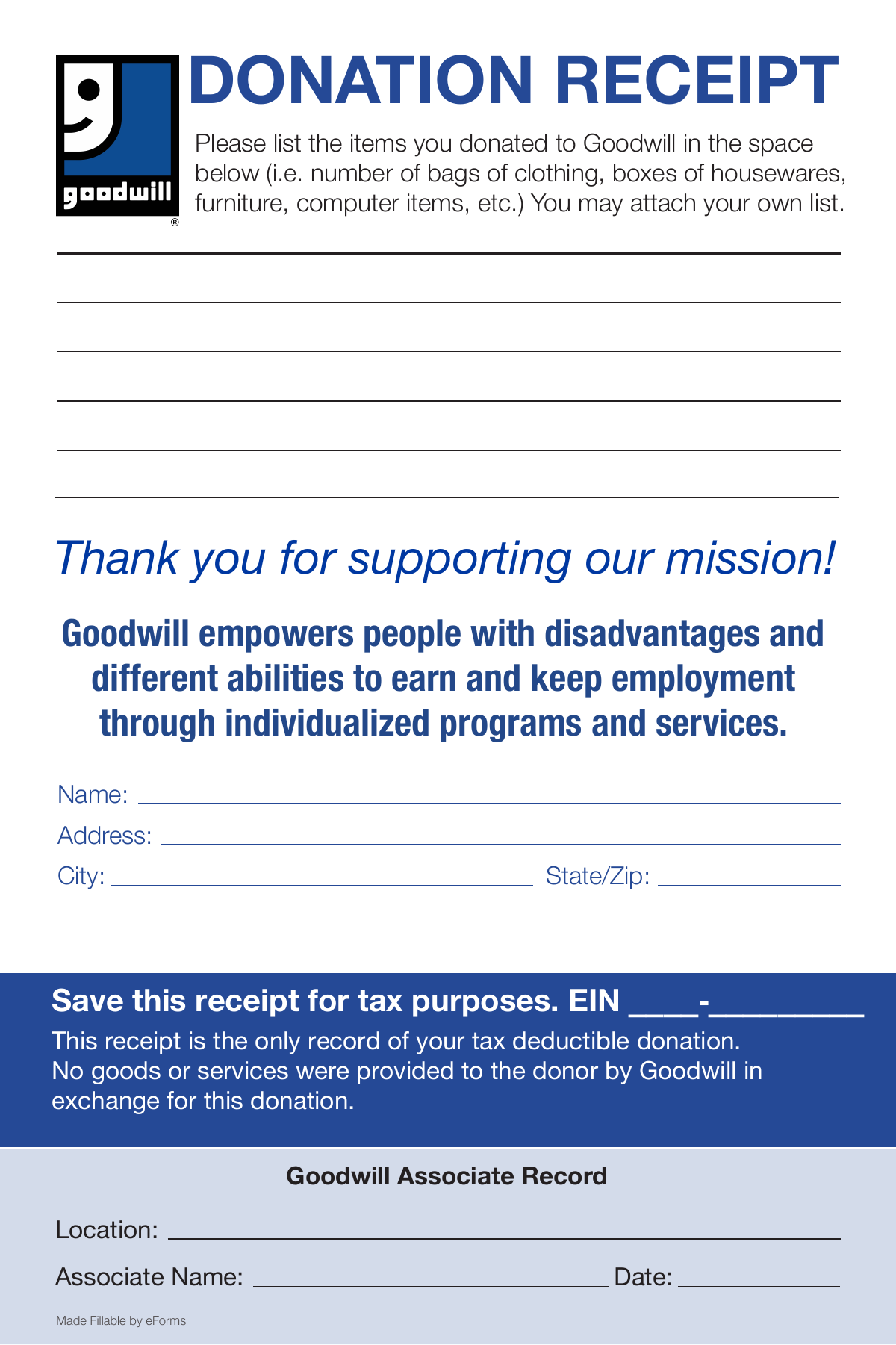

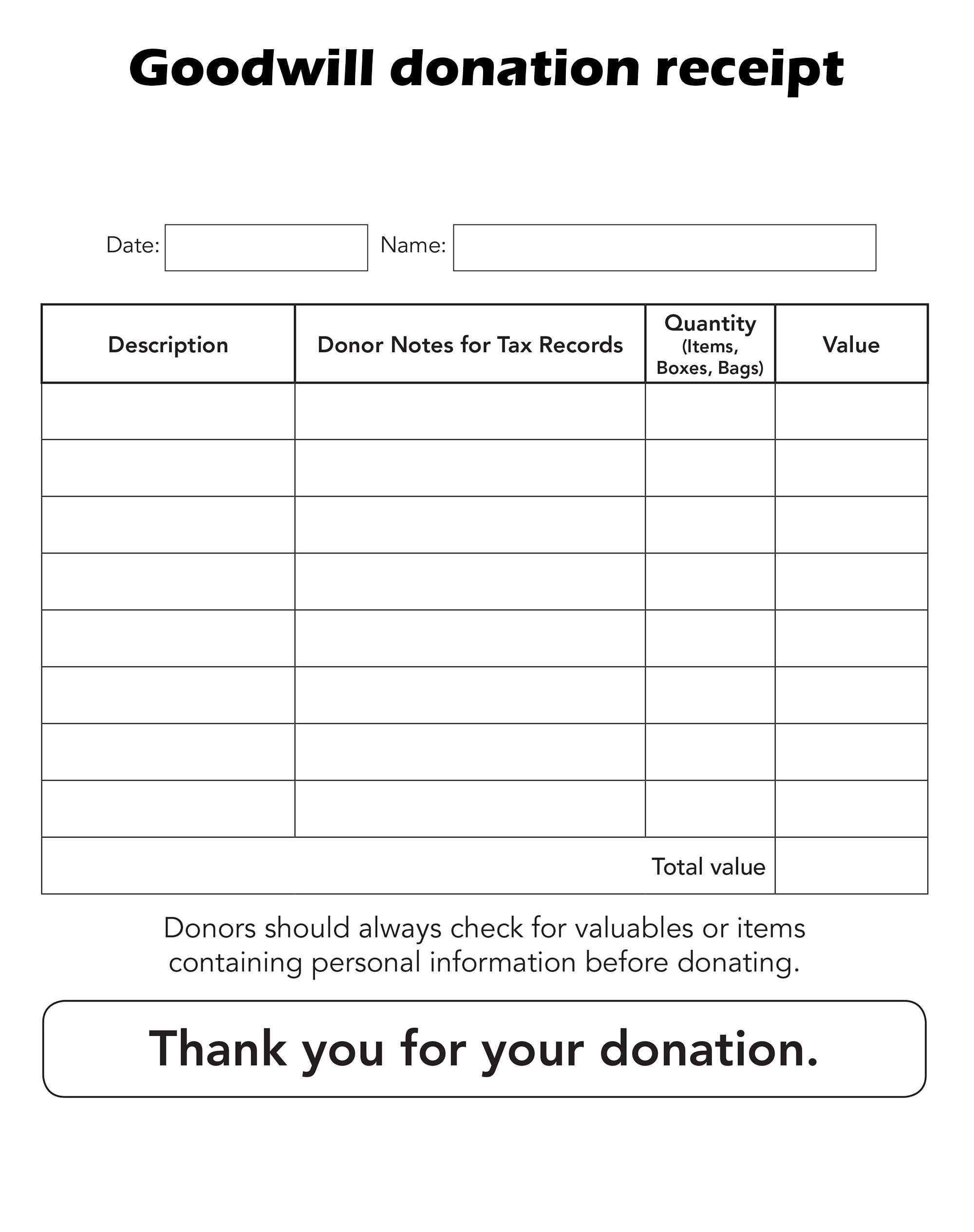

Free Goodwill Donation Receipt Template PDF eForms

Once you register, and every time you donate. Learn how to value and deduct your donations to goodwill on your taxes. Download a pdf guide, find a donation location, and consult a tax. Goods or services were not exchanged. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax.

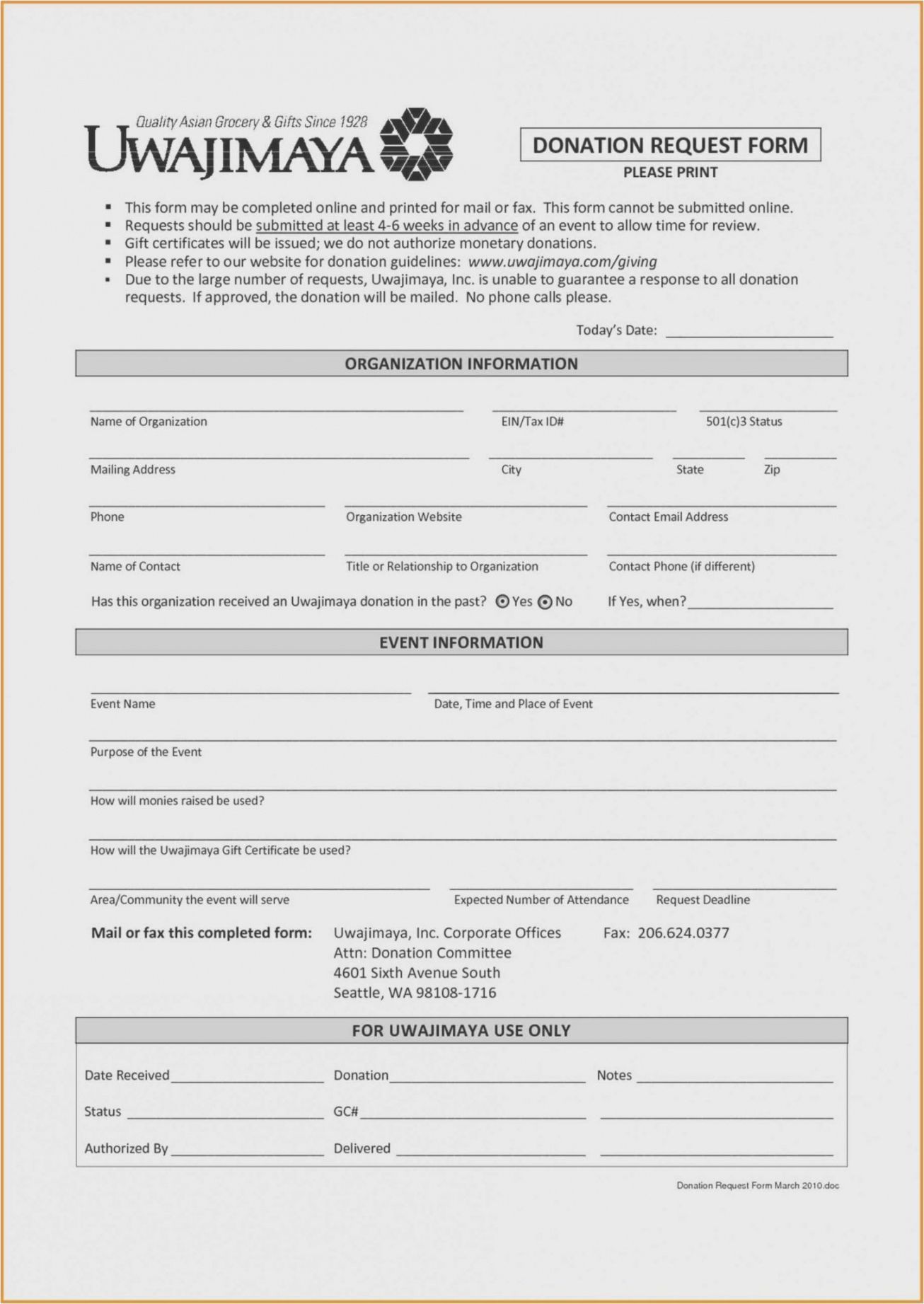

PDF Télécharger goodwill Gratuit PDF

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. Once you register, and every time you donate. Goodwill is a qualified tax exempt public charity under section.

Costum Goodwill Tax Receipt Form PDF Example

It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Learn how to value and deduct your donations to goodwill on your taxes. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Download a pdf guide, find a donation location, and consult a.

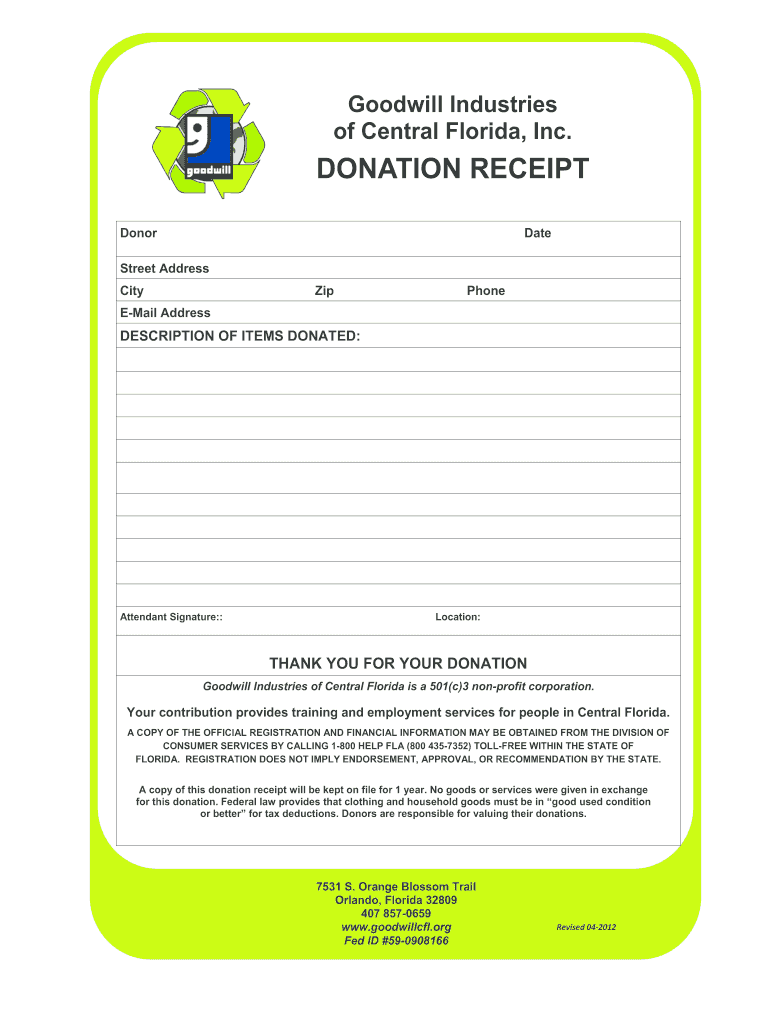

Goodwill Donation Receipt Fill Online Printable Fillable —

Goods or services were not exchanged. Once you register, and every time you donate. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. Goodwill is a qualified tax exempt public charity under section.

Pdf Printable Goodwill Donation Receipt Printable Templates

Goods or services were not exchanged. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Once you register, and every time you donate. When you drop off.

GoodWill Donation Receipt Template Invoice Maker, 40 OFF

When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Once you register, and every time you donate. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Download a pdf guide, find a donation location, and consult a tax. Learn how to value and deduct your donations.

Printable Goodwill Donation Receipt

It’s easier than ever to track your goodwill donations by eliminating your paper receipts. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Learn how to value and deduct your donations to goodwill on your taxes. Once.

Florida Goodwill Donation Receipt Fill Online, Printable, Fillable

Goods or services were not exchanged. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Download a pdf guide, find a donation location, and consult a tax. It’s easier than ever.

Once You Register, And Every Time You Donate.

Learn how to value and deduct your donations to goodwill on your taxes. Goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant.

Goods Or Services Were Not Exchanged.

It’s easier than ever to track your goodwill donations by eliminating your paper receipts. Download a pdf guide, find a donation location, and consult a tax. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax.